W4 Form 2025 | Are you ready to take control of your taxes and make the most of your tax benefits? Look no further than the Federal W4 2025 Form! This essential document is the key to ensuring you’re paying the right amount of taxes throughout the year. By mastering the basics and implementing some savvy tips and tricks, you’ll be well on your way to maximizing your tax benefits and keeping more money in your pocket. Get ahead of the game with our comprehensive guide to the Federal W4 2025 Form!

Mastering the Basics of the Federal W4 2025 Form

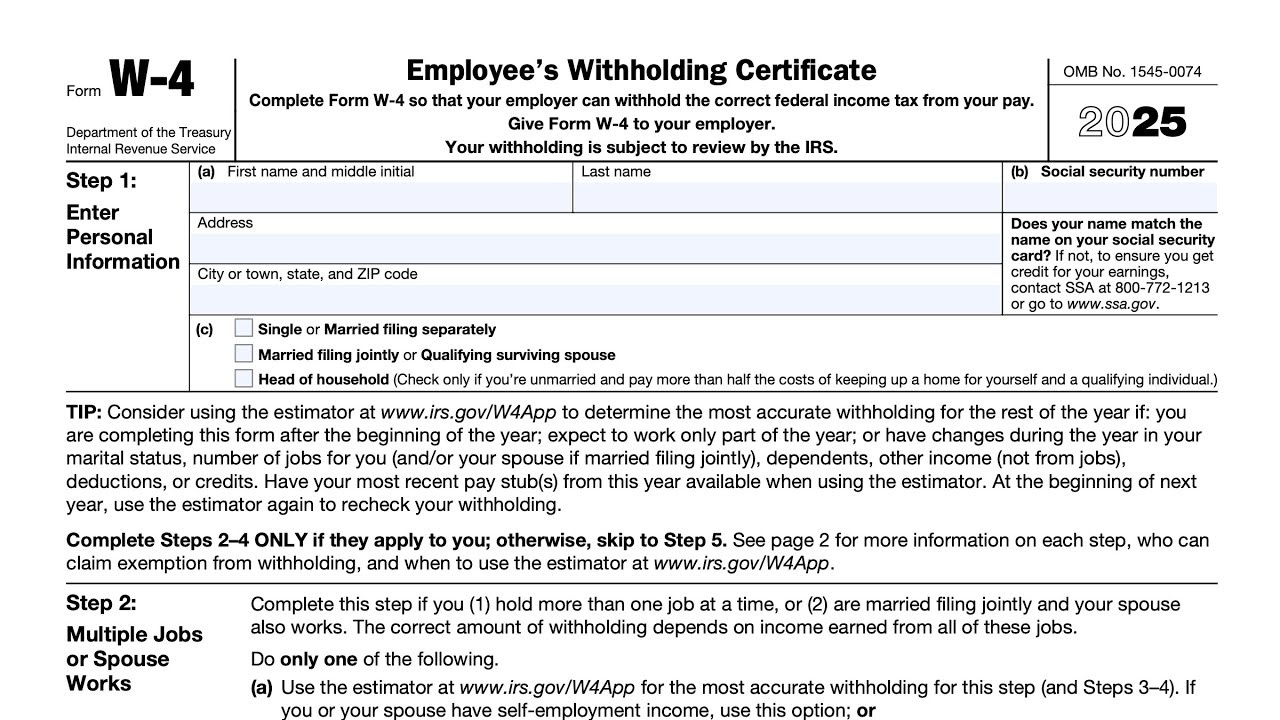

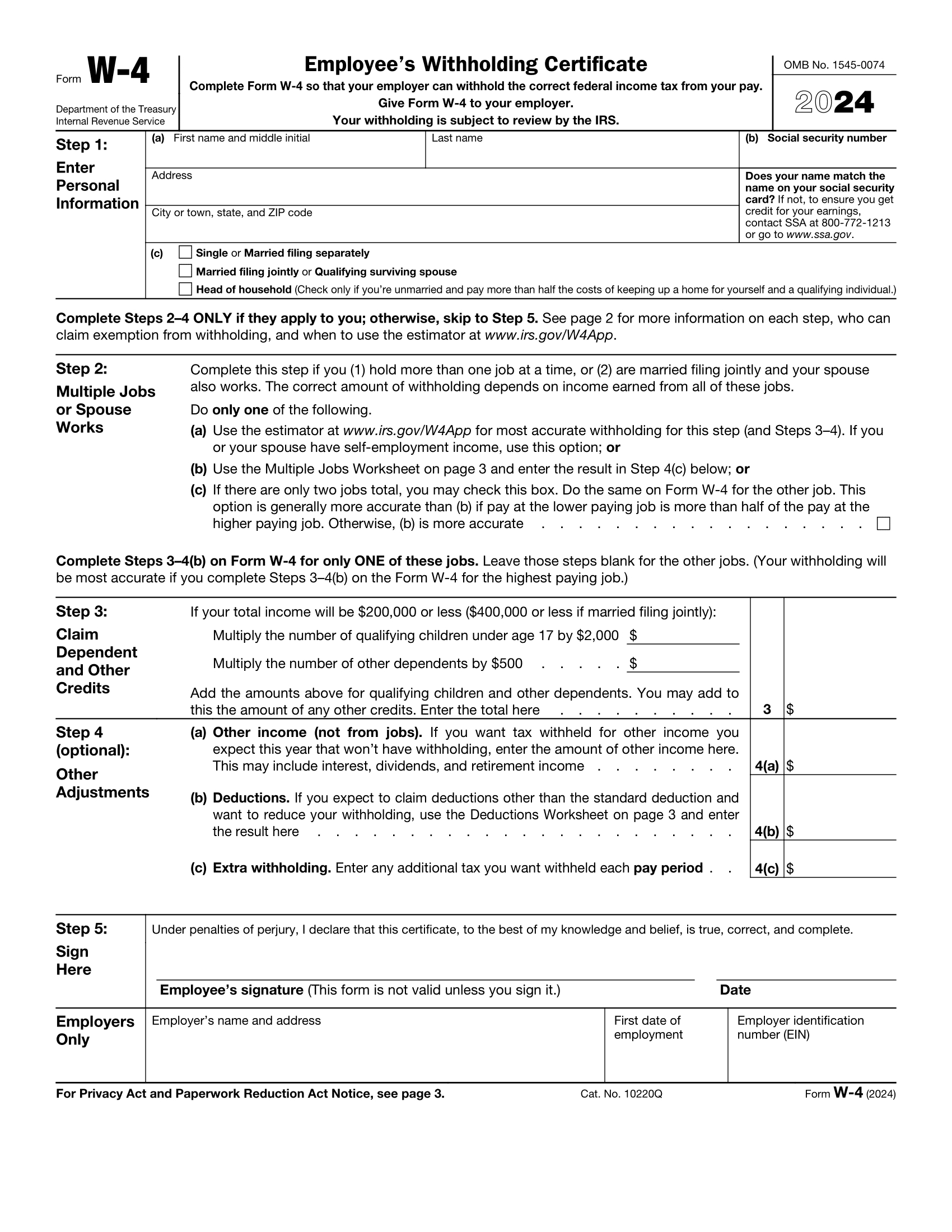

The Federal W4 2025 Form is a crucial tool for employees to determine how much federal income tax should be withheld from their paychecks. When filling out the form, you’ll need to provide information such as your filing status, number of dependents, and any additional income you expect to earn. It’s important to be as accurate as possible to avoid overpaying or underpaying your taxes throughout the year. By understanding the basics of the form and how to properly fill it out, you’ll be setting yourself up for financial success.

One key aspect of the Federal W4 2025 Form is the allowances section, which allows you to adjust the amount of tax withheld from your paycheck. The more allowances you claim, the less tax will be withheld, resulting in a higher net pay. However, it’s crucial to strike a balance and not claim too many allowances, as you may end up owing taxes when you file your return. Take the time to review your financial situation and consider consulting with a tax professional to ensure you’re making the right choices when it comes to claiming allowances on your W4 form.

Once you’ve filled out your Federal W4 2025 Form, be sure to keep it updated as your financial situation changes. Life events such as getting married, having a child, or buying a home can all impact the amount of tax you owe. By regularly reviewing and updating your W4 form, you can ensure that you’re not missing out on any potential tax benefits or deductions. Stay proactive and stay informed to make the most of your tax situation and keep more of your hard-earned money in your pocket.

