W4 Form 2025 – As we step into 2025, taxpayers across the United States are gearing up to tackle their tax responsibilities, with the W4 form playing a crucial role in this annual ritual.

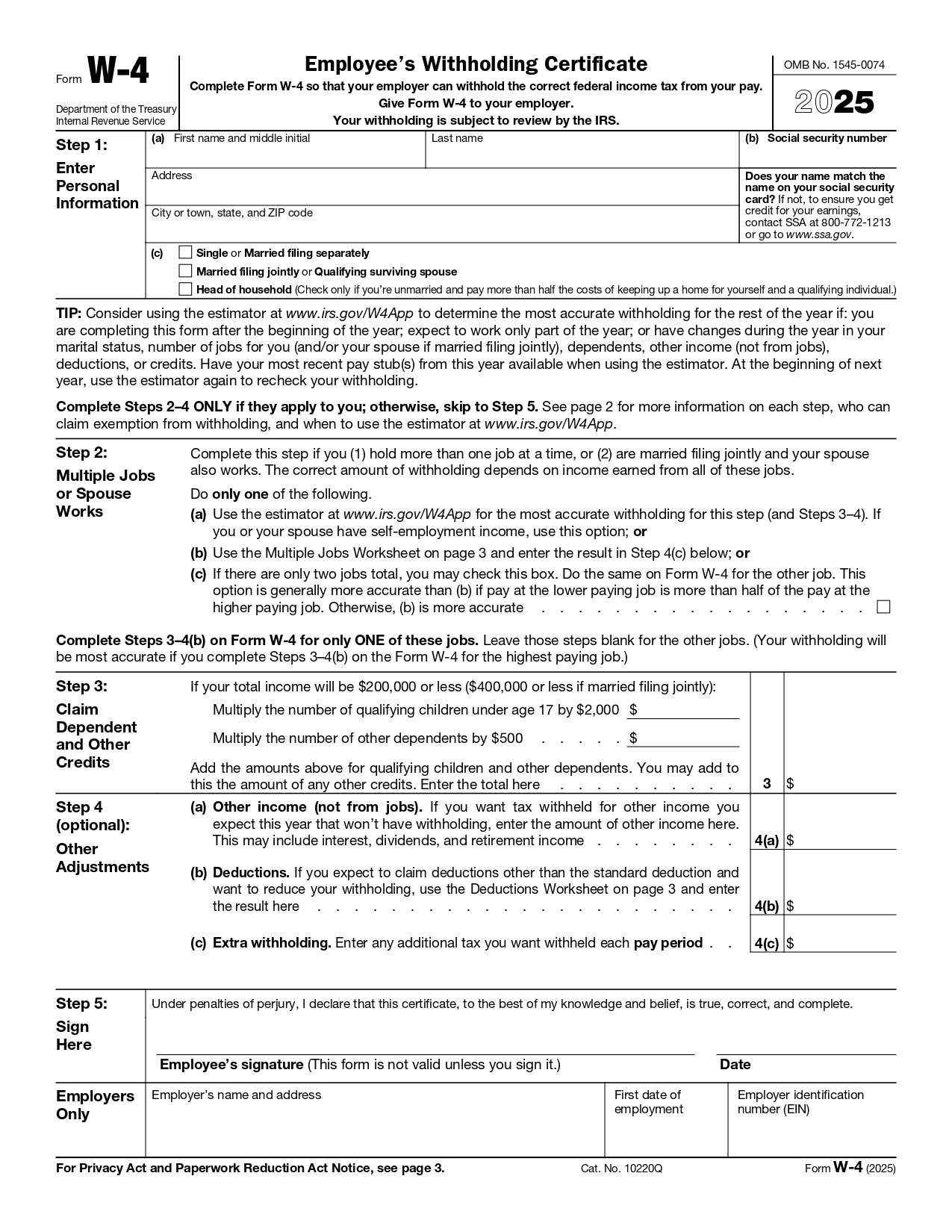

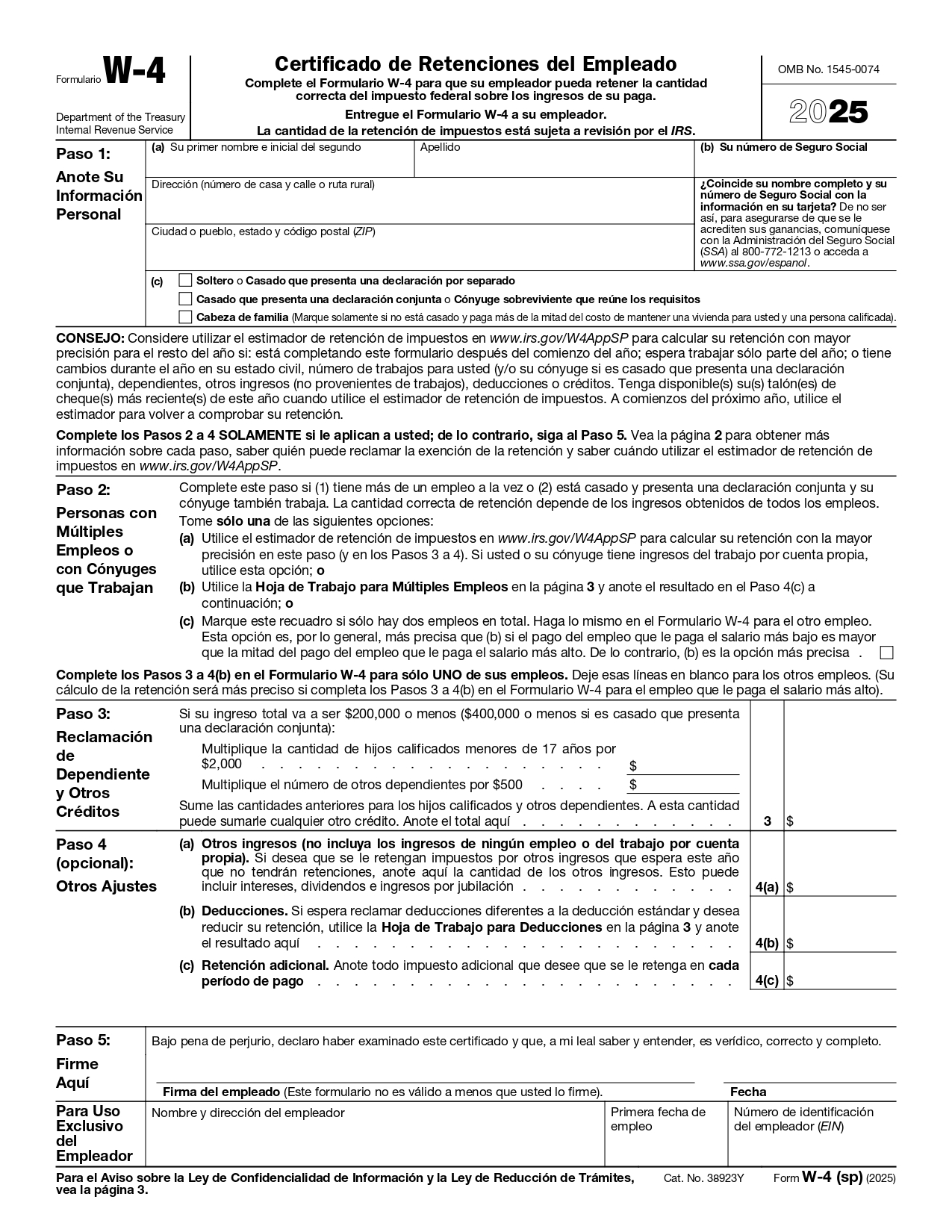

The W4 form, officially known as the Employee’s Withholding Certificate, is a fundamental document used by employers to determine the correct amount of federal income tax to withhold from an employee’s paycheck.

This form has undergone several changes over the years, with the Internal Revenue Service (IRS) continuously refining it to improve accuracy and ease of understanding for taxpayers.

The significance of the W4 form cannot be overstated. It directly influences one’s take-home pay and the eventual tax bill or refund during tax season.

For the year 2025, employees need to familiarize themselves with any new adjustments or guidelines introduced by the IRS.

These changes often reflect broader economic shifts, such as inflation rates, tax bracket adjustments, and alterations in tax credits and deductions.

By accurately completing the W4 form, employees can ensure that they are not over or overpaying their taxes throughout the year, thus avoiding any unwelcome surprises when filing their tax returns.

What is W4 Form 2025?

The W4 Form for the year 2025, officially known as the Employee’s Withholding Certificate, remains a pivotal document in the United States tax system.

It is designed to guide employers in determining the correct amount of federal income tax to withhold from their employees’ paychecks.

This form reflects an individual’s financial situation, including their marital status, number of dependents, and any additional income or expected deductions.

The 2025 version of the W4 Form is expected to continue the trend of recent years, incorporating changes that align with the evolving tax laws and economic conditions.

These modifications are crucial as they directly impact an individual’s taxable income and the amount withheld throughout the year, thereby influencing their overall financial planning and budgeting.

Understanding the W4 Form 2025 is essential for all working individuals. It requires a careful assessment of one’s financial situation, as it determines the amount of tax withheld from each paycheck.

The form is divided into multiple sections, each designed to capture specific information about the taxpayer’s financial status. For instance, the form includes sections for personal information, multiple jobs or spouse’s income, dependents, other adjustments (like deductions and extra withholding), and a declaration section.

The accuracy of this information is vital, as it ensures that the right amount of tax is withheld – not too much, which could result in a smaller paycheck, or too little, which might lead to a tax bill at the end of the year.

The IRS encourages taxpayers to review and update their W4 forms annually or when their personal or financial situation changes, to ensure continued accuracy in tax withholding.

What is The Purpose of W4 Form 2025?

