W4 Form 2025 | Are you ready for some exciting news? The Oregon W4 form is getting a makeover in 2025! That’s right, changes are coming to the way you report your income and deductions to the state. These updates are designed to make the process easier and more efficient for both employees and employers. Get ready to say goodbye to the old way of doing things and hello to a streamlined and user-friendly form that will make tax season a breeze!

Upcoming Changes to Oregon’s W4 Form in 2025!

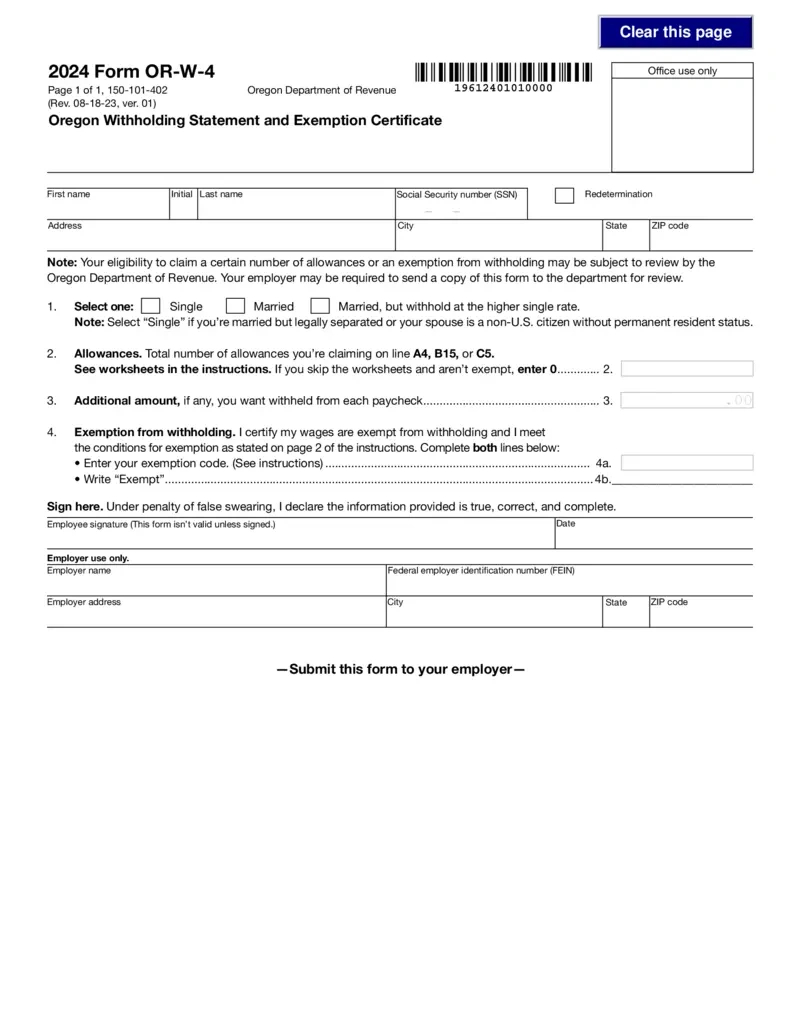

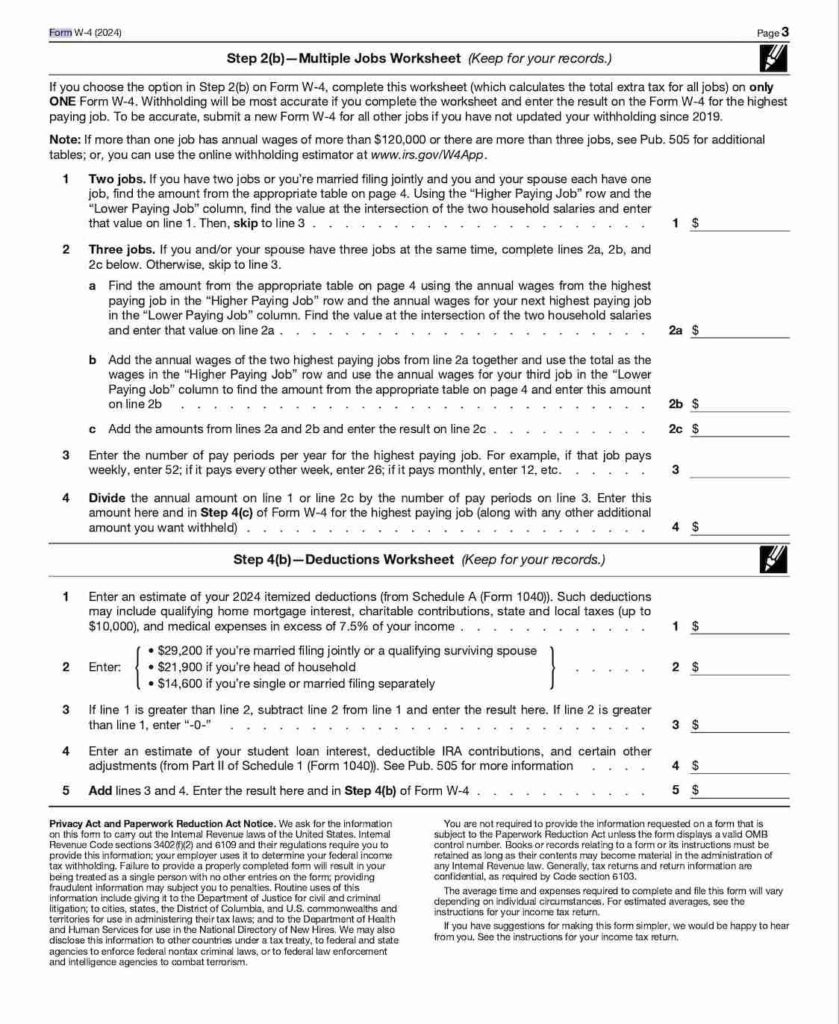

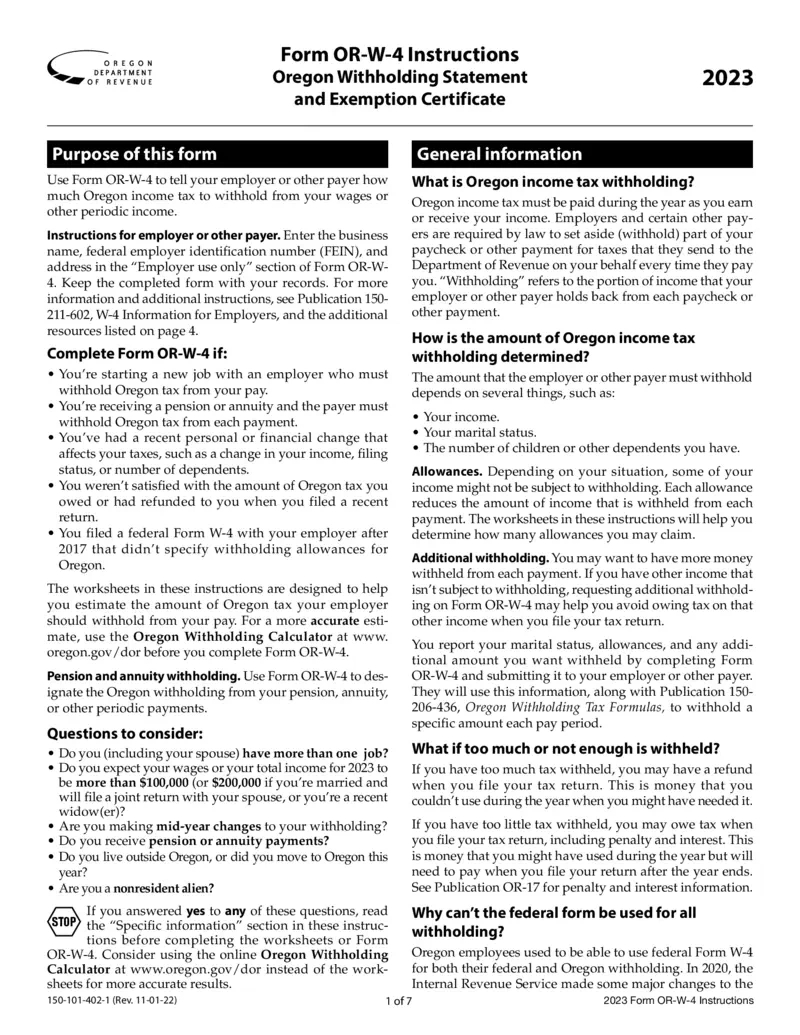

One of the biggest changes you can expect to see on the Oregon 2025 W4 form is a simplified layout. No more confusing jargon or hard-to-understand instructions – the new form will be straightforward and easy to fill out. This means less time spent trying to decipher complex tax language and more time focusing on what really matters. With a cleaner design and clearer instructions, you’ll be able to breeze through the form in no time!

Another exciting update coming to the Oregon 2025 W4 form is the addition of new deductions and credits. Say goodbye to missing out on potential tax savings – the new form will prompt you to include all relevant deductions and credits, ensuring you get the maximum refund possible. From education expenses to childcare costs, the updated form will help you take advantage of every tax break available to you. Get ready to see more money back in your pocket come tax season!

Get Ready to Dive into the Oregon 2025 W4 Updates!

As the release date for the Oregon 2025 W4 form updates draws near, now is the perfect time to get prepared. Familiarize yourself with the changes ahead of time so you can hit the ground running when the new form becomes available. Take some time to review the updated instructions and guidelines, and make sure you have all the necessary documentation on hand. By getting a head start, you can avoid any last-minute stress and ensure a smooth and seamless tax filing experience.

Don’t forget to keep an eye out for any additional resources or tools that may be available to help you navigate the new Oregon 2025 W4 form. Whether it’s online tutorials, tax preparation software, or guidance from your employer, there are plenty of resources out there to assist you in filling out the form accurately and efficiently. Embrace the changes and take advantage of the support available to you – the Oregon 2025 W4 updates are here to make your life easier, so why not make the most of them?

The Oregon 2025 W4 form updates are cause for excitement and celebration. With a simplified layout, new deductions and credits, and a wealth of resources at your disposal, tax season just got a whole lot easier. Get ready to dive into the changes headfirst and embrace the opportunity to maximize your tax savings. Stay informed, stay organized, and get ready to conquer tax season like never before!

Accessing Oregon 2025 W4 Form

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the Oregon 2025 W4 Form is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the Oregon 2025 W4 Form from the link below.

Oregon 2025 W4 Form