W4 Form 2025 | Are you looking to maximize your tax savings and get the most out of your taxes? Look no further than the MI W4 Form 2025! This handy guide will help you navigate through the complexities of tax forms and ensure that you are taking full advantage of all the deductions and credits available to you. By following the tips and tricks outlined in this guide, you can unlock significant savings and keep more money in your pocket.

Maximize Your Savings Today!

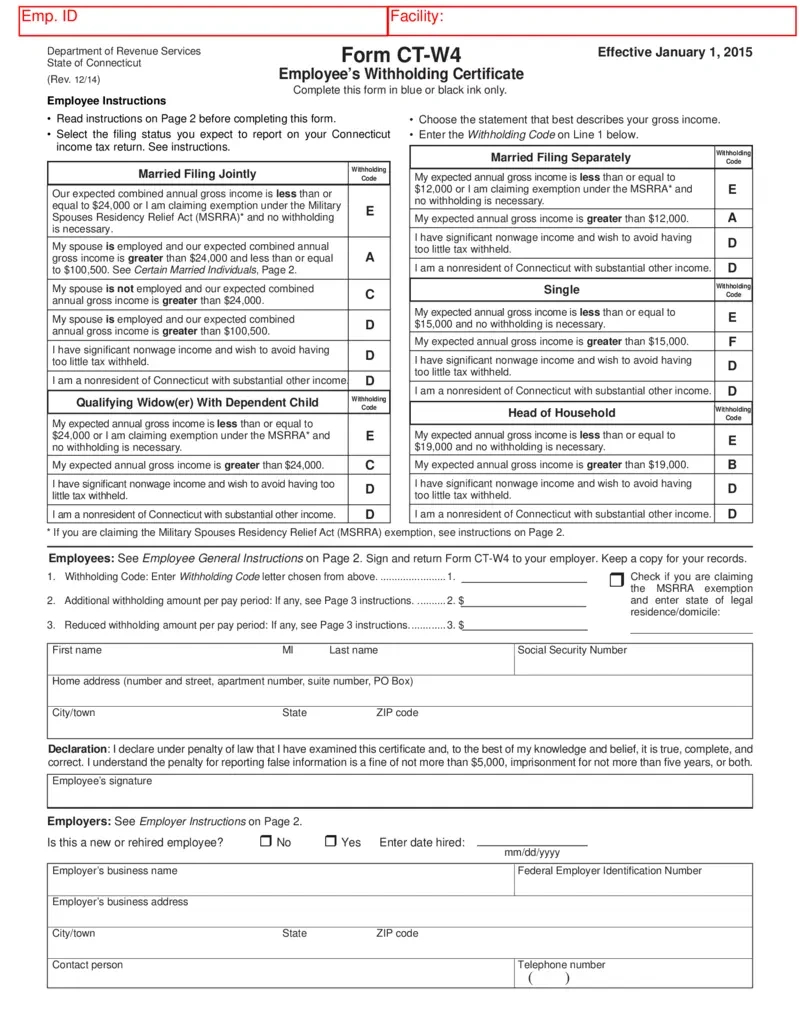

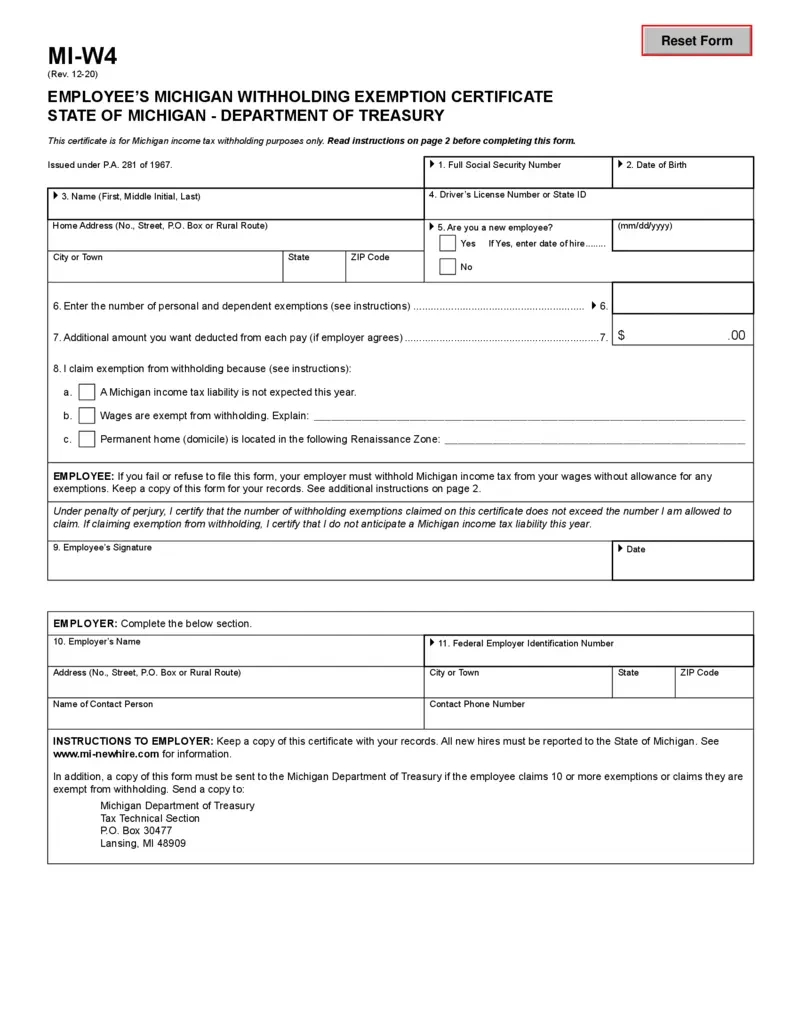

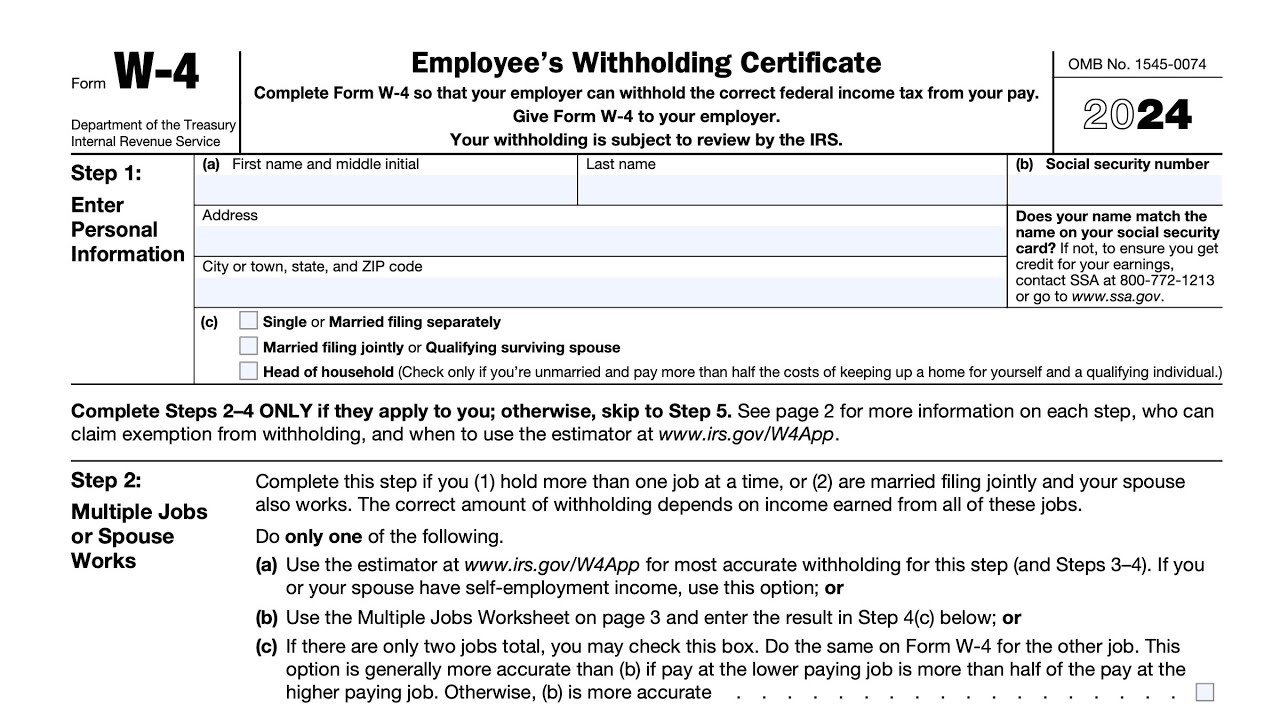