The W4 Form 2025 serves several critical purposes in the U.S. tax system, each aimed at ensuring both the convenience of the taxpayer and the efficiency of the tax collection process. Understanding these purposes helps taxpayers fill out the form accurately and manage their tax obligations effectively:

- Determining Tax Withholding Amount: The primary purpose of the W4 form is to instruct employers on how much federal income tax to withhold from an employee’s paycheck. This amount is based on the employee’s earnings, marital status, number of dependents, and other financial factors.

- Reflecting Personal Financial Changes: The form is designed to capture any changes in an individual’s financial situation, such as marriage, divorce, the birth of a child, or a change in income. This ensures that the tax withholding is adjusted accordingly.

- Avoiding Underpayment or Overpayment of Taxes: By accurately reporting their financial situation, taxpayers can avoid overpaying or underpaying their taxes. Overpayment can lead to a larger tax refund, but it also means less money in each paycheck. Underpayment can result in a tax bill and potential penalties at the end of the year.

- Compliance with Tax Laws: Filling out the W4 form correctly is a legal requirement. It ensures compliance with federal tax laws and helps avoid potential legal issues related to tax evasion or fraud.

- Facilitating Tax Planning: For taxpayers, the W4 form is a tool for tax planning. It allows them to adjust withholdings in anticipation of tax liabilities, such as expected income from other sources or eligibility for tax credits and deductions.

The W4 Form 2025, therefore, plays a pivotal role in the financial planning and legal compliance of working individuals in the United States.

It’s a key instrument in aligning one’s tax withholdings with their current financial situation, ensuring a balanced approach to tax payments throughout the year.

Overview of Changes in the W-4 Form for 2025

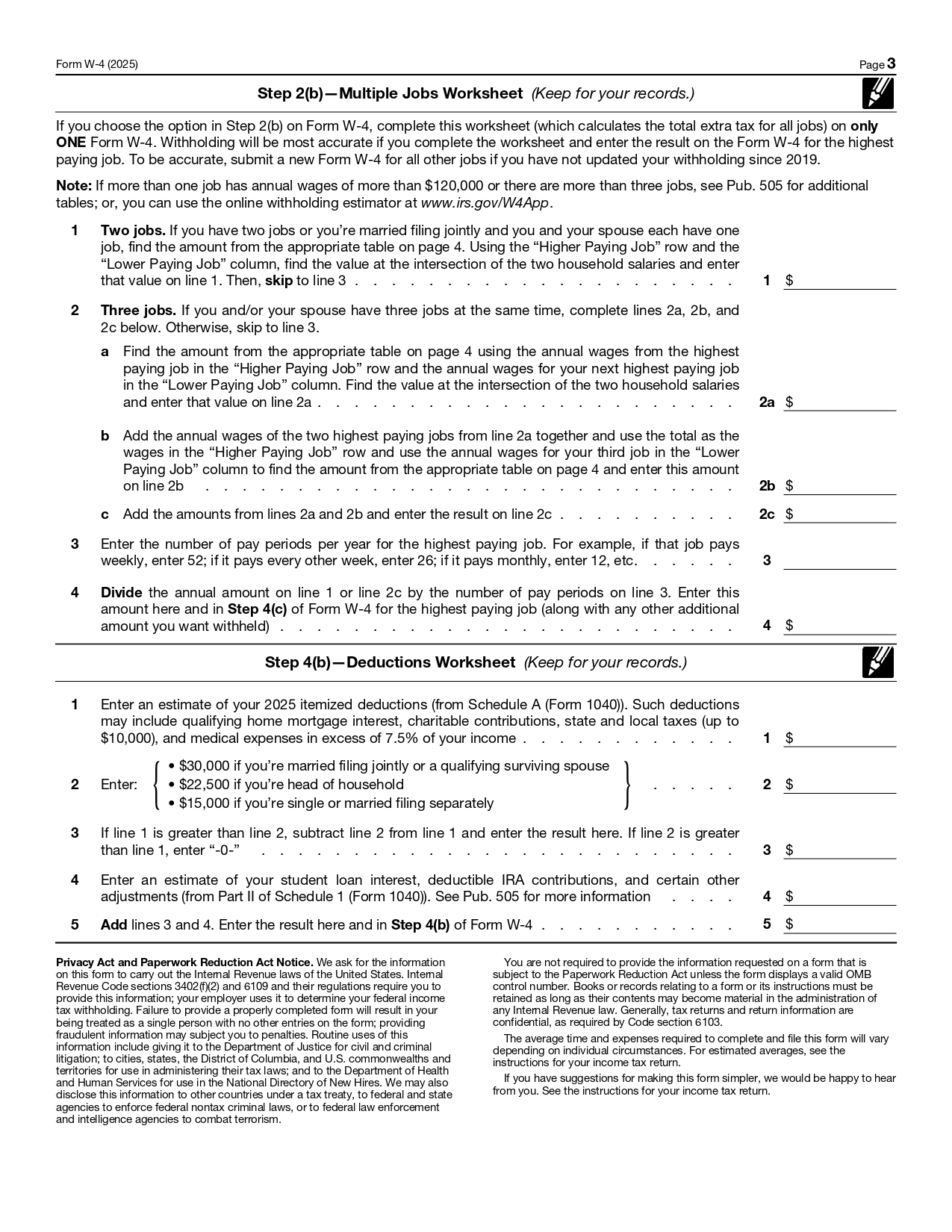

Understanding the W-4 Form is key for managing your tax withholding, and for 2025, there are a few updates you should know. The IRS has introduced subtle but important adjustments to the form that aim to simplify tax calculations for taxpayers. This includes updated figures in the Deductions Worksheet, expanded guidance for using the Tax Withholding Estimator, and more clarity for those with self-employment income or a spouse with similar income. These changes reflect the evolving needs of individuals and families as they plan for the upcoming 2025 tax season.

New W-4 Form 2025: What’s Different?

Although the W-4 Form remains largely the same, here are the key changes you need to be aware of:

1. Updated Deductions Worksheet

The amounts on the Deductions Worksheet have been adjusted to reflect inflation and changes in tax brackets for 2025. This ensures that the withholding calculations are more accurate based on current financial realities.

- What’s new?

- Higher thresholds for deductions.

- Simplified calculations to reduce errors.

Example:

| Deduction Category | 2024 Amount | 2025 Amount |

|---|---|---|

| Standard Deduction (Single) | $13,850 | $14,000 |

| Standard Deduction (Married) | $27,700 | $28,000 |

2. Enhanced IRS Tax Withholding Estimator

For individuals with complex income situations, like those with self-employment income or spouses in similar situations, the IRS Tax Withholding Estimator has been updated to offer:

- Step-by-step guidance tailored to self-employment scenarios.

- Integrated advice on combining multiple income sources.

- Improved clarity in presenting tax outcomes.

3. Focus on Self-Employment Income

Self-employed taxpayers often face challenges in estimating their tax obligations. The 2025 W-4 provides:

- Additional fields to account for irregular income.

- Instructions on coordinating withholding when your spouse is also self-employed.

4. Other Minor Adjustments

- The form’s language has been refined to make it easier to understand.

- More examples included in the instructions to assist first-time users.

How These Changes Benefit You?

1. Simplified Tax Planning

- Easier to predict your tax refund or amount owed.

- Reduced risk of underpaying taxes and facing penalties.

2. Tailored Guidance for Complex Scenarios

- Designed to accommodate modern work arrangements like freelance or gig work.

3. Inflation-Adjusted Deductions

- Helps taxpayers take full advantage of deductions without overestimating withholding.

Key Dates for the 2025 Tax Season

The 2025 tax season is just around the corner, and being aware of key dates can help you avoid stress and late penalties. The IRS has already announced when filing begins and highlighted important deadlines like Tax Day 2025. For those who need extra time, the rules for tax extensions remain the same, but early planning is always the smarter choice. Whether you’re an individual filer or a small business owner, understanding these dates will ensure a smooth tax season. Let’s break it all down so you can stay ahead of the game!

1. Start Date for Filing Taxes

The official start date for filing taxes in 2025 is Monday, January 27, 2025. On this date, the IRS will begin accepting returns electronically and through the mail.

Why it matters?

- Filing early can help you get your refund faster.

- Early filing reduces the risk of tax fraud since your return will be processed before potential scammers can file under your name.

2. Tax Day 2025

The deadline to file your 2024 tax return or request an extension is Tuesday, April 15, 2025. This is the most critical date for taxpayers to remember.

What happens if you miss it?

- Returns filed after April 15 without an approved extension may incur penalties.

- The penalty for late filing is typically 5% of the unpaid taxes for each month your return is late, up to 25%.

3. Extension Deadline

If you can’t file your taxes by April 15, you can request an extension. This will give you until Tuesday, October 15, 2025, to file your return.

4. Timeline at a Glance

| Event | Date | Notes |

|---|---|---|

| Filing Season Opens | January 27, 2025 | Start submitting your returns to the IRS. |

| Tax Day (Filing Deadline) | April 15, 2025 | File or request an extension by this date. |

| Extension Filing Deadline | October 15, 2025 | Final date to file extended returns. |

5. Tips for Staying on Top of Key Dates

Here are some simple tips to help you stay organized during the 2025 tax season:

- Set Reminders: Mark important dates on your calendar or use an app for alerts.

- Organize Documents Early: Gather all necessary tax forms (e.g., W-2s, 1099s) before the season starts.

- File Electronically: E-filing is faster, more secure, and ensures quicker refunds.

- Plan for Payments: If you owe taxes, make arrangements in advance to avoid last-minute stress.

- Consult a Professional: If your taxes are complicated, reach out to a tax preparer early.

