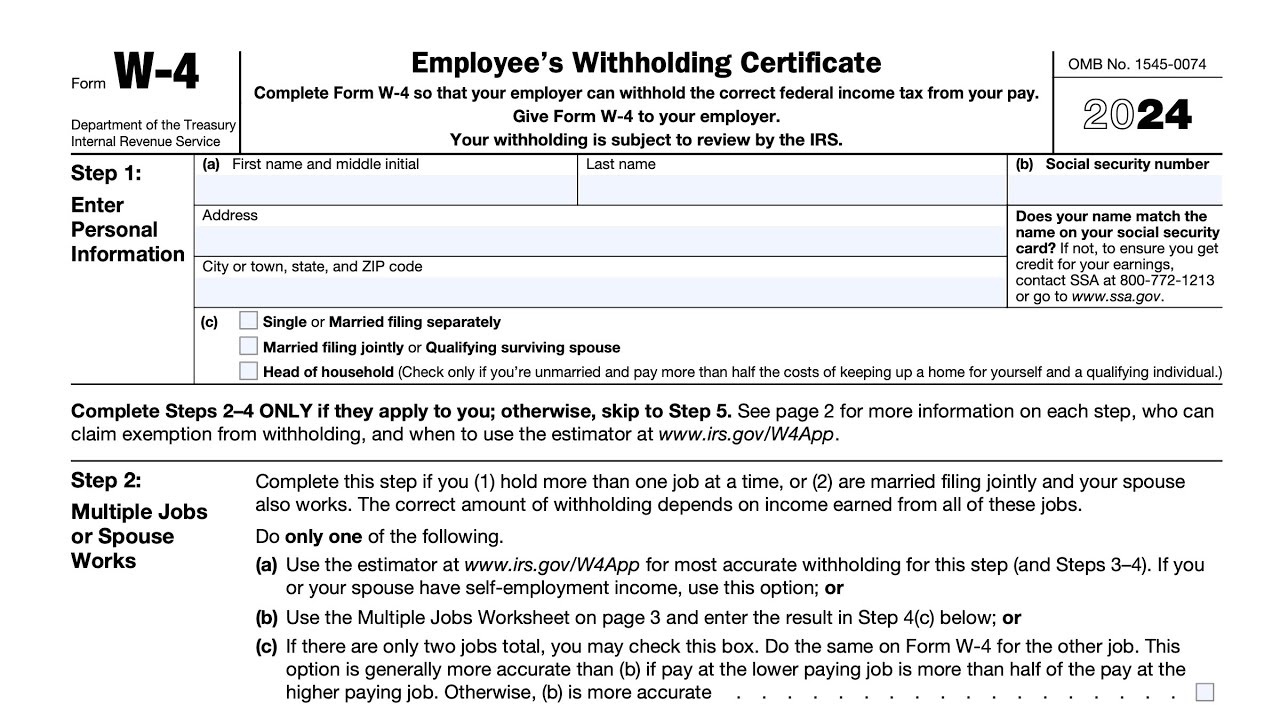

W4 Form 2025 | Tax season is just around the corner, and California has some exciting updates in store for us with the new W4 Form 2025! This updated form is designed to make the tax filing process smoother and more efficient for both individuals and businesses. With new features and enhancements, filling out your W4 form will be easier than ever before. So, get ready to dive in and uncover all the exciting changes that the W4 Form 2025 California has to offer!

Exciting Updates: W4 Form 2025 California!

