W4 Form 2025 | Are you looking to make the most out of your tax return this year? Look no further than the South Carolina W4 Form 2025! By filling out this form correctly, you can unlock your tax potential and maximize your refund. The key is to provide accurate information about your income, deductions, and credits. The more details you provide, the better chance you have of receiving a larger refund. So, grab your W4 form and get ready to unleash your tax savings!

Maximize Your Refund Potential with South Carolina W4 Form 2025!

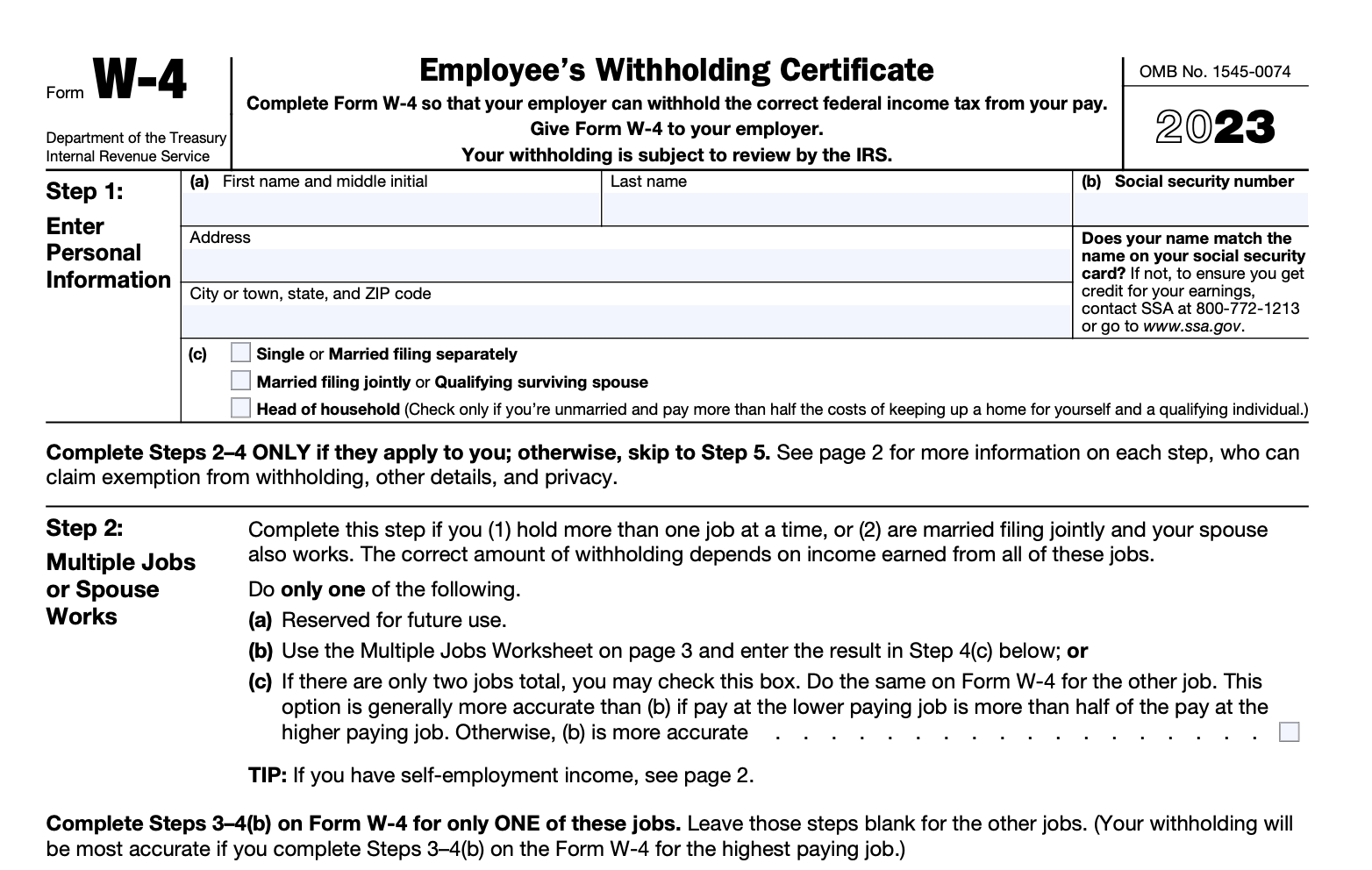