Accessing the W-4 Form 2025

Filing your taxes starts with having the right forms, and the W-4 Form 2025 is one of the most essential. Whether you prefer a PDF version, a printable copy, or need the form in Spanish, there are various ways to access it. The IRS ensures that all taxpayers can easily download, print, or request this form for free, whether you need it for personal or professional use. In this section, we’ll explore the best options for accessing the W-4 Form 2025 and the different formats available to suit your needs.

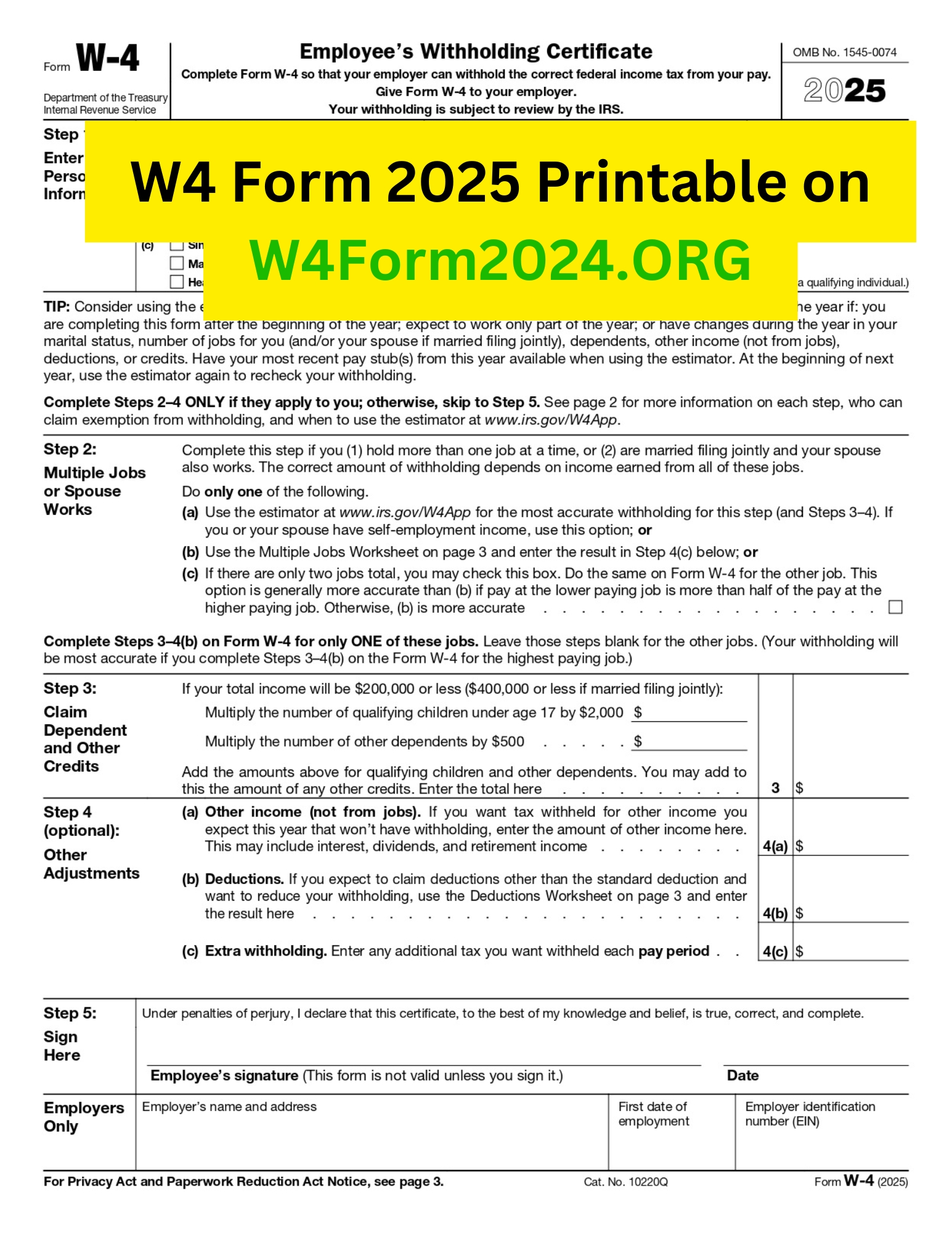

W4 Form 2025 English and Spanish FREE Printable and Fillable | UPDATED (PDF Download)

How to Complete the W4 Form 2025?

Completing the W4 Form 2025 is a straightforward process, but it requires attention to detail to ensure accuracy. Here’s a step-by-step guide to help you navigate through the form:

- Personal Information: Start by filling in your personal information. This includes your name, address, Social Security number, and filing status (single, married filing jointly, married filing separately, or head of household).

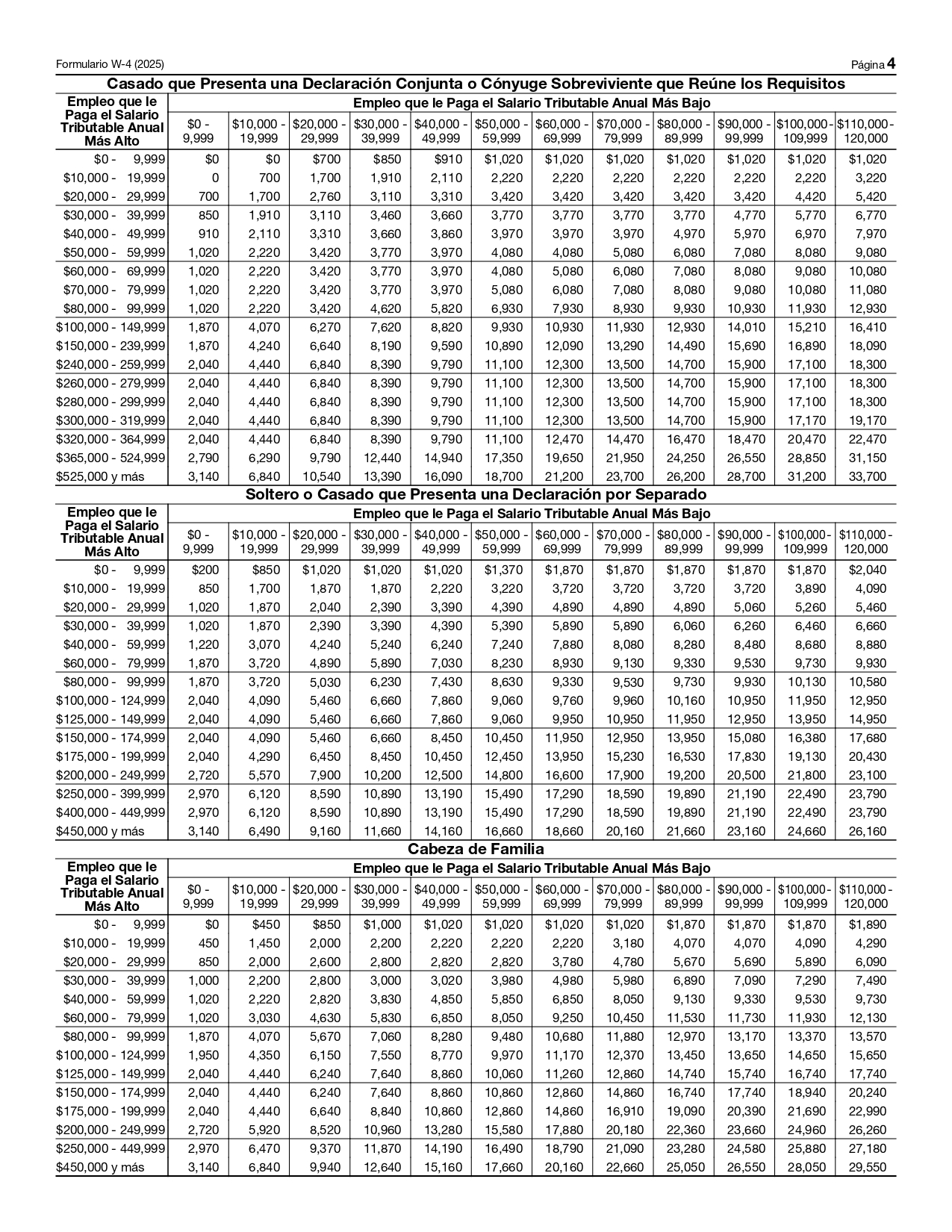

- Multiple Jobs or Spouse’s Income: If you have more than one job or if you’re married and filing jointly, and your spouse also works, you’ll need to complete this section. The IRS provides an online estimator or a worksheet in the form of instructions to help you calculate the correct withholding.

- Claim Dependents: If you have dependents, such as children, you can claim them in this section. This could reduce the amount of tax withheld from your paycheck.

- Other Adjustments: This section is for other income (not from jobs), deductions, and extra withholding. Report any additional income here, such as interest or dividends. If you plan to itemize deductions, you can indicate that here, and you can also choose to have an additional amount withheld from your paycheck.

- Sign and Date the Form: Your W4 form is not valid until you sign and date it. This certifies that the information is accurate to the best of your knowledge.

- Submit to Your Employer: Once completed, hand the form over to your employer. They will use the information to determine your tax withholding.

| Section | Description | Details |

|---|---|---|

| Personal Information | Your identity and tax status | Name, address, SSN, filing status |

| Multiple Jobs/Spouse’s Income | Adjusting for multiple income sources | Use estimator or worksheet for accurate withholding |

| Dependents | Claiming dependents | Reduces withholding if eligible |

| Other Adjustments | Additional income, deductions, extra withholding | Report extra income, itemize deductions, additional withholding |

| Signature | Validation of the form | Sign and date to validate |

| Submission | Final step | Give the completed form to your employer |

Remember, it’s important to review and update your W4 form annually or whenever your personal or financial situation changes. This ensures that your tax withholdings are always aligned with your current circumstances.