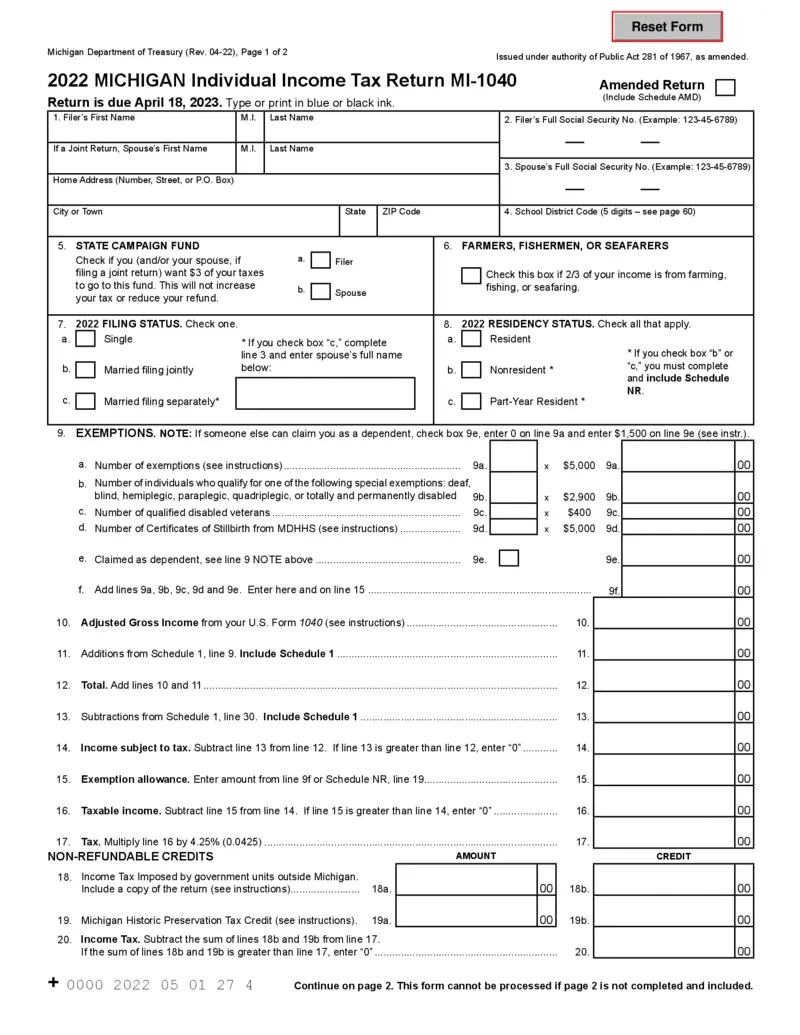

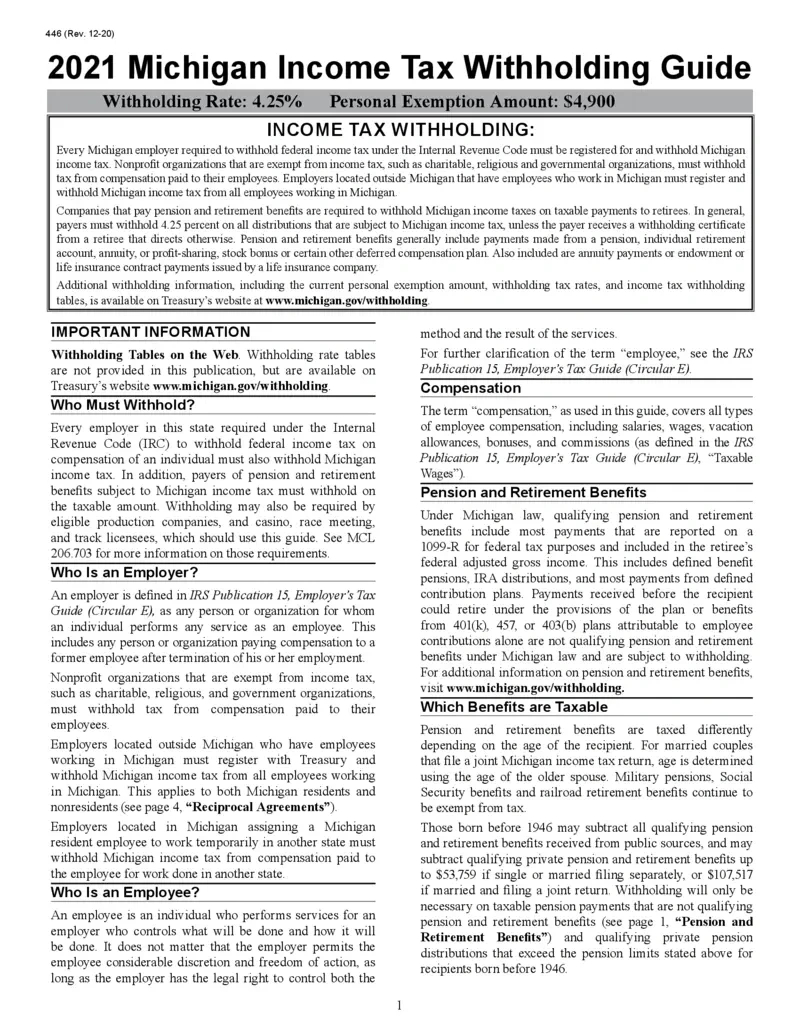

When it comes to maximizing your tax savings, the key is to understand how to properly fill out your MI W4 Form 2025. This form allows you to specify how much tax should be withheld from your paycheck based on your individual circumstances. By accurately completing this form, you can ensure that you are not overpaying in taxes and can potentially increase your take-home pay. Make sure to review your form regularly and make any necessary adjustments to reflect changes in your financial situation.

In addition to filling out your MI W4 Form 2025 correctly, there are other strategies you can use to maximize your tax savings. Take advantage of tax credits and deductions that you qualify for, such as the Earned Income Tax Credit or the Child Tax Credit. By claiming these credits, you can reduce your tax liability and potentially receive a larger refund. It’s also important to keep track of any expenses that may be tax-deductible, such as medical expenses or charitable donations, as these can further lower your tax bill.

Don’t wait until tax season to start thinking about maximizing your savings. By taking proactive steps throughout the year, such as adjusting your withholding allowances or contributing to tax-advantaged accounts, you can set yourself up for success come tax time. Remember, every dollar saved in taxes is a dollar that can be put towards your financial goals. So, start unlocking your tax savings today with the MI W4 Form 2025 guide and keep more money in your pocket!

Accessing MI W4 Form 2025

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the MI W4 Form 2025 is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the MI W4 Form 2025 from the link below.

MI W4 Form 2025