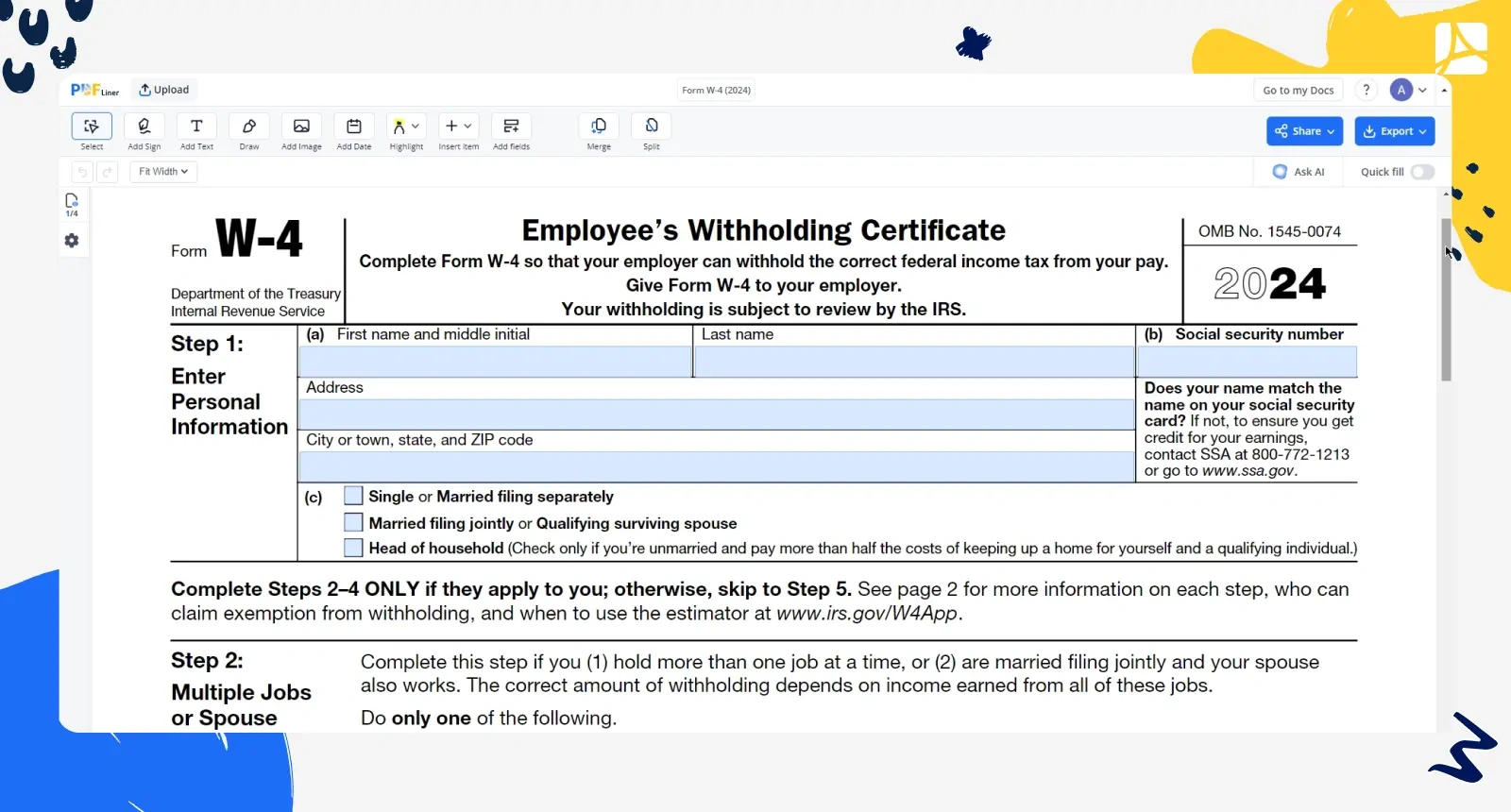

When filling out the South Carolina W4 Form 2025, it’s important to pay attention to every detail. Make sure to include all sources of income, such as wages, tips, bonuses, and any other earnings. Additionally, don’t forget to claim any deductions you may be eligible for, such as mortgage interest, student loan interest, and charitable contributions. By taking the time to fill out the form accurately, you can ensure that you are getting the most out of your tax return.

Unleash Your Tax Savings: A Detailed Guide to SC W4 Form 2025!