W4 Form 2025 Printable

In the digital age, accessibility to essential documents like the W4 Form 2025 is crucial for efficient tax management. The Internal Revenue Service (IRS) recognizes this need and provides a printable version of the W4 Form 2025, ensuring that it is readily available for all taxpayers. This printable form can be easily downloaded from the IRS website.

The advantage of the printable W4 form is its convenience; it allows taxpayers to review and fill out the form at their own pace, ensuring they understand and accurately complete each section. Additionally, having a physical copy enables individuals to consult with tax professionals or financial advisors, ensuring that they make informed decisions about their tax withholdings.

The availability of the W4 Form 2025 in a printable format is particularly beneficial for those who prefer a tangible document over digital completion. It caters to a wide range of taxpayers, including those who may not have consistent access to digital resources or are more comfortable with paper forms.

Once completed, the printed form should be submitted to the employer, who will then use the information to determine the correct amount of federal income tax to withhold.

Taxpayers need to ensure that their employers have the most current version of their W4 form, especially if there have been significant life changes, such as a change in marital status, the birth of a child, or a change in income.

W4 Form 2025 Fillable

Alongside the traditional printable version, the W4 Form 2025 is also available in a fillable format, catering to the growing preference for digital documentation. This fillable version can be accessed and completed directly on a computer, providing a convenient and eco-friendly option for taxpayers.

The fillable W4 Form 2025 is designed to be user-friendly, with interactive fields that guide users through the process, ensuring that all necessary information is provided accurately and efficiently. This digital format can often reduce errors associated with manual entry and is ideal for those who are comfortable with online tools and prefer a paperless approach.

One of the significant advantages of the fillable W4 Form 2025 is the ease with which it can be updated and stored. Changes in personal or financial circumstances can be quickly reflected by simply accessing the form and modifying the relevant sections. This is particularly useful for individuals who anticipate frequent changes or adjustments in their income or dependents.

Once completed, the form can be saved, printed for records, or emailed directly to the employer, streamlining the submission process. Employers also benefit from receiving the form in a digital format, as it simplifies their payroll processing and record-keeping.

The IRS website typically hosts the fillable version of the W4 Form 2025, ensuring that taxpayers always have access to the most current form.

It’s important to note that while the fillable form offers convenience and efficiency, accuracy and thoroughness remain crucial. Taxpayers should review all entries carefully before submission to ensure that their tax withholdings are calculated correctly based on their current financial situation.

W4 Form 2025 Images

W4 Form 2025 English

W4 Form 2025 Spanish

Variants of the W-4 Form

When it comes to managing your tax withholdings, understanding the various forms related to the W-4 can save you time and money. One important variant is the W-4P, also known as the Withholding Certificate for Pension or Annuity Payments. While the W-4 Form is commonly used by employees to adjust federal income tax withholdings from their paycheck, the W-4P Form is specifically designed for individuals receiving retirement income. Knowing the differences between these forms ensures you choose the right one for your financial situation.

What is the W-4P Form?

The W-4P Form serves a specific purpose for retirees and individuals receiving payments from pensions, annuities, or other deferred compensation plans. It helps determine how much federal income tax should be withheld from these payments.

Key Features of the W-4P Form:

- Tailored for retirement income, unlike the W-4, which focuses on active employment.

- Allows recipients to adjust their withholdings to avoid overpayment or underpayment of taxes.

Differences Between the W-4 and W-4P Forms

While both forms aim to manage federal tax withholdings, they apply to different income sources and situations.

| Aspect | W-4 Form | W-4P Form |

|---|---|---|

| Purpose | For employment income tax withholdings | For pension or annuity income tax withholdings |

| Target Users | Employees | Retirees, annuitants |

| Key Fields | Includes marital status, dependents | Includes payment start date, periodic amounts |

| Submission | Submitted to employers | Submitted to plan administrators or payers |

When to Use the W-4P Form?

You should use the W-4P Form if you:

- Receive regular payments from pensions or annuities.

- Are transitioning from employment to retirement and need to update your tax withholdings.

- Want to adjust your withholdings to align with changes in your financial situation or tax liabilities.

Tips for Choosing the Right Form

- Identify Your Income Source: Use the W-4 Form if you’re earning a salary or hourly wages. However, use the W-4P Form if your primary income comes from retirement accounts or pension plans.

- Consult a Tax Professional: If you’re unsure about which form to use, consider seeking advice from a tax advisor.

- Revisit Annually: Both forms should be reviewed and updated annually to reflect changes in income, tax laws, or personal circumstances.

When should I Complete a New Form W4?

You should update your tax withholding by completing a new Form W4 in certain situations. If you’ve had a significant change in income, such as a new job or a second job, you’ll want to reassess your tax withholding. Additionally, if you’ve experienced a change in dependents or married status, you should complete a new Form W4 to ensure you’re withholding the correct amount of taxes from your paycheck. This will help you avoid owing taxes when you file your return.

Determining the Need for a New Form W4

Before completing a new Form W4, you should assess your current tax situation to ensure you’re taking advantage of the most accurate withholding. This involves evaluating your income, deductions, and tax credits to determine if your current W4 is still applicable.

Changes in Personal Finances

Besides your regular income, you should consider any significant changes in your personal finances, such as a new job, divorce, or addition to your family, which may affect your withholding.

Updates in Tax Laws

Determining the impact of tax law updates on your W4 is crucial, as new regulations can alter your withholding eligibility and tax liability.

The updates in tax laws can have a significant impact on your finances, and you should stay informed to avoid any penalties or unforeseen taxes. You should consult a tax professional to ensure you’re in compliance with the latest tax laws and maximizing your benefits.

Life Events Requiring a New Form W4

It is vital to update your tax withholding when your personal or financial situation changes. You should complete a new Form W4 in these situations to ensure accurate tax withholding and avoid potential penalties.

Marriage or Divorce

Requiring a change in your marital status, you should submit a new Form W4 to update your filing status and claim the correct number of allowances. This will help you avoid overpaying or underpaying taxes.

Birth or Adoption of a Child

One of the significant life events that requires a new Form W4 is the birth or adoption of a child. You can claim an additional allowance for your child, which may reduce your tax withholding.

Indeed, having a new child can significantly impact your tax situation. You may be eligible for additional tax credits, such as the Child Tax Credit, which can reduce your tax liability. By completing a new Form W4, you can ensure you are taking advantage of all the tax benefits available to you as a new parent.

Income Changes and Their Impact

Even small changes in your income can affect your tax withholding, making it vital to update your W4 form accordingly. You should review your tax withholding whenever your income changes to avoid owing money or overpaying taxes.

Salary Increases or Decreases

Behind every salary change is a potential impact on your tax withholding. If you have a significant increase or decrease in salary, you should complete a new W4 form to ensure your tax withholding is accurate.

Side Jobs or Freelance Work

Across different income sources, your tax withholding may vary. If you start a side job or freelance work, you should update your W4 form to account for the additional income and potential tax implications.

Increases in income from side jobs or freelance work can substantially impact your tax withholding, and you may need to make quarterly estimated tax payments to avoid penalties. You should consult with a tax professional to ensure you are meeting your tax obligations and taking advantage of available deductions.

Tax Credits and Deductions

Your tax situation may change, and you need to update your W4 form to reflect these changes, especially when it comes to tax credits and deductions.

Claiming Dependents

Any changes in your dependents, such as having a child or a dependentrelative, will impact your tax credits, and you should update your W4 form accordingly to ensure you are taking advantage of the tax benefits you are eligible for.

Itemizing Deductions

After determining your tax deductions, you may need to complete a new W4 form if you itemize your deductions, as this can affect the amount of taxes withheld from your paycheck, potentially leading to a larger refund or lower tax liability.

This process of itemizing deductions can be beneficial for you, as it allows you to deduct certain expenses, such as mortgage interest and charitable donations, which can reduce your taxable income and ultimately lower your tax bill, so it is important to accurately report these deductions on your W4 form to ensure you are taking advantage of the tax savings available to you.

How to Complete a New Form W4?

To complete a new Form W4, you will need to follow a series of steps to ensure your tax withholding is accurate. This involves gathering necessary information and filling out the form carefully.

Gathering Necessary Information

Above all, you should collect your personal and financial documents, including your social security number, current income, and tax filing status. This information will help you determine your tax withholding and ensure you are not over or under withholding.

Filling Out the Form Accurately

At this stage, you will need to fill out the form with the information you have gathered. You will need to provide your personal details, employment information, and tax-related data. Make sure to double-check your entries to avoid any errors.

Due to the complexity of tax laws, it is imperative that you fill out the form accurately to avoid any penalties or fines. You should also be aware of the consequences of under or over withholding, such as owing money to the IRS or receiving a refund. By taking your time and carefully filling out the form, you can ensure your tax withholding is accurate and avoid any issues with the IRS.

Submission and Follow-Up

Now that you have completed your new Form W4, you need to submit it to your employer to update your tax withholding. This will ensure that your taxes are withheld accurately and you avoid any potential penalties or fines. Your employer will use this information to adjust your tax withholding accordingly.

Providing the Form to Your Employer

Following up with your employer is vital to ensure they receive and process your new Form W4 in a timely manner. You should submit the form to your employer’s HR or payroll department, and they will take care of the rest.

Verifying Changes in Your Paycheck

By monitoring your paycheck, you can verify that changes have been made to your tax withholding. Check your pay stub to ensure that your taxes are being withheld correctly and make any necessary adjustments.

Further, it’s a good idea to review your pay stub regularly to catch any errors or discrepancies early on. This will help you avoid unpleasant surprises at tax time and ensure that you’re taking home the right amount of money. By staying on top of your tax withholding, you can avoid financial headaches and keep your finances in order.