Tips and Tricks to Maximize Your Tax Benefits

One savvy tip to maximize your tax benefits is to take advantage of tax credits and deductions. Make sure to research and understand any tax breaks you may be eligible for, such as the Child Tax Credit, Earned Income Tax Credit, or education-related deductions. By utilizing these benefits, you can reduce your tax liability and potentially receive a larger refund at tax time.

Another helpful strategy is to consider adjusting your withholding throughout the year. If you find that you consistently receive a large tax refund or owe taxes when you file your return, it may be time to revisit your W4 form and make adjustments. By fine-tuning your withholding to more accurately reflect your tax situation, you can keep more of your money in your pocket throughout the year, rather than waiting for a refund at tax time.

Lastly, be proactive about staying informed on changes to tax laws and regulations. The tax landscape is constantly evolving, and staying up-to-date on any new developments can help you make informed decisions when it comes to your taxes. Consider attending a tax workshop, reading up on tax-related news, or consulting with a tax professional to ensure you’re taking full advantage of all the tax benefits available to you.

Mastering the Federal W4 2025 Form and implementing savvy tips and tricks can help you maximize your tax benefits and keep more money in your pocket. Take control of your taxes and stay ahead of the game by understanding the basics of the form, claiming the right allowances, and staying informed on tax-related developments. With a little bit of knowledge and planning, you can make the most of your tax situation and set yourself up for financial success in the years to come!

