W4 Form 2025 | Are you ready to take control of your tax savings in 2025? The key to unlocking your potential lies in mastering the W4 Form. By understanding how to navigate this important document like a pro, you can maximize your deductions and keep more money in your pocket. In this guide, we will show you how to unleash your tax savings and make the most of your financial situation.

Unleash Your Tax Savings Potential

When it comes to saving money on your taxes, the W4 Form is your best friend. This form allows you to specify how much tax should be withheld from your paycheck, giving you the power to customize your deductions and credits. By taking the time to carefully fill out your W4 Form, you can ensure that you are not overpaying on your taxes and that you are taking advantage of all the savings available to you. So grab your W4 Form and let’s get started on unlocking your tax savings potential!

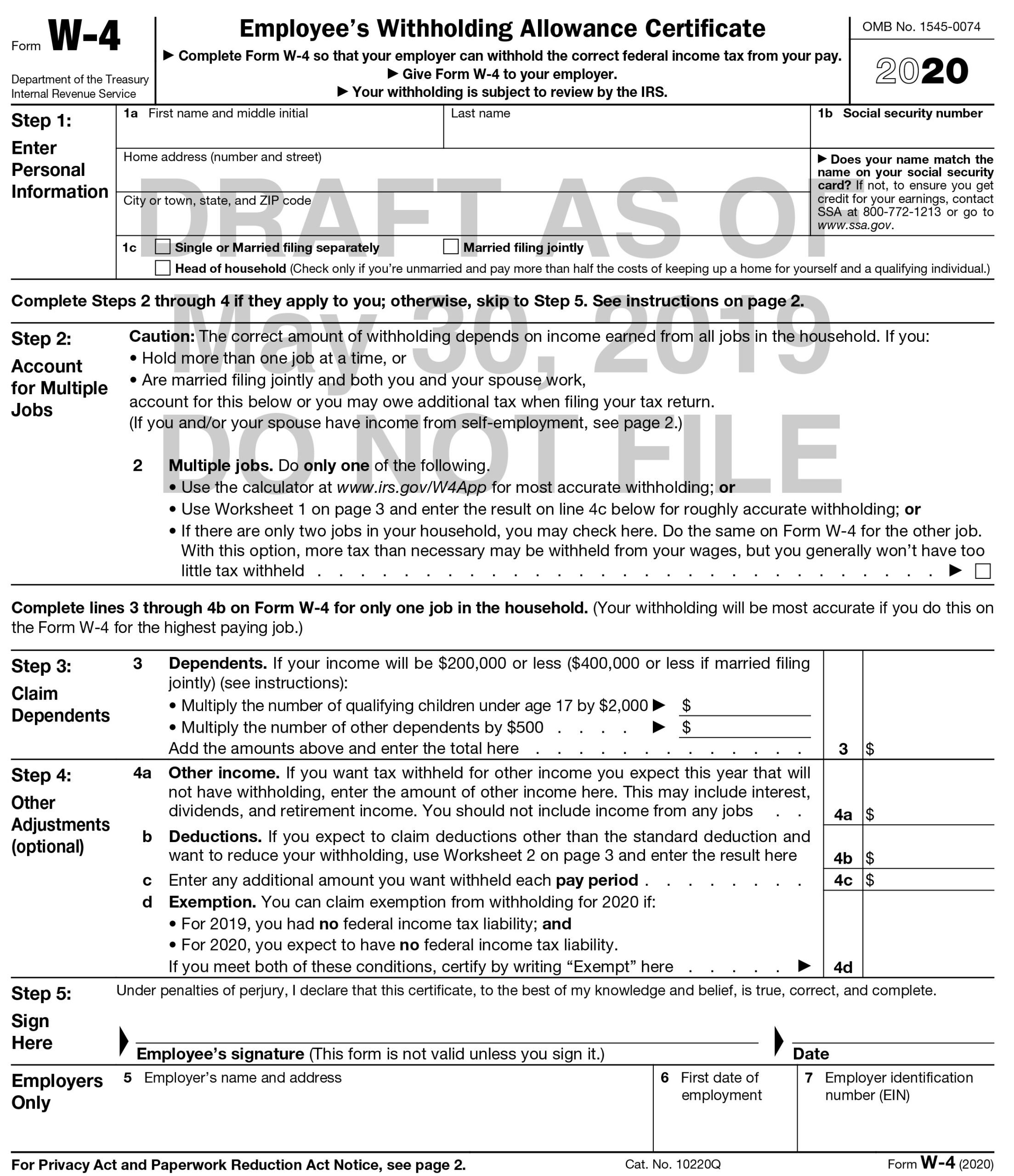

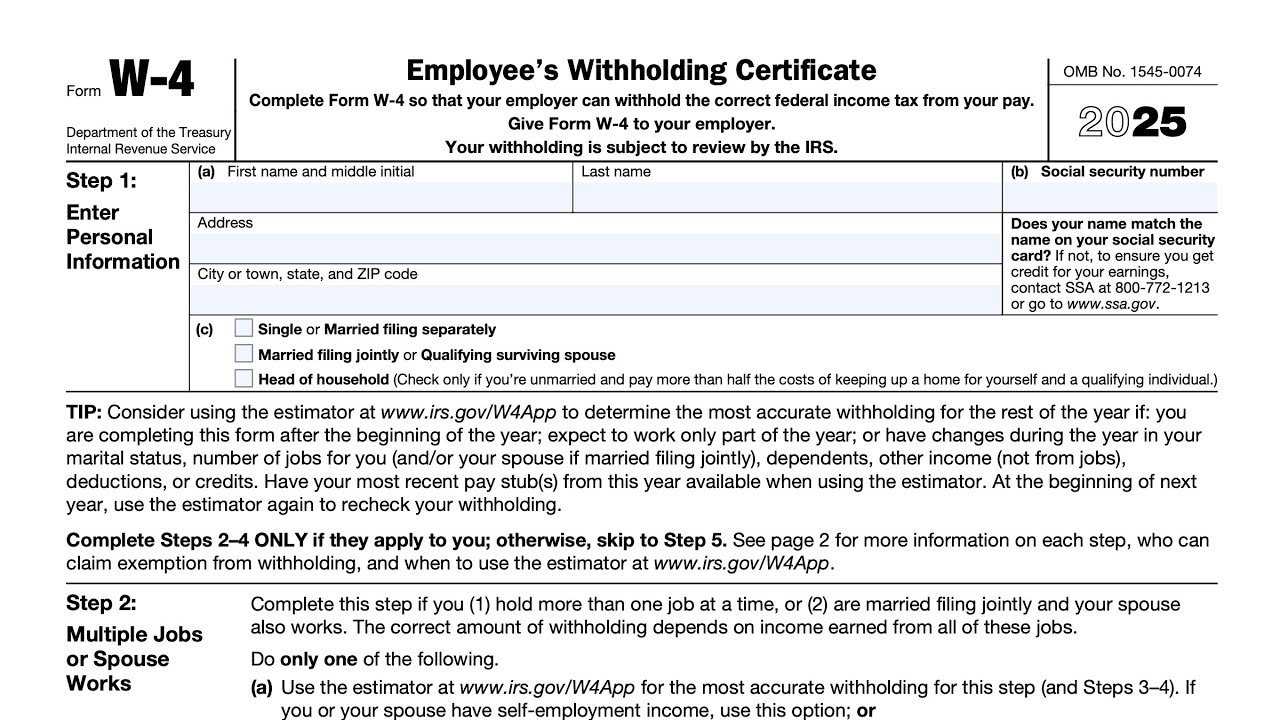

Navigating the W4 Form can seem daunting at first, but with a little guidance, you can become a pro in no time. Start by understanding the different sections of the form, such as your personal information, your filing status, and any additional withholding allowances you may qualify for. By accurately completing each section, you can ensure that you are maximizing your tax savings and minimizing any potential tax liabilities. Don’t be afraid to seek help from a tax professional if you are unsure about how to fill out your W4 Form – they can provide valuable advice and assistance to help you make the most of your tax situation.