What If I don’t Receive a New IRS Form W4 in 2024?

If you’re expecting a new IRS Form W4 in 2024, but haven’t received one yet, you might be wondering what to do. As you prepare for the upcoming tax year, it’s imperative to understand the implications of not having this important document. You’ll need to take prompt action to ensure your taxes are handled correctly, and avoid potential penalties. Your next steps will depend on your individual circumstances, so it’s vital to stay informed and take control of your tax situation.

Background Information

While preparing for the upcoming tax season, you may be wondering what happens if you don’t receive a new IRS Form W4 in 2024. This form is used to determine the amount of taxes withheld from your paycheck, and its accuracy is vital to avoiding tax penalties or owing back taxes.

Overview of IRS Form W4

To understand the significance of the Form W4, you should know that it’s used by employers to calculate your tax withholding. The form takes into account your filing status, number of dependents, and other factors that affect your tax liability.

Importance of Receiving a New Form W4

On the other hand, receiving a new Form W4 is necessary because it allows you to update your tax withholding based on changes in your life, such as getting married or having children. This ensures that the right amount of taxes is being withheld from your paycheck.

In addition, failing to update your Form W4 can lead to underpayment of taxes, resulting in penalties and interest when you file your tax return. You may also overpay your taxes if you don’t update your Form W4, which means you’ll have to wait for a refund after filing your taxes. It’s your responsibility to ensure your Form W4 is accurate and up-to-date to avoid these issues.

Potential Consequences

Clearly, not receiving a new IRS Form W4 in 2024 can lead to several issues with your tax payments and take-home pay. You may face penalties and fines if your tax payments are not accurate or timely.

Delayed or Incorrect Tax Payments

To avoid any complications, you should inform your employer if you don’t receive the new form. This can help prevent delayed or incorrect tax payments that may affect your financial situation.

Impact on Employee Take-Home Pay

Along with potential payment issues, not having the updated form can impact your take-home pay. You may see changes in your paycheck amount due to incorrect tax withholding.

In fact, inaccurate tax withholding can lead to underpayment or overpayment of taxes, affecting your overall financial stability. If you don’t review and update your tax information, you may face unpleasant surprises at tax time, such as owing more taxes or receiving a smaller refund than expected. You should stay on top of your tax obligations to avoid any negative consequences and ensure your take-home pay is accurate.

Reasons for Not Receiving a New Form W4

Assuming you are expecting a new IRS Form W4 in 2024, there could be several reasons why you may not receive one. Your employer may not provide you with a new form, or there may be changes in tax law or regulations that affect the distribution of the form.

Employer Error or Oversight

Among the possible reasons for not receiving a new Form W4 is your employer’s error or oversight. You may need to follow up with your employer’s HR department to request the form if you don’t receive it automatically.

Changes in Tax Law or Regulations

Between the various factors that influence the distribution of the Form W4, changes in tax law or regulations can have a significant impact. You should stay informed about updates to tax laws to understand how they may affect your situation.

At the heart of the issue is the fact that tax laws and regulations are subject to change. You will need to adapt to these changes to ensure you are in compliance with the IRS. If you are unsure about how changes in tax law or regulations affect your Form W4, you may want to consult with a tax professional for guidance.

Actions to Take

Despite the potential consequences of not receiving a new IRS Form W4, you can take steps to address the issue. You should contact your employer or HR department to inquire about the status of your Form W4 and request a new one if necessary.

Contacting the Employer or HR Department

The next step is to reach out to your employer or HR department to clarify the situation and obtain the necessary form. You can ask them about their procedures for handling Form W4 and when you can expect to receive a new one.

Filing a Complaint with the IRS

Employer noncompliance can lead to severe penalties, and you may need to file a complaint with the IRS. You can do this by contacting the IRS directly and reporting the issue.

For instance, if your employer fails to provide you with a new Form W4, you may be subject to incorrect tax withholding, which can result in financial difficulties. To avoid this, you should act promptly and file a complaint with the IRS, providing them with detailed information about your situation. This will help you resolve the issue and ensure that your taxes are handled correctly.

Alternative Solutions

Not having a new IRS Form W4 in 2024 may cause concerns, but you can explore other options to ensure your tax withholding is accurate.

Using Online Tax Tools and Resources

Beneath the surface of tax complexities, you can find online tools and resources to help you estimate your tax withholding and make necessary adjustments, allowing you to avoid potential penalties and ensure compliance with tax laws.

Consulting a Tax Professional

For instance, you can seek guidance from a tax professional who can provide personalized advice and help you navigate the complexities of tax laws, minimizing your tax liability and maximizing your refund.

Consequently, consulting a tax professional can give you peace of mind knowing that your tax withholding is accurate and compliant with IRS regulations, and you can avoid costly mistakes that may lead to audits or penalties. By seeking professional help, you can ensure that your tax situation is handled correctly and optimized for your benefit.

Tax Implications

Many taxpayers are concerned about the tax implications of not receiving a new IRS Form W4 in 2024. You may be wondering how this will affect your tax liability and refunds.

Effects on Tax Liability and Refunds

Refunding your taxes may be delayed if you don’t receive a new Form W4, which could impact your tax liability and refunds. You should be aware of the potential effects on your tax payments.

Potential Penalties and Fines

An issue with your tax forms can lead to penalties and fines. You may face late payment penalties and interest on your unpaid taxes if you don’t file accurately.

In fact, if you fail to file or pay your taxes on time, you may be subject to severe penalties, including fines of up to 47.6% of your unpaid taxes. You should take immediate action to avoid these penalties and ensure your tax forms are accurate and up-to-date to minimize the risk of audits and penalties.

Can I Claim Exempt Withholding Status in 2025?

As you prepare for the upcoming tax season, you may be wondering if you can claim exempt withholding status in 2025. Your financial situation plays a significant role in determining your eligibility. If you owe no federal income tax or have no tax liability for the current year, you might be able to claim exemption. However, failing to meet the requirements can result in penalties and fines. You should carefully evaluate your situation to determine if claiming exempt withholding status is right for you.

Eligibility Criteria

A key aspect of claiming exempt withholding status is meeting the eligibility criteria set by the IRS. You must ensure you meet the requirements to avoid any penalties or issues with your tax return.

Income Requirements

Besides your income level, other factors are considered when determining exempt status. You will need to have had no tax liability for the previous tax year and expect to have no tax liability for the current year to qualify for exempt withholding status.

Dependency Status

Beside income, your dependency status also plays a role in claiming exempt status. You can claim exemption from withholding if you are exempt from paying taxes due to your dependency status, such as being claimed as a dependent on someone else’s tax return.

It is necessary to note that if you are a dependent, you will need to meet specific requirements, such as having no tax liability for the previous year and no expected tax liability for the current year, to qualify for exempt withholding status. You should carefully review your situation and consult with a tax professional if you are unsure about your eligibility.

Filing Status

If you’re considering claiming exempt withholding status, your filing status will play a significant role in determining your eligibility. You should understand how your filing status affects your tax obligations.

Single Filers

About your filing status as a single person, you can claim exempt withholding status if you meet certain conditions, such as having no tax liability for the previous year and expecting no tax liability for the current year, with no penalties or interest owed.

Joint Filers

By filing jointly, you and your spouse can claim exempt withholding status together, but you must both qualify and meet the requirements. You should be aware that joint filers are subject to combined income and tax obligations.

increase your tax liability or reduce your refund. You will need to carefully evaluate your situation to determine if claiming exempt withholding status is beneficial for you and your spouse.

Tax Obligations

One of the key aspects to consider when claiming exempt withholding status is your tax obligations. You must understand how your tax status affects your financial situation.

Tax Liability

Before determining your tax liability, you need to assess your income and expenses to ensure you meet the exempt withholding criteria. You will be liable for any taxes owed if you do not meet these requirements.

Withholding Requirements

Likewise, liability for withholding depends on your income level and tax status. You must comply with withholding requirements to avoid penalties and fines, ensuring you do not owe a significant amount of taxes.

Requirements for claiming exempt withholding status include meeting specific income thresholds and having <strong=no unpaid taxes. You should carefully evaluate your financial situation to ensure you meet these requirements and can maintain your exempt status, avoiding any potential penalties and ensuring a smooth tax process.

Exempt Withholding Status

Not all individuals are eligible for exempt withholding status, as it depends on your income and tax obligations. You must meet specific requirements to qualify for this status.

Qualifying Conditions

With regard to your tax history, you may be eligible if you had no tax liability in the previous year and expect none in the current year. Your income and filing status also play a significant role in determining your eligibility.

Application Process

About the process, you will need to submit a claim to the IRS, providing detailed information about your income and tax obligations. You should be prepared to provide documentation to support your claim, such as proof of income and tax returns.

Considering your application, you should be aware that the IRS thoroughly reviews each claim, and any inaccurate information can lead to rejection or even penalties. You should carefully follow the instructions and provide all required documents to ensure a smooth process and avoid any delays or complications.

Potential Implications

After claiming exempt withholding status, your tax situation may change significantly. You should be aware of the potential implications on your tax benefits and audit risks.

Tax Benefits

Following your decision to claim exempt status, you may be eligible for increased tax savings and reduced tax liability. You can enjoy these benefits as long as you meet the exemption requirements.

Audit Risks

To minimize audit risks, you must ensure your exemption claim is valid and supported by accurate documentation. You should be prepared to provide evidence of your eligibility for exempt status.

Benefits of claiming exempt withholding status include lower tax withholdings and increased take-home pay. However, if you are audited and found ineligible, you may face penalties and interest on the taxes you should have paid. You must carefully evaluate your situation to determine if claiming exempt status is right for you and be prepared for the potential consequences.