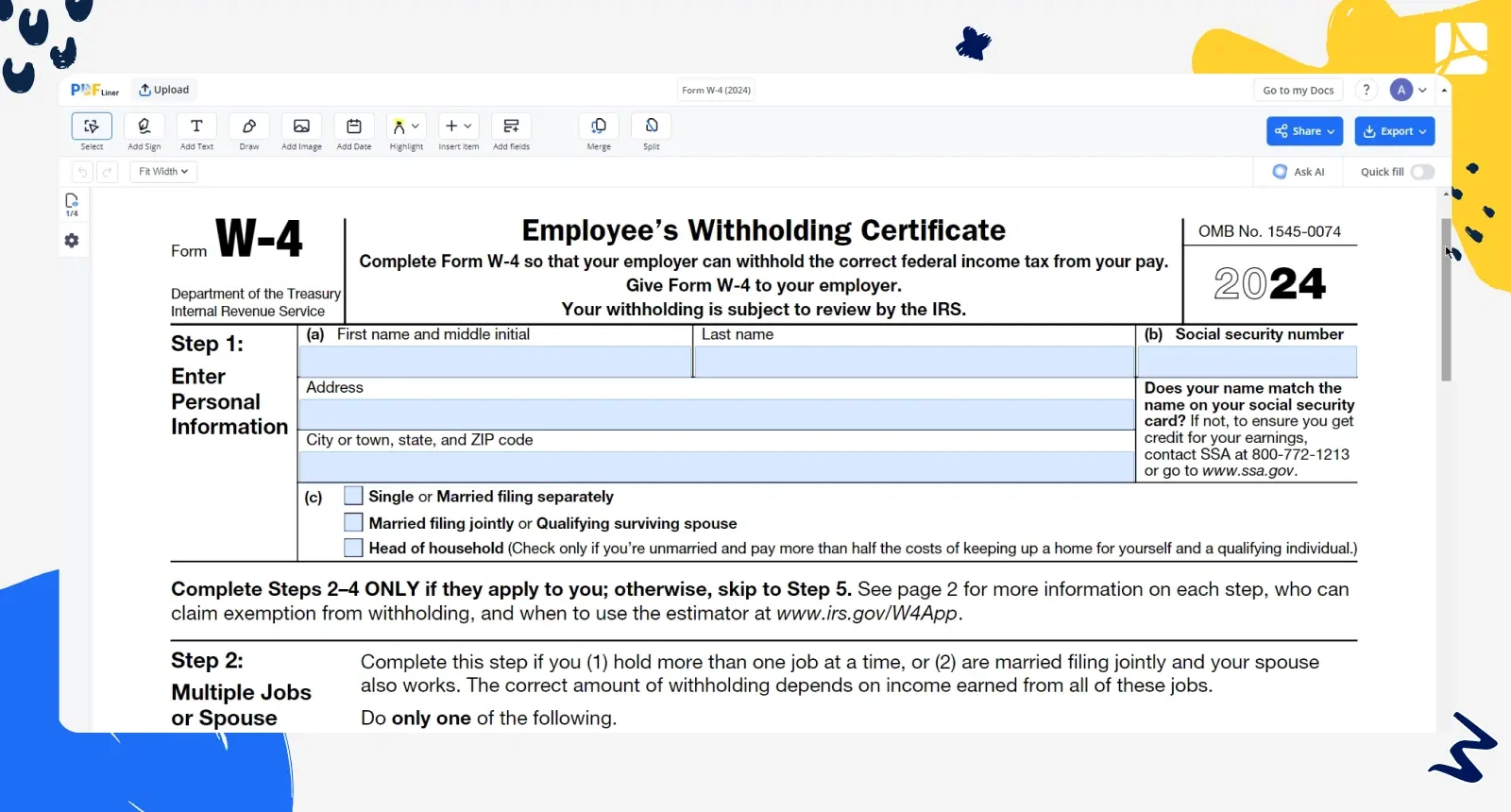

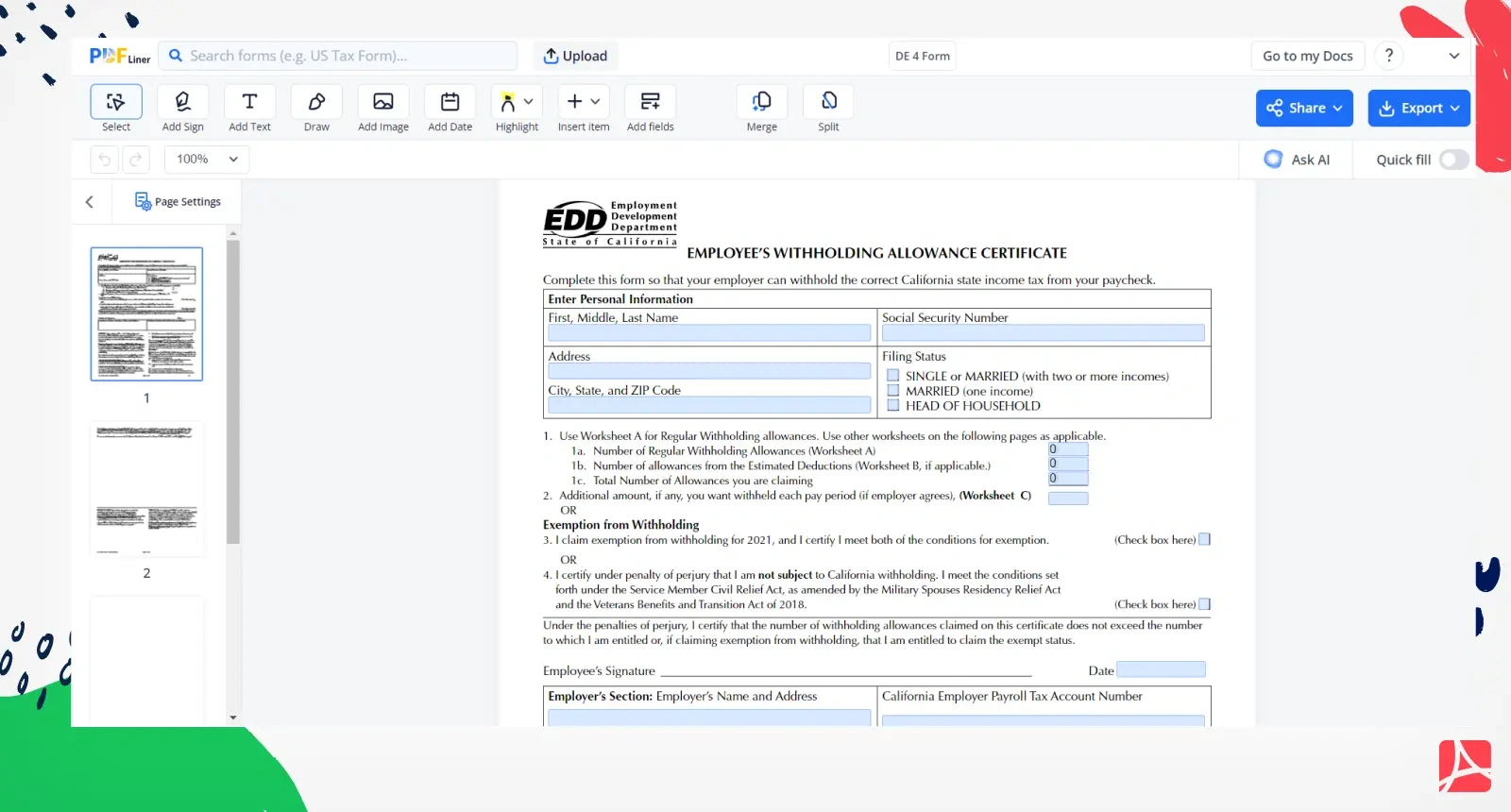

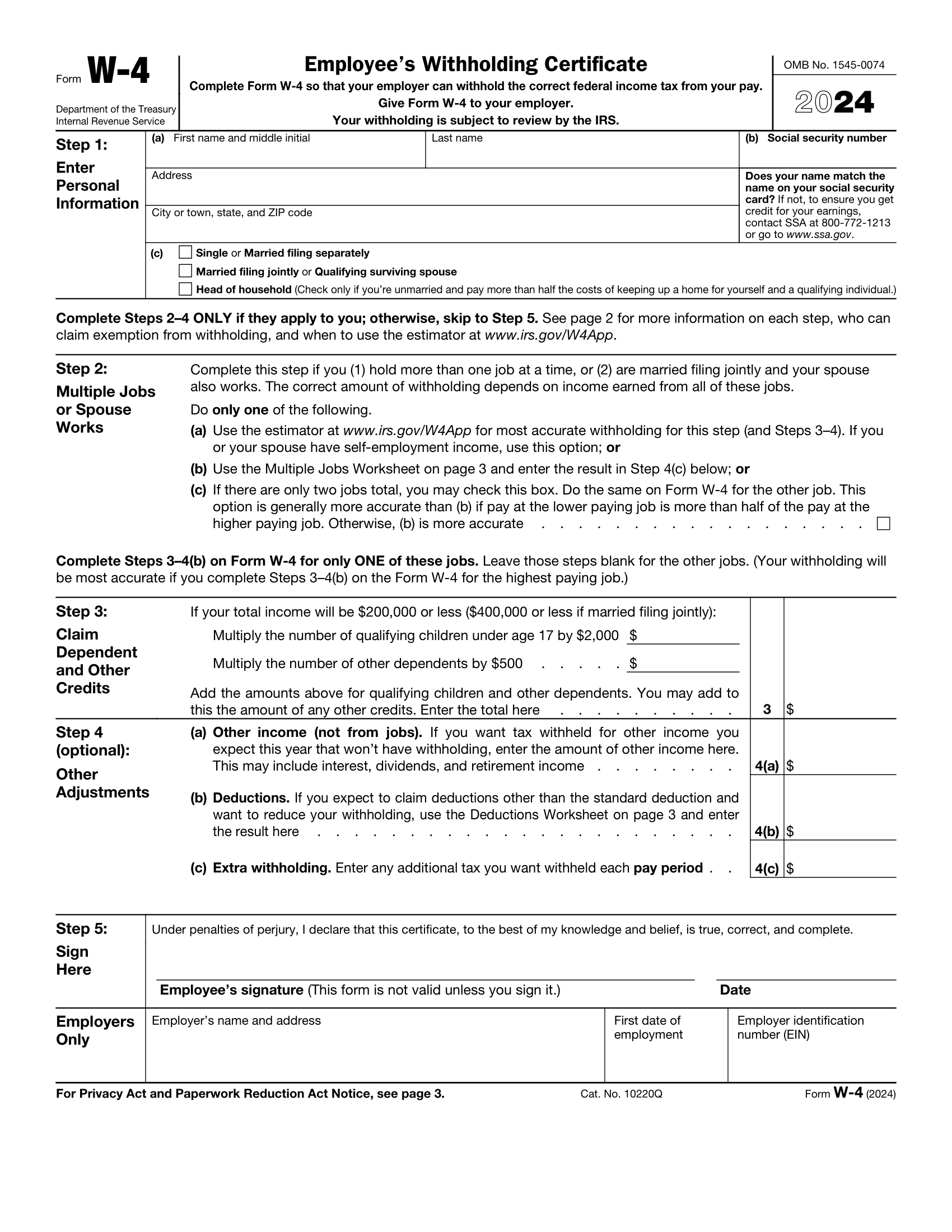

One of the most exciting updates in the W4 Form 2025 California is the addition of more detailed instructions and guidance for taxpayers. The form now includes helpful tips and explanations to make it easier for individuals to accurately fill out their W4 form. Additionally, the new form has been redesigned to be more user-friendly, with clear sections and instructions that are easy to follow. These updates are sure to make the tax filing process a breeze for everyone.

Another exciting feature of the W4 Form 2025 California is the incorporation of new tax credits and deductions that can help individuals save money on their taxes. The form now includes updated information on available tax credits and deductions, making it easier for taxpayers to take advantage of these savings. By carefully reviewing the new form and understanding the available credits and deductions, individuals can potentially reduce their tax liability and keep more money in their pockets.

