W4 Form 2025 | Are you feeling overwhelmed by the thought of filling out the 2025 W4 Form? Don’t worry, you’re not alone! Many people find this form confusing and intimidating, but with the right guidance, you can tackle it with confidence. The key is to unravel the mysteries of the form and understand each section. Once you break it down step by step, you’ll see that it’s not as complicated as it seems.

Unveiling the Mysteries of the 2025 W4 Form!

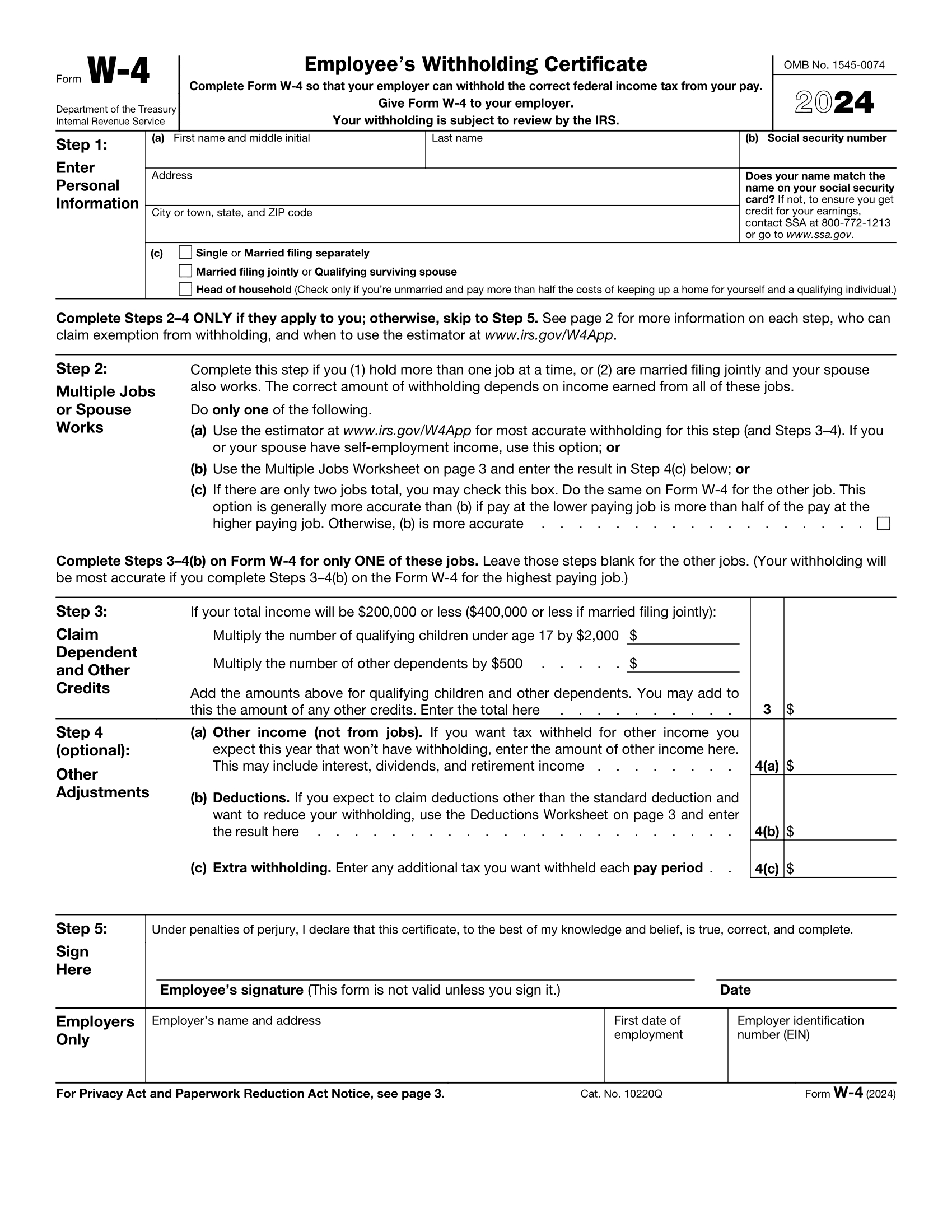

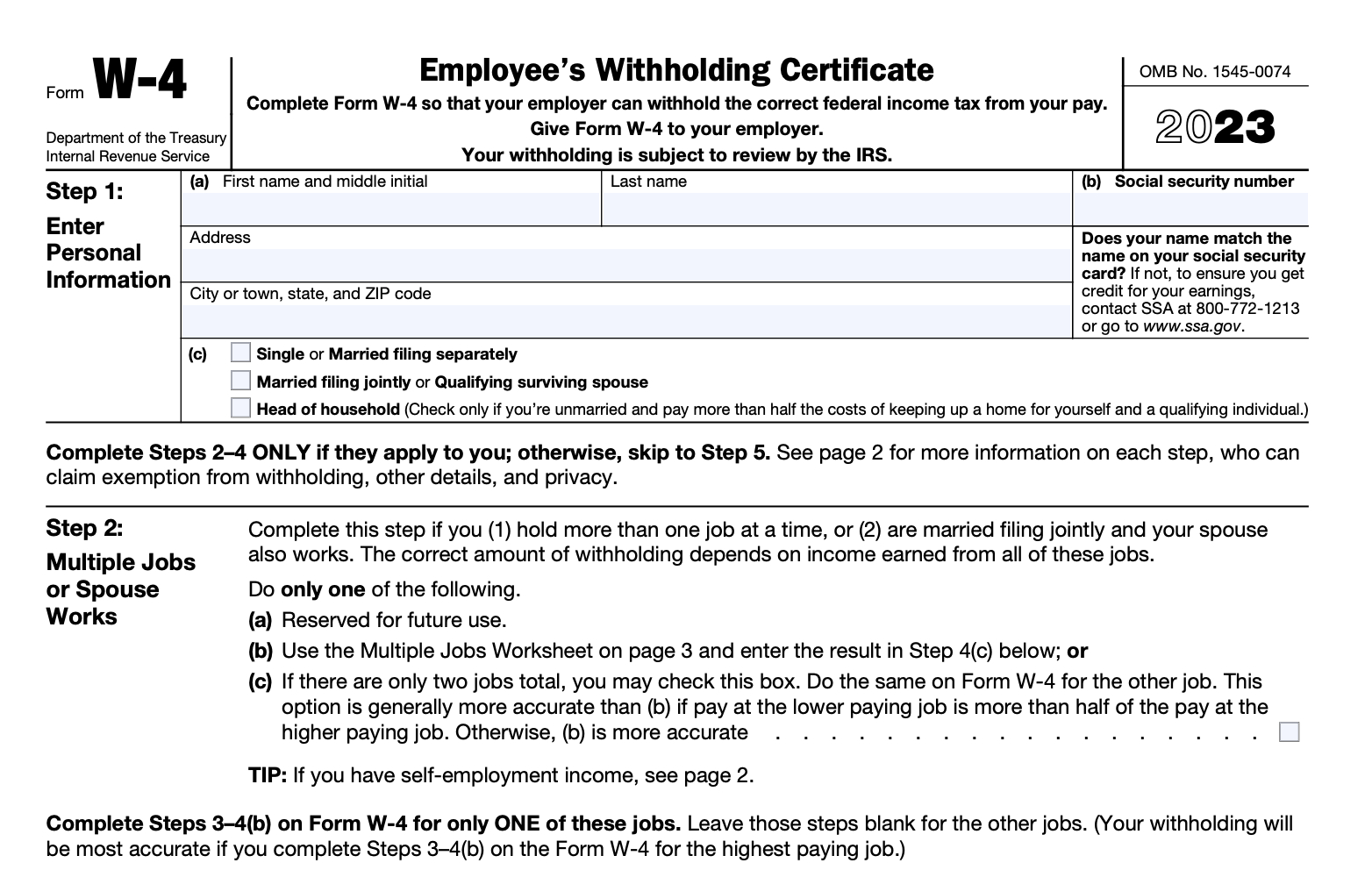

The 2025 W4 Form is designed to help your employer determine how much federal income tax to withhold from your paycheck. It includes sections for your personal information, such as your name, address, and Social Security number, as well as your filing status and any allowances you wish to claim. The form also allows you to indicate any additional withholding amounts or exemptions you may qualify for. By understanding the purpose of each section, you can provide accurate information and ensure that the right amount of tax is withheld from your earnings.

When filling out the 2025 W4 Form, it’s important to take your time and double-check your entries for accuracy. Mistakes on the form can lead to incorrect withholding amounts, which could result in a larger tax bill come tax season. Make sure to read the instructions carefully and seek help from a tax professional if needed. Remember, mastering the 2025 W4 Form is all about understanding the process and taking the time to complete it correctly. With a little patience and attention to detail, you can navigate the form with ease and peace of mind.

Simplifying the Process: Your Ultimate Guide to the 2025 W4 Form!