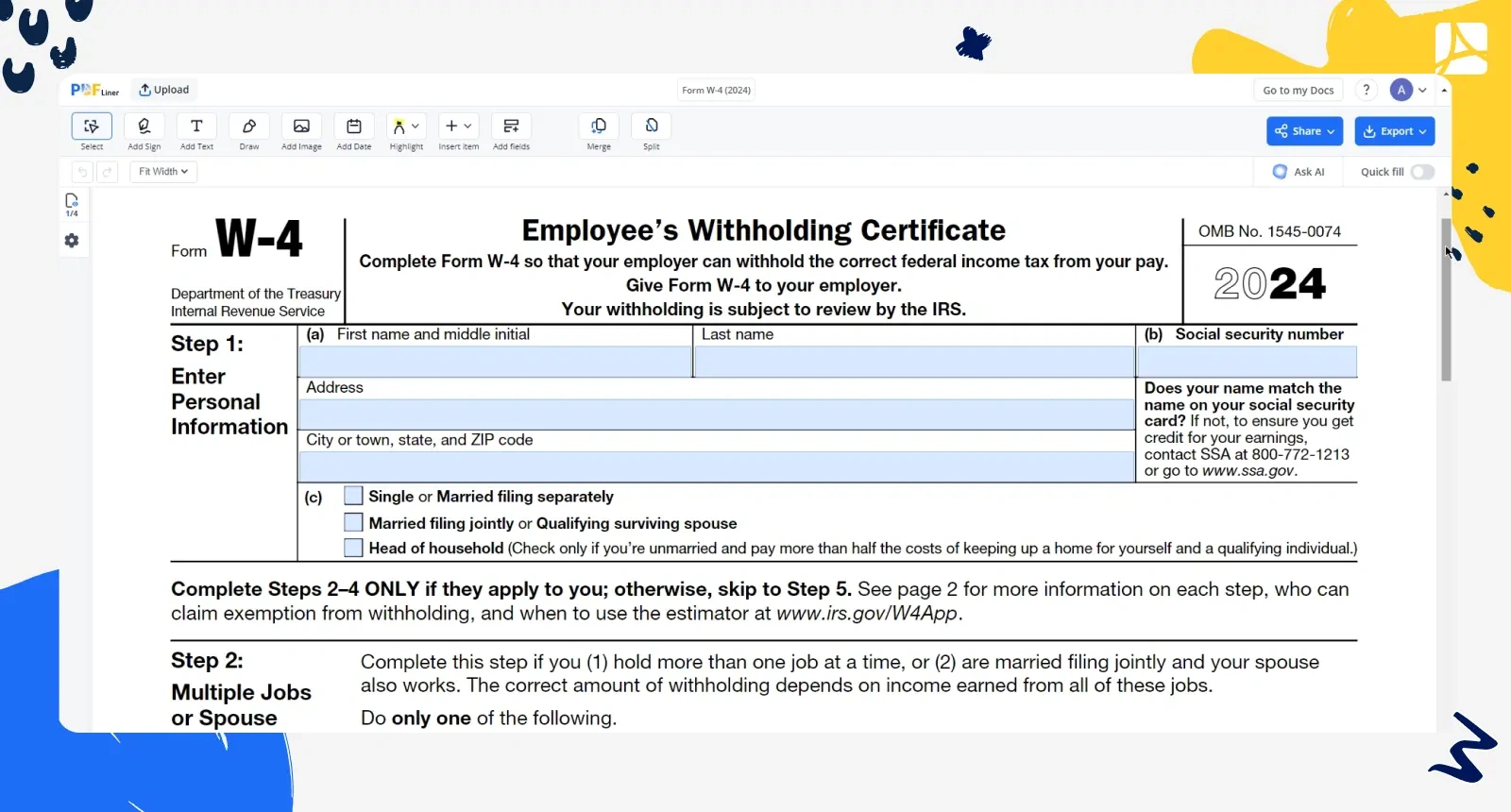

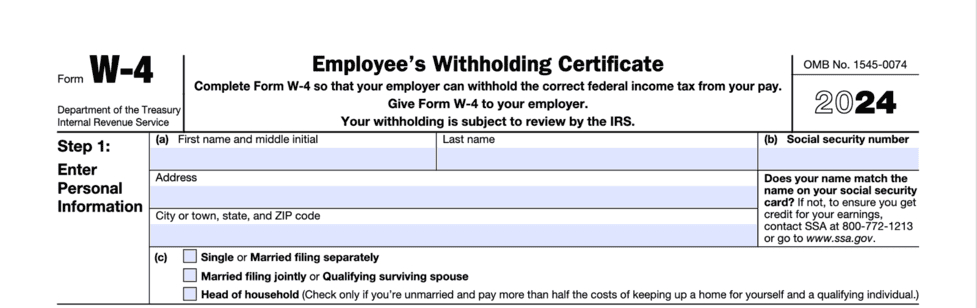

Accessing Federal W4 2025 Form

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the Federal W4 2025 Form is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the Federal W4 2025 Form from the link below.

Federal W4 2025 Form