Tips and Tricks for Tax Season Success

As you prepare to tackle the tax season, it’s important to stay organized and informed. Start by gathering all necessary documents, such as W2 forms, receipts, and any other relevant financial information. Next, carefully review the new W4 Form 2025 California and follow the provided instructions to ensure that you accurately report your income and deductions. If you have any questions or need assistance, don’t hesitate to reach out to a tax professional for guidance.

To maximize your tax savings and avoid any potential issues, consider consulting with a tax advisor or accountant. They can provide valuable insights and advice on how to optimize your tax return and take advantage of all available credits and deductions. By staying proactive and informed throughout the tax season, you can ensure a smooth and successful filing process. So, get ready to tackle tax season with confidence and make the most of the new W4 Form 2025 California!

The unveiling of the W4 Form 2025 California brings exciting updates and enhancements to the tax filing process. With more detailed instructions, new tax credits, and user-friendly design, this form is sure to make tax season smoother and more efficient for everyone. By staying organized, informed, and seeking professional advice when needed, you can navigate the tax season with ease and maximize your savings. So, get ready to tackle tax season with confidence and make the most of the W4 Form 2025 California!

Accessing W4 Form 2025 California

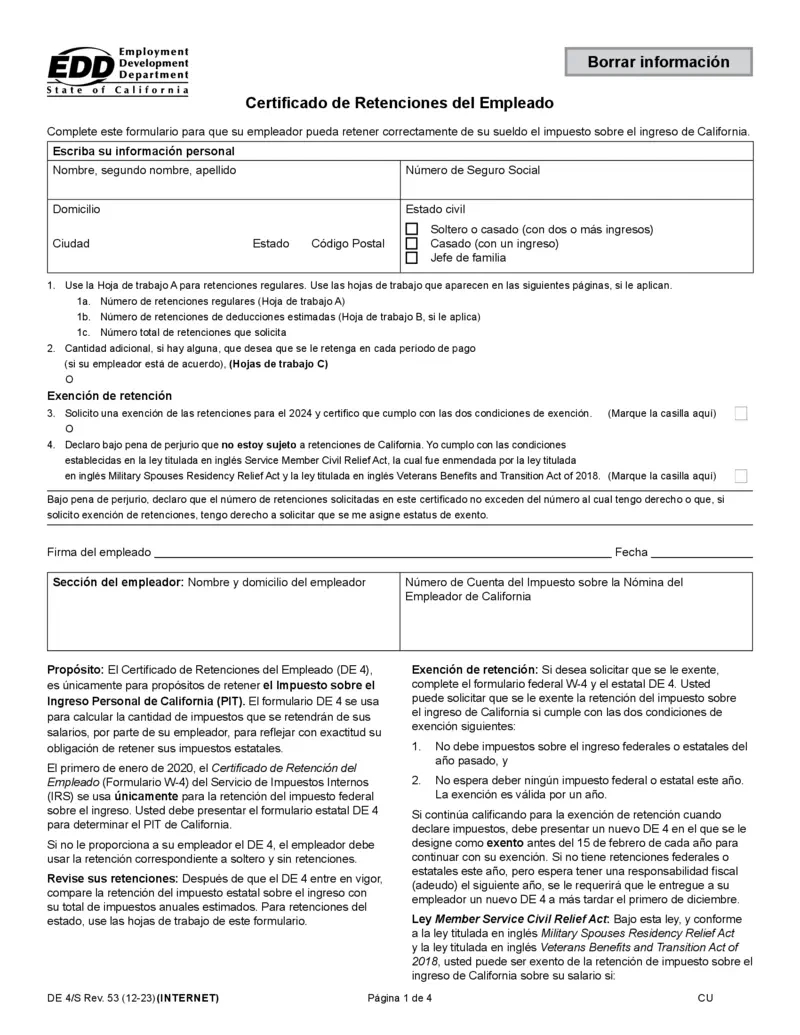

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the W4 Form 2025 California is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the W4 Form 2025 California from the link below.

W4 Form 2025 California