Navigate the W4 Form like a Pro in 2025

As you navigate the W4 Form in 2025, remember to regularly review and update your information as needed. Life changes, such as getting married, having children, or changing jobs, can all impact your tax situation and may require adjustments to your withholding. By staying on top of your W4 Form and making updates as necessary, you can ensure that you are always maximizing your tax savings potential. So don’t let this important document intimidate you – embrace it as a tool to help you keep more of your hard-earned money in your pocket.

Mastering the W4 Form is essential for unlocking your tax savings potential in 2025. By familiarizing yourself with the form, accurately completing each section, and regularly updating your information, you can take control of your tax situation and keep more money in your pocket. So grab your W4 Form, follow our guide, and start maximizing your tax savings today!

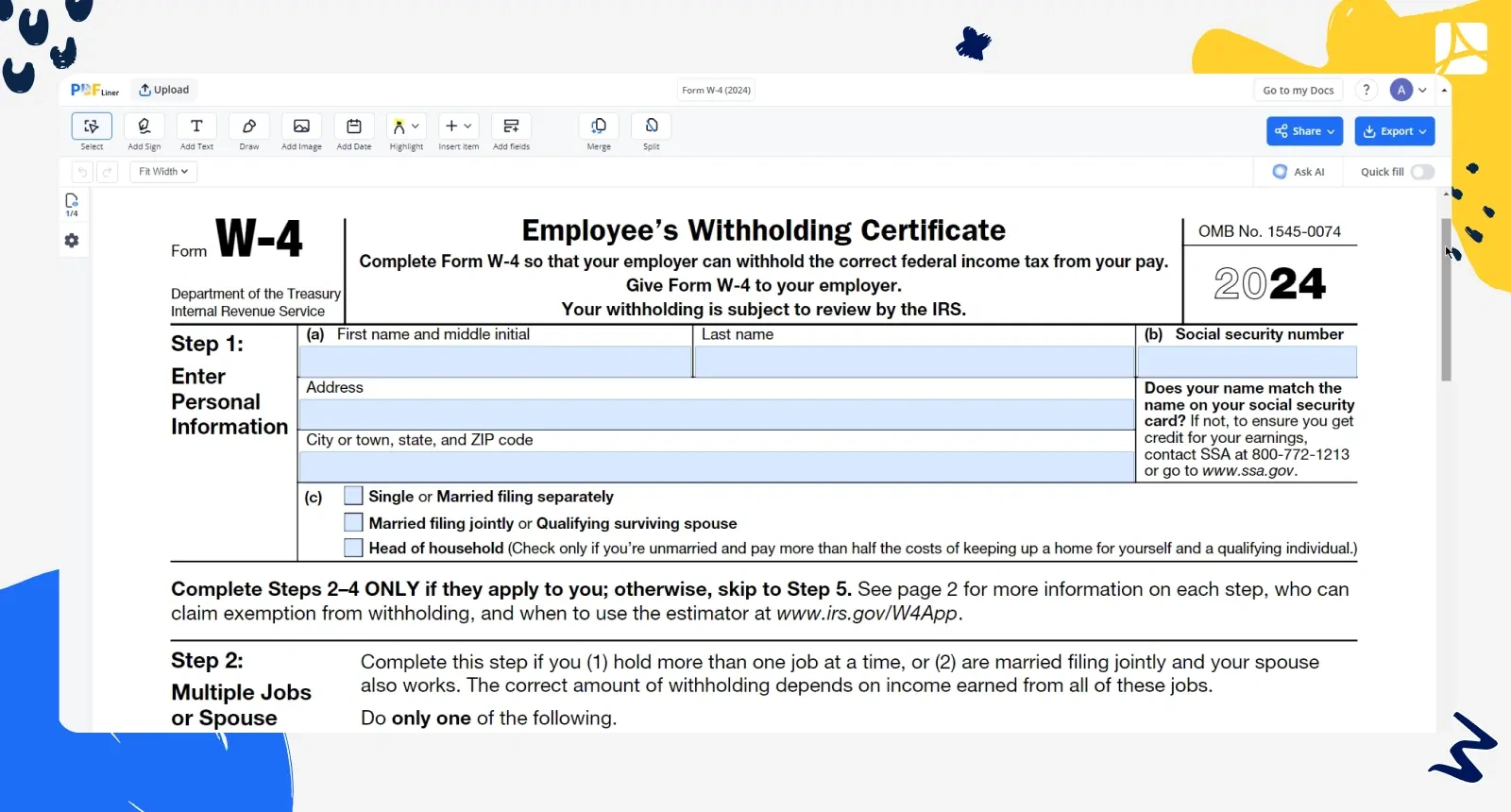

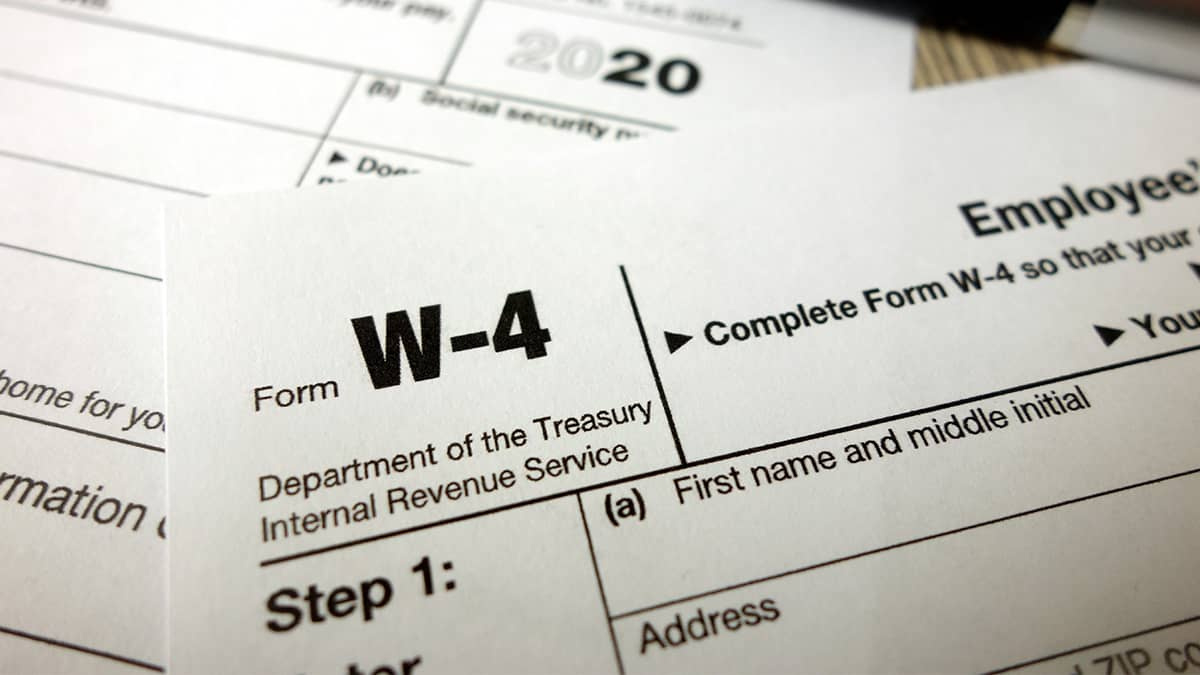

Accessing W4 Tax Form 2025

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the W4 Tax Form 2025 is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the W4 Tax Form 2025 from the link below.

W4 Tax Form 2025