Important Deadlines

Many taxpayers are unaware of the deadlines for claiming exempt withholding status. You should be aware of these dates to avoid any penalties or fines.

Filing Dates

The first step in claiming exempt withholding status is to file the necessary forms by the designated dates. You will need to submit your application by the specified deadline to ensure your exemption is processed in a timely manner.

Payment Due Dates

An important aspect of claiming exempt withholding status is meeting the payment due dates. You must ensure that your payments are made on time to avoid any late payment penalties or interest charges.

A key consideration when making payments is to plan ahead and ensure you have sufficient funds to meet your payment obligations. You should also be aware that missing a payment can result in the loss of your exempt withholding status, so it is imperative to stay on top of your payments and communicate with the authorities if you are experiencing any difficulties.

Can I Use the W4 Form to Reduce my Tax Burden?

As you navigate the complex world of taxes, you’re likely looking for ways to minimize your financial burden. You may have heard that adjusting your W4 form can help, but you’re not sure how. With potential penalties for incorrect filing looming, it’s natural to feel overwhelmed. This article will guide you through the process, helping you understand how to maximize your tax savings and avoid costly mistakes. You’ll learn how to use the W4 form to your advantage, putting more money in your pocket.

What is the W4 Form

While navigating the complex world of taxes, you’ll likely encounter the W4 form, a document that plays a significant role in determining your tax burden. The W4 form is used by your employer to calculate the amount of taxes to withhold from your paycheck, and it’s necessary to understand its purpose and how to fill it out accurately.

Purpose of the W4 Form

Above all, the primary function of the W4 form is to provide your employer with the necessary information to accurately calculate your tax withholding, ensuring you don’t overpay or underpay your taxes throughout the year. This form takes into account your filing status, number of dependents, and other income sources.

How to Fill Out the W4 Form

What you need to know is that filling out the W4 form requires careful consideration of your financial situation and tax obligations. You’ll need to provide personal information, including your name, address, and Social Security number, as well as income details, such as your filing status and number of dependents.

Form completion can be a daunting task, but breaking it down step by step can make it more manageable. As you fill out the form, you’ll need to claim allowances and account for multiple jobs or side hustles, which can impact your tax withholding. Be cautious when completing the form, as inaccurate information can lead to penalties or unwanted audits. By taking the time to thoroughly understand the form and its requirements, you can minimize your tax burden and avoid potential issues.

Tax Burden Reduction

Clearly, reducing your tax burden is a goal for many individuals, and using the W4 form can be a viable option. You can adjust your withholdings to minimize your tax liability, but be cautious not to underpay, as this can lead to penalties.

How the W4 Form Impacts Taxes

One of the primary ways the W4 form affects your taxes is by determining how much money is withheld from your paycheck. You can claim exemptions and deductions to reduce the amount of taxes taken out, but this requires careful planning to avoid underpayment.

Strategies for Reducing Tax Liability

Above all, accurate planning is key to reducing your tax liability. You can use the W4 form to claim dependent exemptions or itemize deductions to minimize your taxable income.

But as you explore strategies for reducing your tax liability, be aware of the risks of underpayment. If you claim too many exemptions or deductions, you may owe penalties when you file your tax return. To avoid this, carefully review your W4 form and consult a tax professional if you are unsure about the best approach for your situation. By doing so, you can minimize your tax burden and maximize your refund.

Claiming Allowances

Even if you’re familiar with the W4 form, claiming allowances can be a bit tricky. You’ll need to understand how allowances work and how to claim them correctly to reduce your tax burden.

What are Allowances on the W4 Form

After reviewing the W4 form, you’ll notice that allowances are a key component. Amidst the paperwork, allowances are importantly exemptions that reduce your taxable income, and you can claim them based on your personal situation.

How to Claim Allowances Correctly

Against the backdrop of complex tax laws, claiming allowances correctly is vital. Unlike other tax forms, the W4 form penalizes you for incorrect claims, so you must ensure you’re claiming the right number of allowances based on your dependents and filing status.

Consequently, as you navigate the process of claiming allowances, you should be cautious not to overclaim, as this can lead to tax penalties and interest on the amount you owe. You should carefully review your situation and claim only the allowances you’re eligible for, ensuring you’re in compliance with tax laws and minimizing your tax burden.

Tax Implications

Once again, you’re faced with the task of navigating the complex world of taxes, and the W4 form is no exception. You must understand how it affects your tax burden, as incorrect filings can lead to financial trouble. Your W4 form determines the amount of taxes withheld from your paycheck, and accurate completion is vital to avoid any issues.

How the W4 Form Affects Take-Home Pay

For instance, when you fill out your W4 form, you’re vitally determining how much of your hard-earned money will be taken out in taxes. You can choose to have more taxes withheld, which may reduce your tax burden at the end of the year, or less taxes withheld, which may increase your take-home pay.

Potential Tax Consequences of Misfiling

Consequently, if you misfile your W4 form, you may face severe penalties and fines. You could end up owing a significant amount of money to the IRS, which can be financially devastating.

Another aspect to consider is that inaccurate W4 forms can lead to audits, which can be a time-consuming and costly process. You may need to provide extensive documentation to support your tax claims, and if you’re found to have intentionally misfiled, you could face even harsher penalties. It’s vital to take the time to carefully review and complete your W4 form to avoid any potential tax consequences.

Filing Status

Despite the complexity of tax laws, your filing status plays a significant role in determining your tax burden. You must understand how it affects your W4 form to make informed decisions.

How Filing Status Impacts W4 Form

Around the time you complete your W4 form, you’ll need to consider your filing status, as it will impact the number of allowances you can claim, affecting your take-home pay and potential tax liability.

Choosing the Correct Filing Status

Status as a single person, married, or head of household will impact your taxes, and incorrect filing status can lead to penalties and fines. You must carefully evaluate your situation to choose the correct status.

Choosing the right filing status is crucial for minimizing your tax burden. You should consider your marital status, dependents, and income level when selecting your filing status, as these factors can significantly impact your tax withholding and refunds. By selecting the correct status, you can avoid unpleasant surprises during tax season and ensure you’re taking advantage of available tax benefits.

Review and Revision

After completing your W4 form, it’s important to review it for accuracy to ensure maximal tax savings. This step helps you avoid potential penalties and financial losses.

Importance of Reviewing the W4 Form

Revisiting your W4 form is vital to ensure your tax withholding is correct, and you’re not overpaying or underpaying your taxes. You should check for any errors or discrepancies that may affect your tax refund.

How to Revise the W4 Form if Necessary

Importantly, you should be aware of the process to amend your W4 form if you find any mistakes. You can submit a new form to your employer, and they will update your tax withholding accordingly.

Necessary changes to your W4 form can be made at any time, and it’s highly recommended that you do so if your financial situation changes. You can use the IRS website to access the form and follow the step-by-step instructions to ensure you’re filling it out correctly, minimizing the risk of audits and penalties. By being proactive, you can optimize your tax strategy and keep more of your hard-earned money.

Why redesign W-4 Form 2025?

As you prepare for the upcoming tax season, you’ll notice a significant change in the W-4 Form. The new design aims to simplify the process, increasing transparency and accuracy of the withholding system. With this updated form, you’ll find that complicated worksheets are replaced with more straightforward questions, making it easier for you to achieve accurate withholding.

Background

To understand the need for a redesigned W-4 Form, you should consider the changes in the tax system. The new design aims to reduce complexity and increase transparency and accuracy in the withholding system, making it easier for employees to accurately withhold taxes.

Overview of the Old W-4 Form

After reviewing the old form, you will notice that it relied on complicated worksheets to determine withholding amounts. This complexity often led to inaccurate withholding, causing issues for both employees and employers.

Limitations of the Previous Design

About the previous design, you should know that it was often difficult to understand and navigate, leading to errors in withholding. The old form’s complexity made it hard for employees to accurately determine their withholding, resulting in potential tax liabilities.

Hence, as you consider the limitations of the previous design, you will see that the new form uses the same underlying information but replaces complicated worksheets with more straightforward questions, making accurate withholding easier for you and reducing the likelihood of errors and potential tax liabilities. This change aims to increase transparency and accuracy in the withholding system, benefiting both employees and employers.

Rationale for Redesign

Now, you’re wondering why the W-4 Form needs a redesign. The current system has several flaws that affect its effectiveness.

Complexity and Inaccuracy Issues

Revising the old design is necessary because it has been marred by complicated worksheets that make it difficult for employees to accurately calculate their withholding, leading to inaccurate withholding.

Need for Transparency and Simplicity

Inaccurately, the old design has been lacking in transparency, making it hard for you to understand how your withholding is calculated.

Need to simplify the process is evident as the new design aims to increase transparency and accuracy of the withholding system by replacing complicated worksheets with straightforward questions, making it easier for you to get your withholding right, and avoiding potential penalties associated with inaccurate withholding.

Key Features of the New Design

You will notice the new design has several key features, including:

- straightforward questions

- transparent withholding system

. After implementing these features, your tax experience will be improved.

Simplified Questions and Worksheets

Previously, the old design was complicated, but the new design simplifies questions and worksheets, making it easier for you to accurately withhold your taxes.

Improved Accuracy and Transparency

Following the new design, you will experience improved accuracy and transparency in your tax withholding system, making it easier to avoid errors.

Improved accuracy and transparency are achieved through the use of straightforward questions that reduce complexity and make it easier for you to understand your tax obligations. You will be able to accurately determine your tax withholding, avoiding potential penalties and ensuring compliance with tax regulations.

Benefits for Employees

Not only will the new W-4 Form 2025 simplify the withholding process, but it will also provide you with a more accurate and transparent system.

Easier Withholding Process

The new design uses straightforward questions to make accurate withholding easier for you, increasing the overall efficiency of the process.