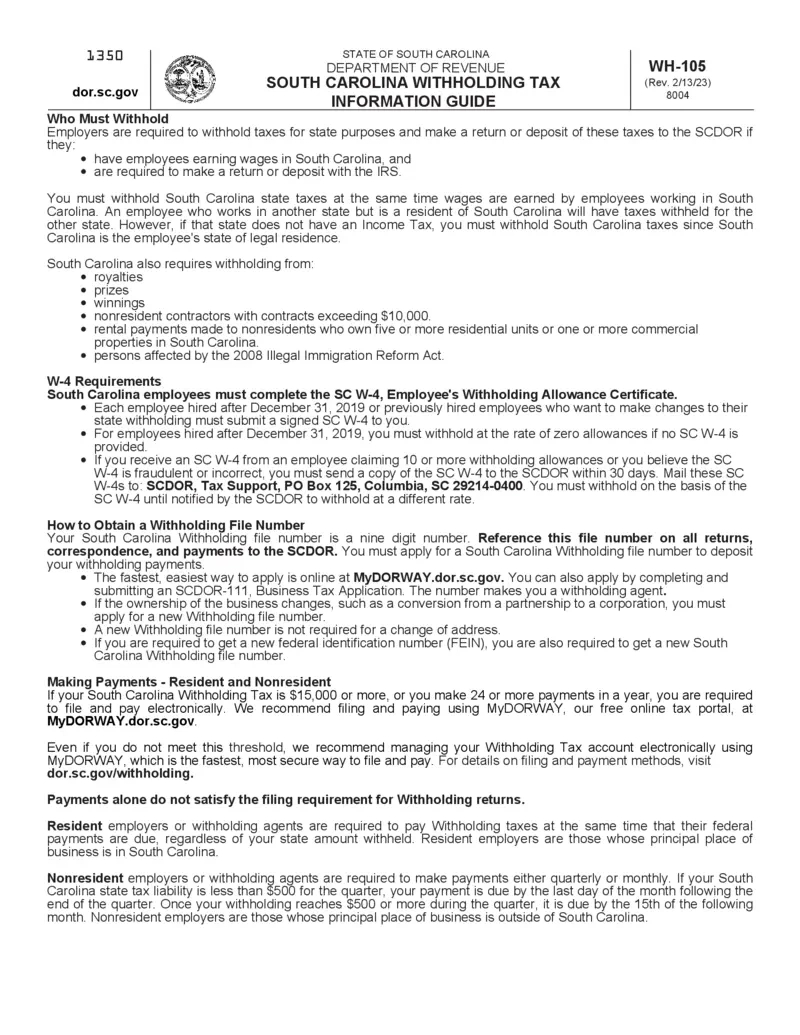

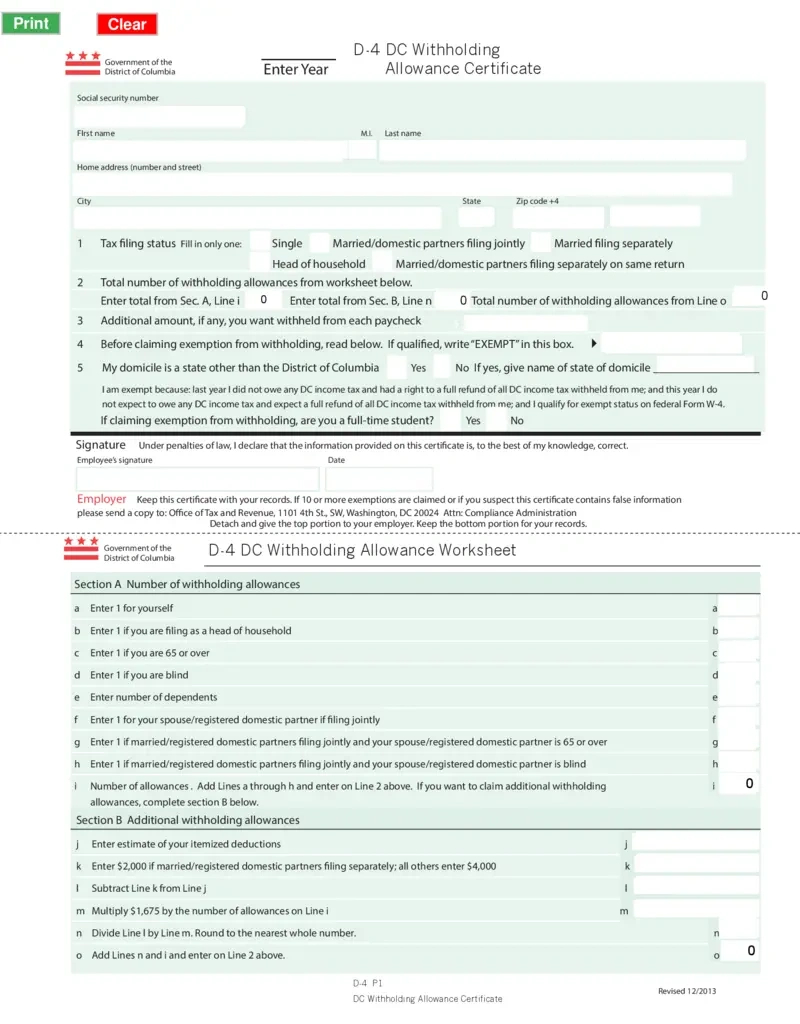

Navigating the South Carolina W4 Form 2025 may seem daunting at first, but with a detailed guide, you can easily unlock your tax savings. Start by carefully reviewing each section of the form and providing accurate information. Remember to update your withholding allowances based on your current financial situation. By doing so, you can avoid overpaying taxes throughout the year and increase your chances of receiving a larger refund.

Another important aspect of the South Carolina W4 Form 2025 is understanding how to properly complete the worksheet. This will help you calculate the correct amount of withholding to ensure you are not overpaying or underpaying your taxes. By following the instructions provided on the form and seeking guidance if needed, you can unleash your tax savings and make the most out of your tax return. So, don’t delay – start filling out your W4 form today and watch as your refund potential grows!

The South Carolina W4 Form 2025 is a valuable tool that can help you unlock your tax potential and maximize your refund. By providing accurate information, updating your withholding allowances, and understanding how to complete the form correctly, you can unleash your tax savings and make the most out of tax season. So, grab your W4 form, follow the detailed guide, and get ready to reap the rewards of your hard work. Happy tax filing!

Accessing South Carolina W4 Form 2025

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the South Carolina W4 Form 2025 is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the South Carolina W4 Form 2025 from the link below.

South Carolina W4 Form 2025