W4 Form 2025 | Are you ready to embark on an exciting tax adventure with the W4 2025 form? Tax season may seem daunting, but with the right tools and knowledge, it can actually be a fun and rewarding experience. The W4 2025 form is your ticket to navigating the complex world of taxes and ensuring that you are paying the right amount to Uncle Sam. So buckle up, grab your calculator, and get ready to dive into the world of tax deductions, credits, and exemptions!

Embark on an Exciting Tax Journey

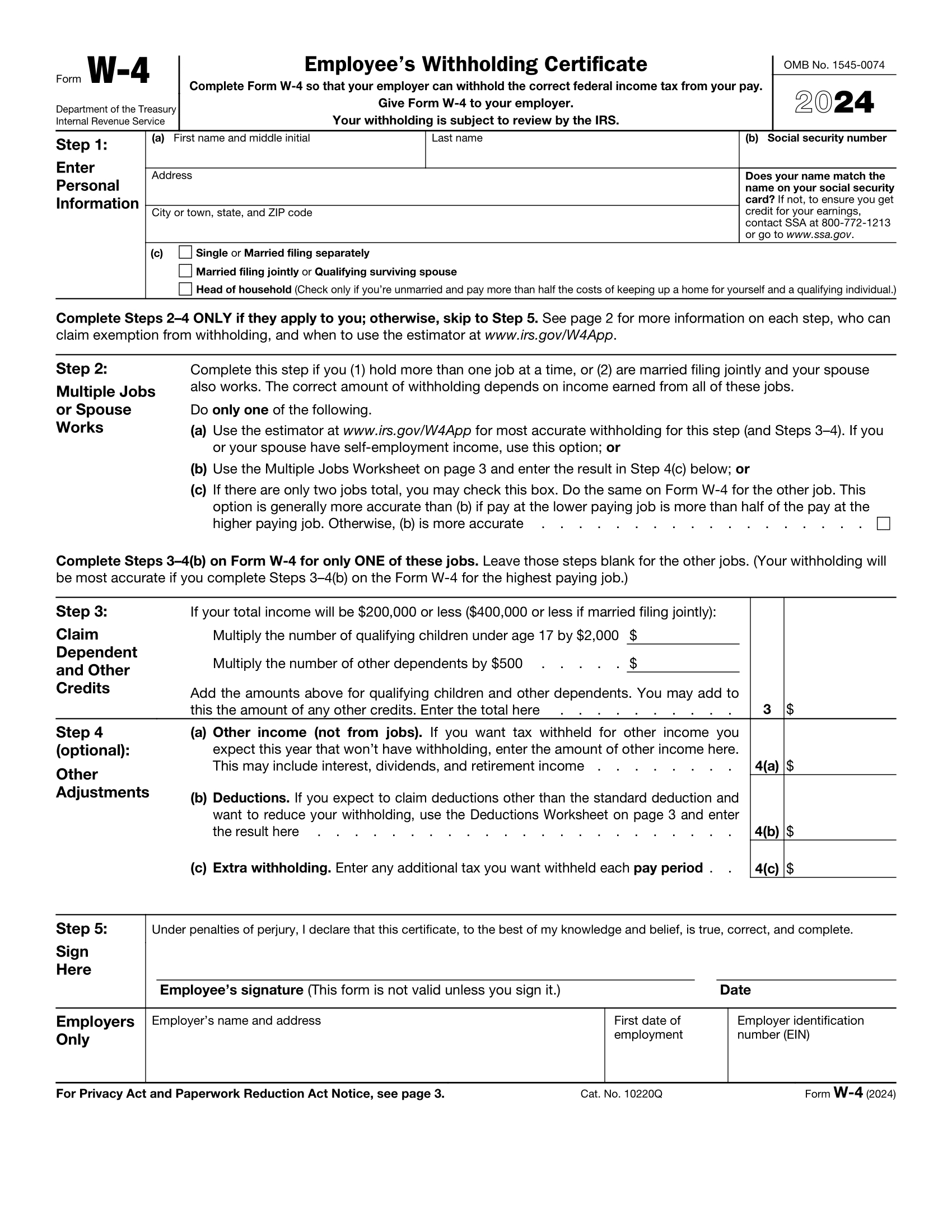

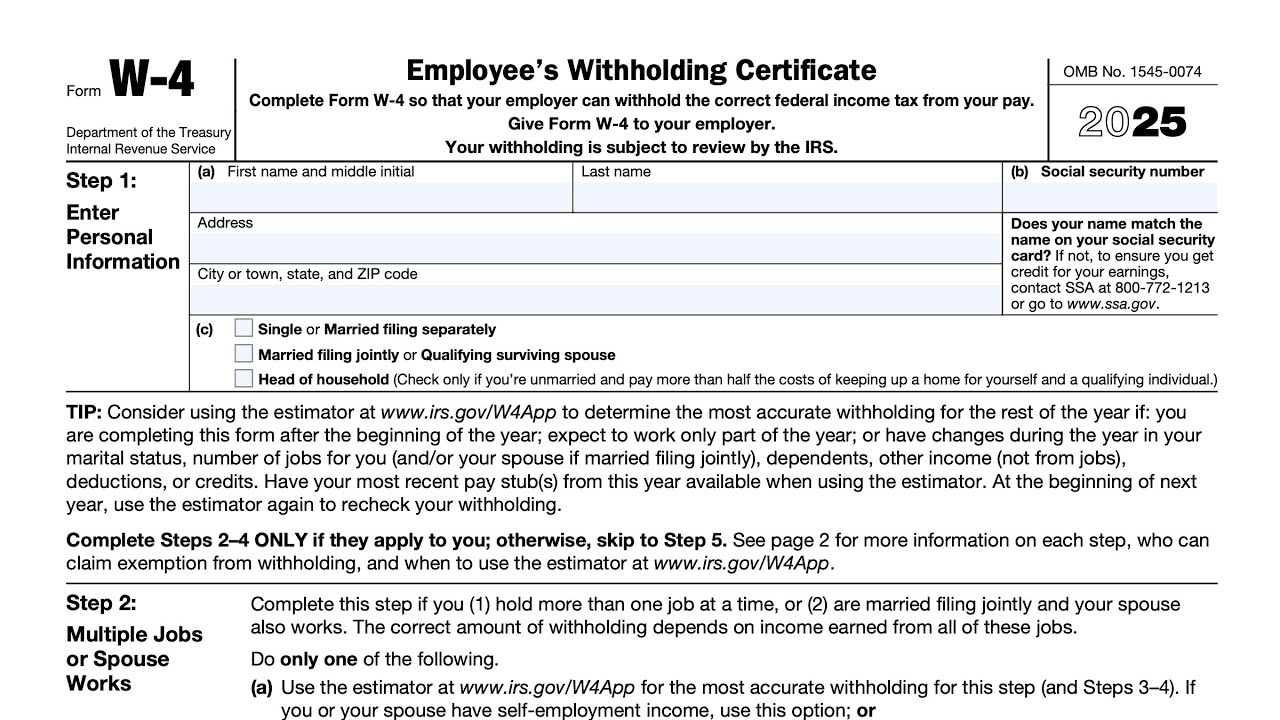

Navigating the W4 2025 form may seem like a daunting task, but fear not – we are here to guide you through the process with ease. This form is designed to help you calculate the correct amount of federal income tax to withhold from your paycheck, based on your filing status, number of dependents, and other factors. By filling out the W4 2025 form accurately, you can avoid underpaying or overpaying your taxes, ensuring that you don’t end up with a surprise bill come tax season. So roll up your sleeves and let’s dive into the world of tax planning and preparation!

Navigate the W4 2025 Form with Ease

The W4 2025 form may seem like a maze of confusing boxes and numbers, but with a little patience and attention to detail, you can tackle it like a pro. Start by carefully reading the instructions provided with the form to ensure that you understand each section and what information is required. Then, gather all necessary documents such as pay stubs, previous tax returns, and any other relevant financial information. Take your time to fill out each section accurately, double-checking your calculations to avoid any errors.

As you navigate the W4 2025 form, consider seeking assistance from a tax professional if you have any questions or concerns. They can help you decipher complex tax laws, determine your eligibility for various credits and deductions, and optimize your tax withholding strategy. Remember, the goal is to maximize your take-home pay while still meeting your tax obligations. By taking the time to properly fill out the W4 2025 form, you can set yourself up for a smooth and stress-free tax season. So don’t be afraid to ask for help and make the most of this tax adventure!

Preparing your taxes can be a daunting task, but with the right tools and knowledge, you can navigate the W4 2025 form with ease and confidence. By taking the time to understand your tax obligations, gather necessary documents, and seek assistance if needed, you can ensure that you are on the right track towards financial success. So gear up, embrace the tax adventure, and let the W4 2025 form be your guide to a successful tax season!

Accessing W4 2025 Tax Form

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the W4 2025 Tax Form is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the W4 2025 Tax Form from the link below.

W4 2025 Tax Form