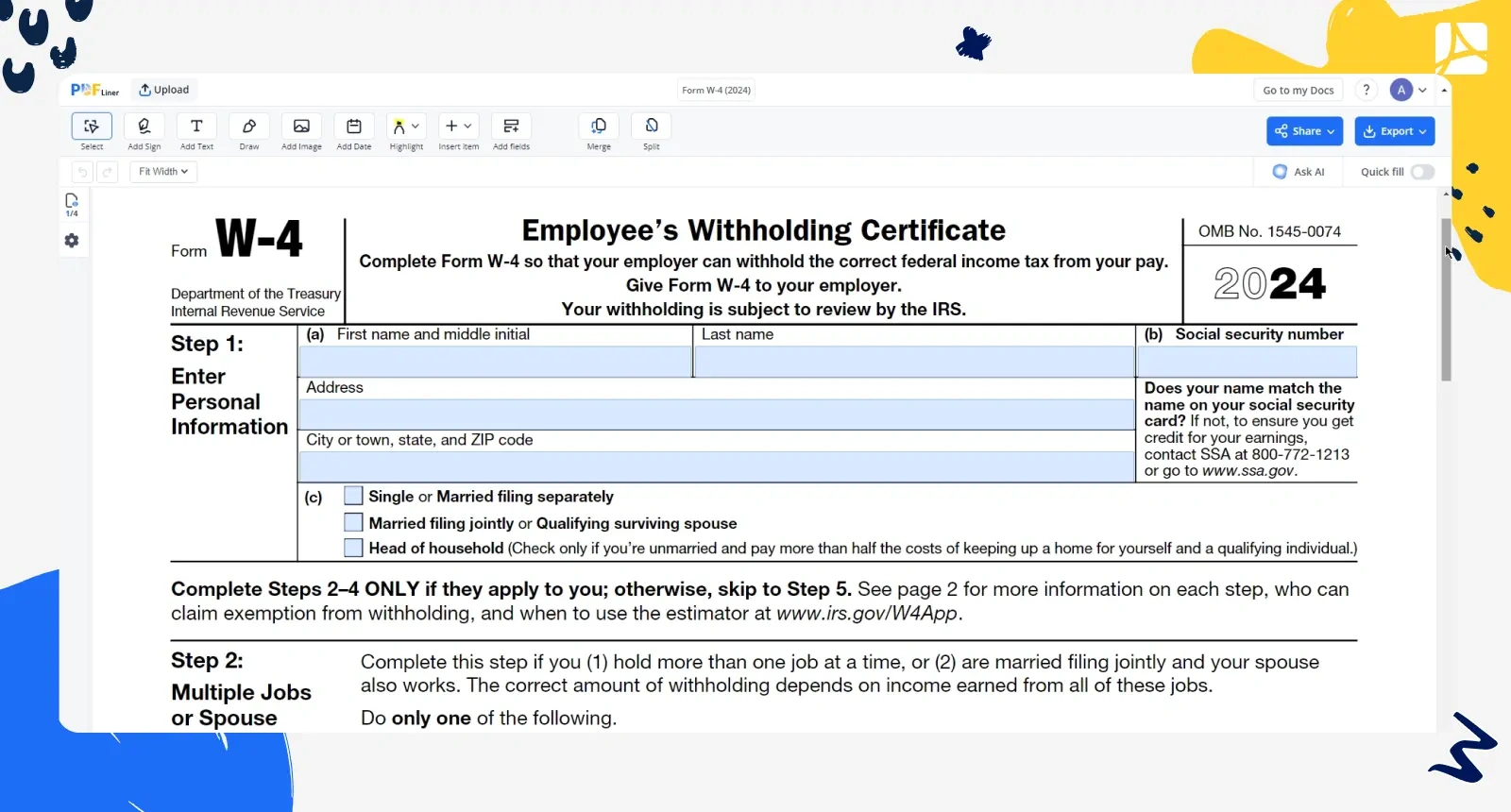

To simplify the process of filling out the 2025 W4 Form, start by gathering all the necessary information and documents you’ll need. This includes your Social Security number, your filing status, and any relevant financial information, such as income from other sources or deductions you may qualify for. Having everything on hand will make it easier to complete the form accurately and efficiently. Next, carefully review each section of the form and follow the instructions provided. Take your time to ensure that you understand what is being asked and provide the correct information in each field.

As you work through the form, pay close attention to any changes that may have been made for the 2025 tax year. The IRS updates the form periodically, so it’s important to be aware of any new requirements or adjustments. For example, the 2025 W4 Form may include updated tax brackets or changes to withholding calculations. By staying informed and keeping up to date with the latest changes, you can ensure that you are filling out the form correctly and in compliance with current regulations. Remember, the goal is to make the process as straightforward as possible, so don’t hesitate to ask for help or clarification if needed.

Mastering the 2025 W4 Form is a manageable task that anyone can tackle with the right approach. By unveiling the mysteries of the form and simplifying the process, you can confidently fill it out and ensure that the correct amount of tax is withheld from your earnings. Take your time, gather all the necessary information, and follow the instructions provided. With a bit of patience and attention to detail, you’ll be on your way to mastering the 2025 W4 Form in no time!

Accessing 2025 W4 Form How To Fill Out

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the 2025 W4 Form How To Fill Out is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the 2025 W4 Form How To Fill Out from the link below.

2025 W4 Form How To Fill Out