Reduced Errors and Complexity

Across the board, you will experience a significant reduction in errors and complexity, making it easier for you to navigate the system.

Benefits of the new W-4 Form 2025 include increased accuracy and transparency in the withholding system, which will reduce errors and complexity for you, allowing you to avoid potential penalties and ensure you receive the correct refund. With the new design, you can easily claim deductions and credits, making the overall process more efficient and less stressful for you.

Implementation and Impact

Many employees will benefit from the redesigned W-4 Form 2025, as it simplifies the withholding process, increasing transparency and accuracy. You will find it easier to determine your withholding, making it a significant improvement over the old design.

Rollout and Adoption

Contrary to initial concerns, the new form’s implementation is expected to be smooth, with minimal disruptions to your payroll process. You will likely find the transition to be seamless, with the new design’s straightforward questions making it easier to understand and complete.

Expected Outcomes and Benefits

Toward the goal of improving the withholding system, the new W-4 Form 2025 is expected to increase accuracy and reduce errors. You can expect a more efficient process, with the new design’s simplified questions making it easier to determine your withholding.

And as you navigate the new form, you will notice that it uses the same underlying information as the old design, but with a more intuitive approach. This means you will be able to complete the form more quickly and with greater confidence, reducing the risk of inaccurate withholding and potential penalties. With the new W-4 Form 2025, you can expect a more streamlined and effective withholding process, making it a significant improvement over the old design.

Challenges and Opportunities

Despite the W-4 form’s importance, its complexity has led to inaccurate withholding and confusion among employees. You will face challenges in understanding the form, but the new design aims to simplify it.

Potential Issues and Concerns

Across various industries, you will encounter difficulties in implementing the new design, including training employees and updating systems to accommodate the changes.

Future Development and Improvement

Across the country, you will see improvements in the withholding system, with the new W-4 form design increasing transparency and accuracy. You can expect a simplified process for employees to claim allowances and deductions.

Challenges in implementing the new W-4 form design will arise, but you can expect long-term benefits, including reduced errors and increased compliance. As you navigate the new design, you will find that it replaces complicated worksheets with straightforward questions, making it easier for you to accurately withhold taxes. With this new design, you can expect a more efficient and user-friendly experience, allowing you to focus on other important tasks.

What happened to withholding allowances?

You’ve likely noticed a change in your tax forms, and withholding allowances are no longer used. This shift is designed to bring transparency, simplicity, and accuracy to the redesigned Form W-4. Your old allowances were tied to the personal exemption amount, but with recent law changes, you can no longer claim personal exemptions or dependency exemptions, leading to this significant update.

Background

While reviewing your tax forms, you may have noticed that withholding allowances are no longer included. This change aims to increase transparency, simplicity, and accuracy of the form.

History of Withholding Allowances

About a decade ago, the value of a withholding allowance was tied to the amount of the personal exemption, which you could claim on your tax return.

Changes in Tax Law

Withholding taxes has become more complex due to changes in law, and currently, you cannot claim personal exemptions or dependency exemptions, making withholding allowances obsolete.

Further, as you navigate the new tax laws, you’ll find that the redesigned Form W-4 no longer includes allowances, which may simplify your tax filing process, but also requires you to accurately estimate your tax liability to avoid penalties or owed taxes.

Redesign of Form W-4

It is imperative to understand the changes made to the Form W-4, which no longer includes allowances. This redesign aims to make the form more straightforward and easier for you to fill out.

Removal of Allowances

Along with the updates, allowances are no longer a factor in calculating your withholding. You will no longer claim them, making the process more streamlined.

Increased Transparency and Accuracy

Between the lines, the new design provides clearer instructions, helping you accurately calculate your withholding. This change ensures you have a better understanding of your tax obligations.

It is worth noting that the removal of allowances and personal exemptions significantly impacts how you fill out your Form W-4. You will need to provide detailed information about your income, dependents, and other factors that affect your taxes. By doing so, you will get a more accurate calculation of your withholding, reducing the risk of underpayment or overpayment of taxes. As you go through the process, you will find that the new design is more intuitive, making it easier for you to navigate and avoid potential penalties.

Impact on Taxpayers

Some taxpayers may notice a change in their take-home pay due to the removal of withholding allowances. You will need to review your W-4 form to ensure your payroll withholding is accurate.

Effect on Tax Liability

Behind the scenes, the new W-4 form aims to reduce over-withholding and under-withholding, which can impact your tax liability. You should review your tax situation to avoid any penalties or interest on your tax bill.

Simplified Tax Filing

Against the complexity of the old system, the new W-4 form simplifies tax filing by eliminating the need to claim personal exemptions. You will no longer have to worry about keeping track of dependency exemptions either.

In fact, with the redesigned form, you will have a more accurate and transparent way of calculating your withholding. You can expect a simplified tax filing process, with less chance of errors or audits, as the new form is designed to increase compliance with tax laws, making it easier for you to manage your taxes and avoid any unpleasant surprises when filing your tax return.

Reasons for Change

Despite the previous use of withholding allowances, the system has undergone changes. You’ll find that the new Form W-4 no longer includes allowances, aiming to make the form more transparent and accurate.

Tie to Personal Exemptions

Rationale behind the change lies in the fact that the value of a withholding allowance was tied to the amount of the personal exemption, which you can no longer claim due to changes in law.

Legislative Updates

Exemptions from the past are no longer applicable, and you cannot claim personal or dependency exemptions, making the old allowance system outdated.

But as you navigate the new system, you’ll notice that the simplification of the Form W-4 is meant to benefit you, increasing the accuracy of your withholding. You’ll need to consider your individual circumstances, including tax credits and income, to ensure your withholding is correct, making the new system more tailored to your needs.

Current Exemption Rules

Keep in mind that the rules have changed, and you need to understand the new system. You can no longer claim personal exemptions or dependency exemptions, which affects your tax withholding.

Personal Exemptions

About your personal exemptions, you should know that they are no longer allowed due to changes in the law, simplifying the tax filing process for increased accuracy.

Dependency Exemptions

An important aspect to consider is that dependency exemptions are also no longer claimable, which may impact your tax situation.

The dependency exemptions’ elimination means you must adjust your tax strategy, considering other deductions you may be eligible for, to minimize your tax liability. You should review your situation to ensure you’re taking advantage of all available tax benefits.

Filing Implications

All taxpayers should be aware of the changes to the Form W-4, as it affects your filing process. You will no longer claim allowances, which were previously used to calculate withholding.

New Form W-4 Requirements

For instance, you will need to provide accurate income information to ensure the correct amount of taxes is withheld from your paycheck.

Taxpayer Responsibility

By understanding the new Form W-4 requirements, you can take control of your tax withholding and avoid potential penalties or underpayment of taxes.

Even with the changes, you are still responsible for ensuring the correct amount of taxes is withheld from your income. You should review your Form W-4 regularly to ensure it accurately reflects your situation, including any changes to your income, dependents, or filing status, to avoid tax liabilities at the end of the year.

Are all employees required to furnish a new Form W-4?

If you have already furnished a Form W-4 before 2020, you are not required to submit a new one due to the redesign. Your employer will continue to use the information from your most recently submitted Form W-4 to compute your withholding, making the process seamless for you.

Employee Requirements

The new Form W-4 requirements apply to you if you start a new job or want to make changes to your withholding. You will need to complete a new Form W-4 to ensure accurate withholding from your paycheck.

New Form W-4 for New Employees

Across the board, new employees are required to furnish a new Form W-4 to their employers. You will need to complete this form as part of your onboarding process to ensure correct withholding from your first paycheck.

Existing Employees and Form W-4

Around this time, you may be wondering if you need to complete a new Form W-4. If you have already furnished a Form W-4 in any year before 2020, you are not required to furnish a new form unless you want to make changes to your withholding status.

Employees who have furnished Form W-4 in any year before 2020 are not required to furnish a new form merely because of the redesign. You should note that your employer will continue to compute withholding based on the information from your most recently furnished Form W-4, unless you choose to submit a new form to make changes to your withholding status. If you want to adjust your tax withholding, you can complete a new Form W-4 at any time, and your employer will use the new form to update your withholding.

Withholding Computations

It is necessary to understand that you, as an employer, will continue to compute withholding based on the information from your employee’s most recently furnished Form W-4, even if it was submitted before 2020.

Employer Responsibilities

Beneath the new regulations, you are still required to follow the same procedures for withholding computations, using the most recent Form W-4 submitted by your employees.

Using the Most Recent Form W-4

Across the board, you will use the information from the most recent Form W-4 to determine the correct withholding amount, ensuring accurate calculations and compliance with tax regulations.

Considering the changes to the Form W-4, you should note that employees who submitted a Form W-4 before 2020 are not required to furnish a new form solely due to the redesign. As an employer, you must continue to use the most recent Form W-4 on file to compute withholding, ensuring correct withholding amounts and avoiding potential penalties for non-compliance. By following these guidelines, you can ensure a smooth transition to the new Form W-4 and maintain compliance with tax laws.

Redesign of Form W-4

If you’re wondering about the new Form W-4, you should know that it’s been redesigned to better account for multiple income sources and to make it easier for you to accurately calculate your withholding.

Changes and Updates

Besides the new format, the updated form also includes changes to withholding calculations and new input fields to help you better estimate your tax liability.

Impact on Employees and Employers

Behind the scenes, the new form will affect how you and your employer handle tax withholding and compliance. You’ll need to review and update your withholding information to ensure accuracy.

Plus, as you navigate the new form, you’ll find that it’s designed to help you avoid over- or under-withholding, which can lead to penalties or unwanted tax bills. You’ll need to carefully review your income sources and claim the correct number of allowances to ensure your employer withholds the correct amount of taxes from your paycheck.

Exemptions and Exceptions

Your employer will continue to compute withholding based on the information from your most recently furnished Form W-4, so you are not required to furnish a new form if you have already done so in any year before 2020.

Employees Not Required to Furnish New Form

The employees who have furnished Form W-4 in any year before 2020 are exempt from furnishing a new form merely because of the redesign, as their employer will continue to use the existing information.

Special Considerations

Around certain tax implications, you should be aware that your employer will continue to compute withholding based on the information from your most recently furnished Form W-4, which may affect your take-home pay.

Plus, if you have changes in your tax situation, such as getting married or having children, you may need to furnish a new Form W-4 to ensure accurate withholding and avoid potential penalties or underpayment of taxes, which could impact your financial situation.

Employer Obligations

Despite the changes to Form W-4, you are not required to have all employees submit a new form. Employees who previously submitted a Form W-4 will not need to furnish a new one, and you will continue to use the existing information for withholding purposes.

Compliance with Tax Regulations

Between the old and new forms, your main concern should be ensuring compliance with tax regulations. You must continue to compute withholding based on the most recently furnished Form W-4 to avoid any potential penalties.

Communication with Employees

Compliant with the new regulations, you should inform your employees about the changes to Form W-4 and their obligations. This will help prevent any confusion and ensure a smooth transition.

To effectively communicate with your employees, you should clearly explain the purpose of the new Form W-4 and emphasize that employees who previously submitted a form will not need to furnish a new one unless their circumstances have changed. By doing so, you can avoid confusion and ensure compliance with tax regulations.

My tax situation is simple. Do I have to complete all of the steps?

You can breathe a sigh of relief, as the form is divided into 5 steps, and only two are mandatory for all employees: Step 1, where you enter personal information like your name and filing status, and Step 5, where you sign the form. You only need to complete Steps 2 – 4 if they apply to your specific situation, which will help make your withholding more accurately match your liability.

Tax Filing Requirements

Before filing your taxes, it’s imperative to understand the requirements. You are required to complete certain steps to ensure accurate withholding.

Mandatory Steps

Filing your taxes involves completing specific steps, and for you, this includes Step 1, where you enter personal information like your name and filing status, and Step 5, where you sign the form.

Optional Steps

One aspect to consider is that Steps 2-4 are only necessary if they apply to your situation. Completing these steps will help make your withholding more accurately match your liability.

And, if you choose to complete the optional steps, you’ll have a more precise calculation of your tax withholding. This can help you avoid overpayment or underpayment of taxes, which can lead to penalties or interest on your tax bill. By taking the time to review and complete the applicable steps, you can ensure a smooth tax filing process and potentially minimize your tax liability.

Step 1: Personal Information

Even if you think your tax situation is simple, you still need to complete Step 1 of the form, which requires you to enter your personal information. This step is mandatory for all employees, as it provides the foundation for your tax withholding.

Entering Your Details

Information such as your name, address, and Social Security number are necessary to ensure that your tax withholding is accurate and that you receive the correct amount of refunds or tax credits you are eligible for.

Filing Status

Above all, your filing status is a key factor in determining your tax withholding, as it affects your tax rates and deductions. You will need to select your filing status, such as single, married, or head of household, to proceed with the form.

With your filing status in mind, you should be aware that it can significantly impact your tax obligations. If you are unsure about your filing status, you can consult the instructions provided or seek guidance from a tax professional to ensure you select the correct status and receive the benefits you are entitled to, such as lower tax rates or increased deductions.

Steps 2-4: Conditional Requirements

If you have a simple tax situation, you may not need to complete all the steps. You are required to fill out Steps 1 and 5, but Steps 2-4 are conditional.

Applicability Criteria

An analysis of your tax situation will determine if you need to complete these steps. You should review the criteria to see if they apply to your situation.

Withholding Accuracy

The accuracy of your withholding depends on the information you provide in these steps. Accurate withholding can help you avoid penalties and ensure you receive the correct refund.

Another important aspect of withholding accuracy is that it can help you avoid overpaying or underpaying taxes throughout the year. By completing Steps 2-4 if they apply to you, you can ensure your tax liability is accurately calculated and make any necessary adjustments to your withholding. This will help you avoid any surprises when you file your tax return.

Step 5: Signing the Form

Despite the simplicity of your tax situation, you are still required to complete Step 5, which involves signing the form. This step is mandatory for all employees, and your signature confirms the accuracy of the information provided.

Finalizing Your Submission

Along with signing the form, you should review your submission to ensure all information is correct and complete. This will help prevent errors and potential delays in processing your tax return.

Importance of Signature

Above all, your signature authenticates your tax return and acknowledges that you are responsible for the information provided. This is a legally binding declaration, and it is crucial that you sign the form truthfully and accurately.

With your signature, you are confirming the accuracy of your tax return and accepting responsibility for any errors or omissions. It is strongly advised that you take the time to review your return carefully before signing, as this will help prevent potential penalties and ensure that you are in compliance with tax laws. By doing so, you can ensure a smooth and efficient tax filing process and avoid any unnecessary complications.

Navigating the Form

For your convenience, the form is divided into 5 steps, but you only need to complete the ones that apply to your situation. You are required to fill out Steps 1 and 5, which include your personal information and signature, respectively.

Simple Situations

Navigating through the form is straightforward when your tax situation is simple. You can skip Steps 2-4 if they do not apply to your circumstances, making the process even more efficient for you.

Complex Scenarios

About your specific situation, if you have multiple jobs, dependents, or other factors that affect your taxes, you will need to complete the relevant steps to ensure accurate withholding and avoid potential penalties.

A key aspect of completing the form is understanding which steps apply to your situation. If you have a complex tax scenario, it is crucial to carefully review each step to ensure you are taking advantage of all the deductions and credits you are eligible for, which can help reduce your tax liability. By doing so, you can ensure your withholding is accurate and avoid any potential issues with the IRS.

Benefits of Accurate Withholding

Now, when you complete the required steps, you can ensure your tax withholding is accurate, which has several benefits. This includes reducing your tax liability and avoiding overpayment, ultimately leading to a more precise tax calculation.

Reduced Liability

Benefits such as lower tax bills and increased take-home pay can be achieved by accurately completing your tax form. You can minimize your tax liability by following the steps that apply to your situation.

Avoiding Overpayment

Adequate completion of your tax form helps you avoid overpaying taxes. By doing so, you can ensure that you are not giving the government more money than you need to, allowing you to keep more of your hard-earned money.

For instance, if you overpay your taxes, you will have to wait until you file your tax return to get a refund, which can take several months. By accurately completing your tax form, you can avoid this delay and have more control over your financial situation, ensuring that you have the money you need when you need it, and reducing financial stress.

What happens if I only fill out Step 1 and then sign the form?

Many taxpayers wonder what the implications are if they only fill out Step 1 on their tax form and sign it without providing additional information. By doing so, you may potentially miss out on tax benefits and adjustments that could lessen your tax burden. Your withholding will be based solely on the standard deduction and tax rates for your filing status, which could lead to significant tax liabilities down the line. It’s vital to consider completing all necessary steps to ensure your tax situation is optimal.

Understanding Step 1 of the Form

Before completing your tax withholding form, it’s important to understand Step 1. This step is designed to collect basic information regarding your filing status, which sets the foundation for your withholding calculations. By providing accurate details, you ensure that your withholding aligns with your tax obligations, preventing unexpected liabilities or refunds when you file your tax return.

Purpose of Step 1

Below is the primary goal of Step 1: to establish your filing status and enable the IRS to accurately compute your withholding amounts based on recognized standard deductions and tax rates. Your filing status significantly impacts how much tax is withheld from your paycheck.

Key Information Required

Against popular belief, Step 1 requires specific information about your filing status, which is fundamental for calculating your withholding. If you only fill out this part of the form and sign, the IRS will use the provided standard deduction and tax rates without any additional adjustments.

Due to the focus on basic filing status in Step 1, it’s important to input accurate information. If you misstate your filing status, it could lead to over-withholding or under-withholding from your paychecks. Over-withholding results in less take-home pay, which means you might have to wait until tax season to receive a refund. Conversely, under-withholding could lead to a surprising bill when you file your taxes. Understanding this step helps ensure that your tax situation stays balanced throughout the year.

Potential Consequences of Incomplete Submission

While filing only Step 1 of your tax form may seem straightforward, you could face significant consequences. Not providing complete information means the IRS lacks the necessary details to accurately compute your withholding, which can lead to issues during tax season. Ultimately, this can affect your overall tax liability, resulting in unexpected costs or delays in refunds.

Delays in Processing

Against a backdrop of an already busy tax season, incomplete submissions can result in lengthy delays in processing your form. The IRS may take additional time to review or correct your information, which can hinder timely refunds and impact your financial planning.

Risk of Rejection

Along with processing delays, there is a tangible risk of your submission being rejected. Incomplete forms often lead to automatic rejections by the IRS, leaving you with no option but to start the process over again. This not only consumes your time but can also affect your filing status and any associated benefits.

At this stage, it’s vital to note that if your submission is rejected, the IRS may not notify you immediately. This could mean that your withholding calculations are misaligned with your actual tax situation, potentially leading to underwithholding or overwithholding. Furthermore, if you rely on a refund, delays in correcting your submission could result in extended waiting periods that disrupt your financial plans. Ensuring complete and accurate information on your tax forms is vital to avoid these complications.

Importance of Completing the Entire Form

The process of filling out tax forms should never be taken lightly. By only completing Step 1, you risk misalignment with your tax obligations, as your withholding calculations are based on your filing status’s standard deduction and tax rates. This oversight could lead to issues when it’s time to file your return, potentially complicating your interactions with the IRS and impacting your financial situation.

Legal Implications