W4 Form 2025 | Are you ready to tackle tax season 2025 head-on? With the new Federal W4 form, you can stay ahead of the game and make sure your taxes are in order. It’s never too early to start preparing, and with the right tools and information, you can breeze through tax season with ease. Let’s dive into how you can get ready for tax season 2025 with the new Federal W4 form!

Stay Ahead of the Game: Prepare for Tax Season 2025!

The key to a stress-free tax season is preparation. By starting early and familiarizing yourself with the new Federal W4 form, you can avoid any last-minute surprises and ensure that your taxes are filed accurately and on time. Take the time to gather all necessary documents, such as your W2 form and any additional income statements, so you have everything you need to complete the new W4 form with ease.

Additionally, staying organized throughout the year can make the tax filing process much smoother. Consider keeping track of any deductible expenses, such as medical bills or charitable donations, so you can easily input this information into the new Federal W4 form. By staying ahead of the game and preparing in advance, you can minimize stress and maximize your tax refund potential.

Introducing the New Federal W4 Form: Your Guide to Success!

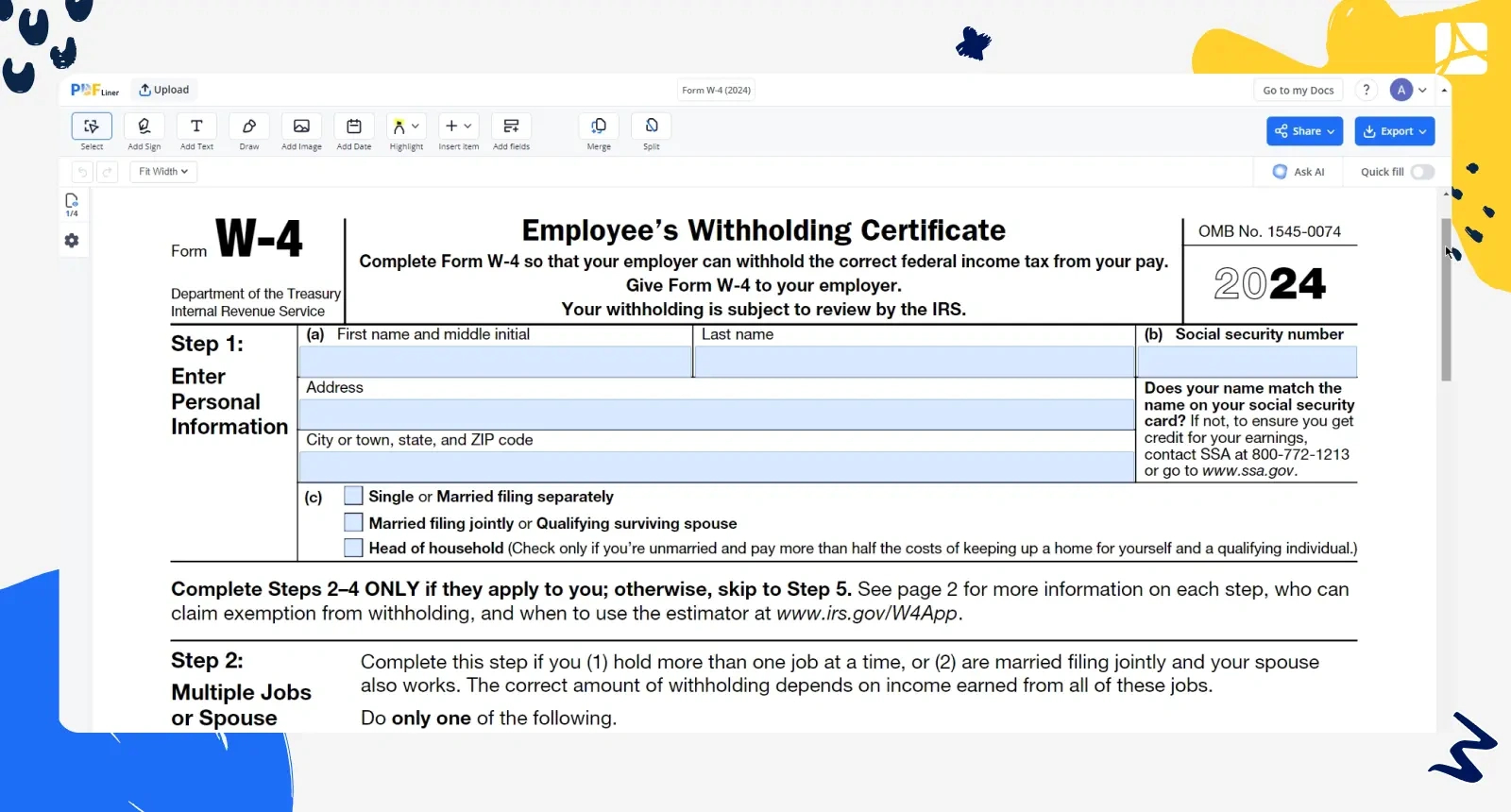

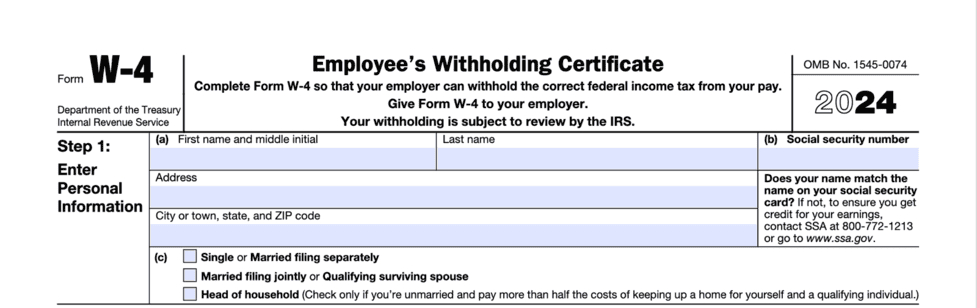

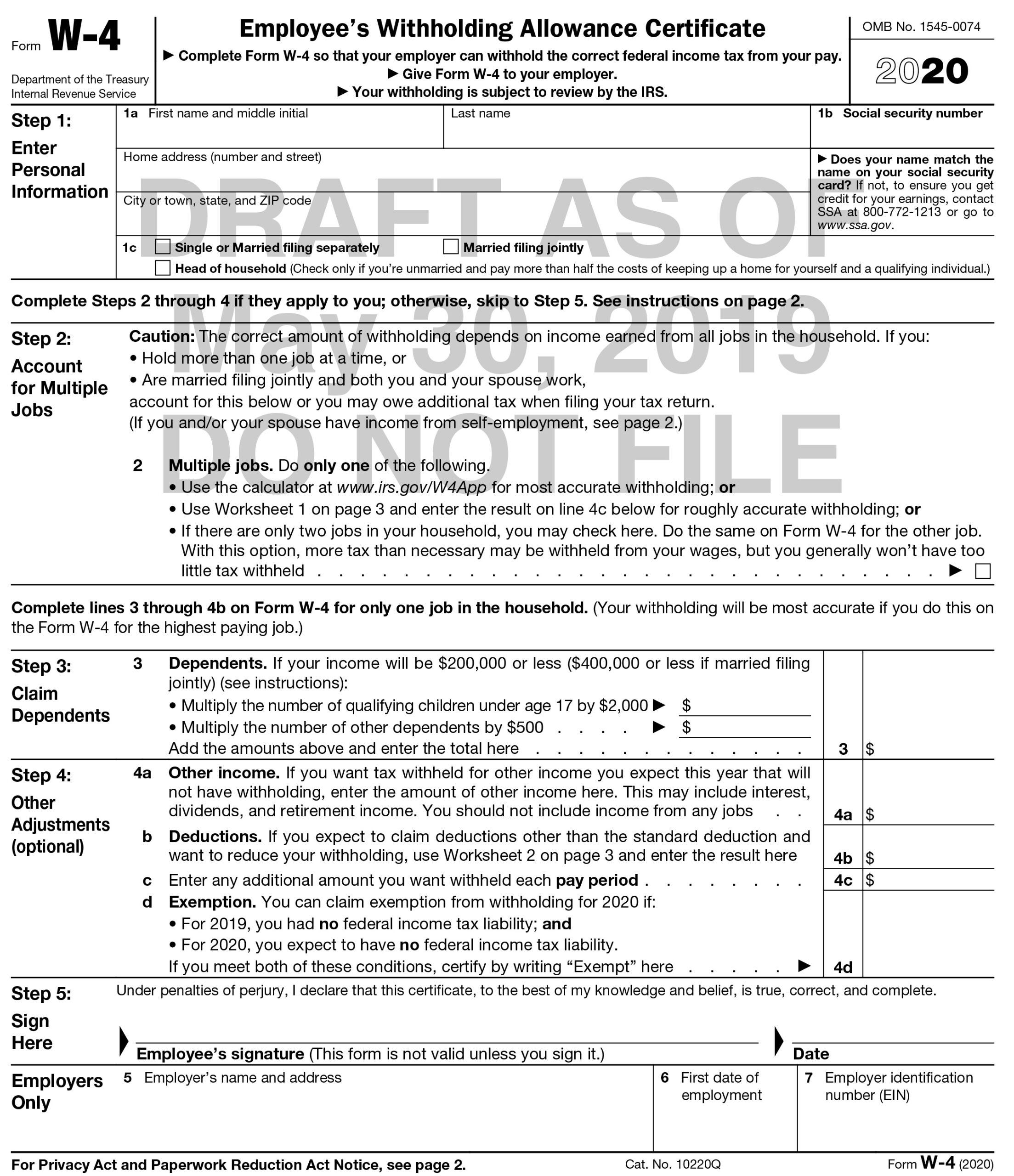

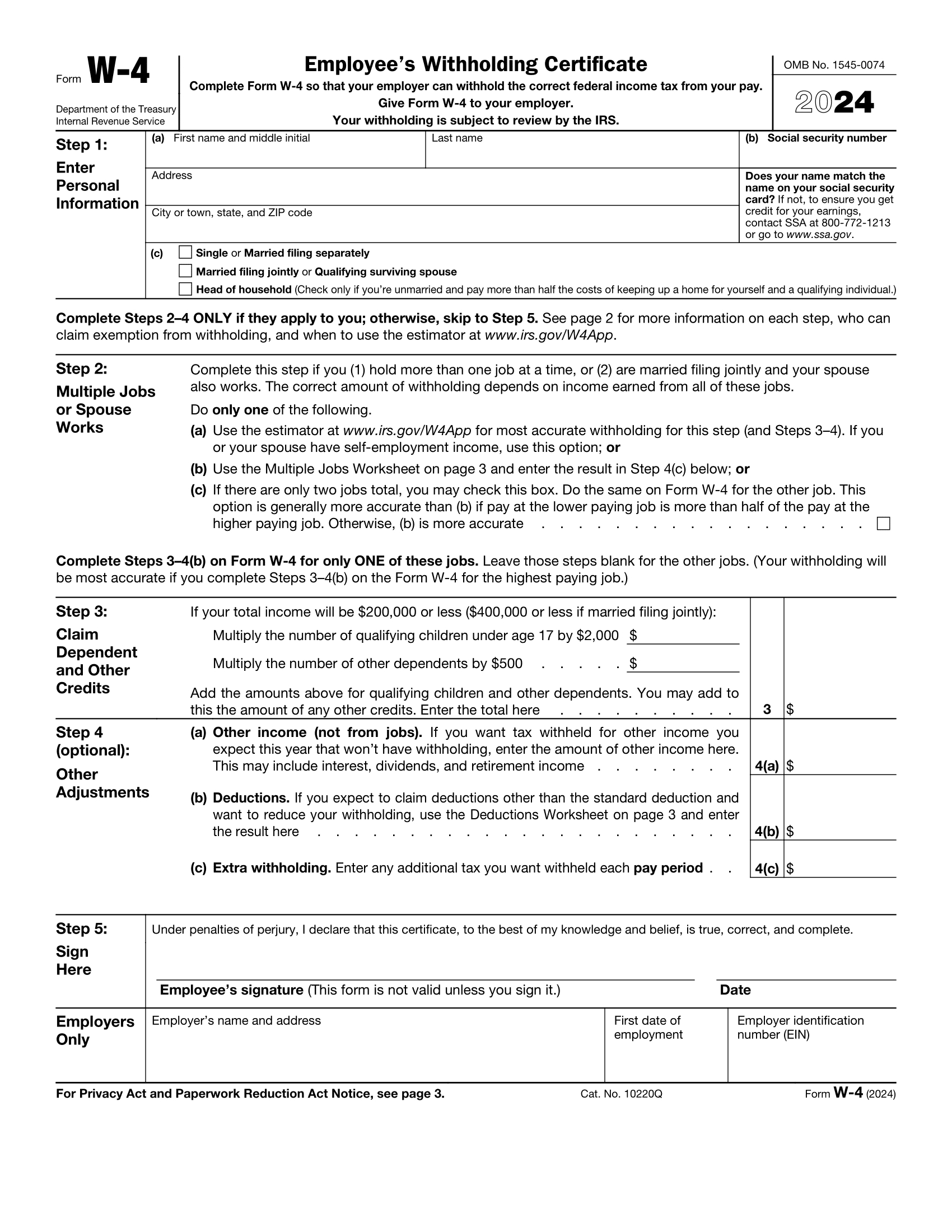

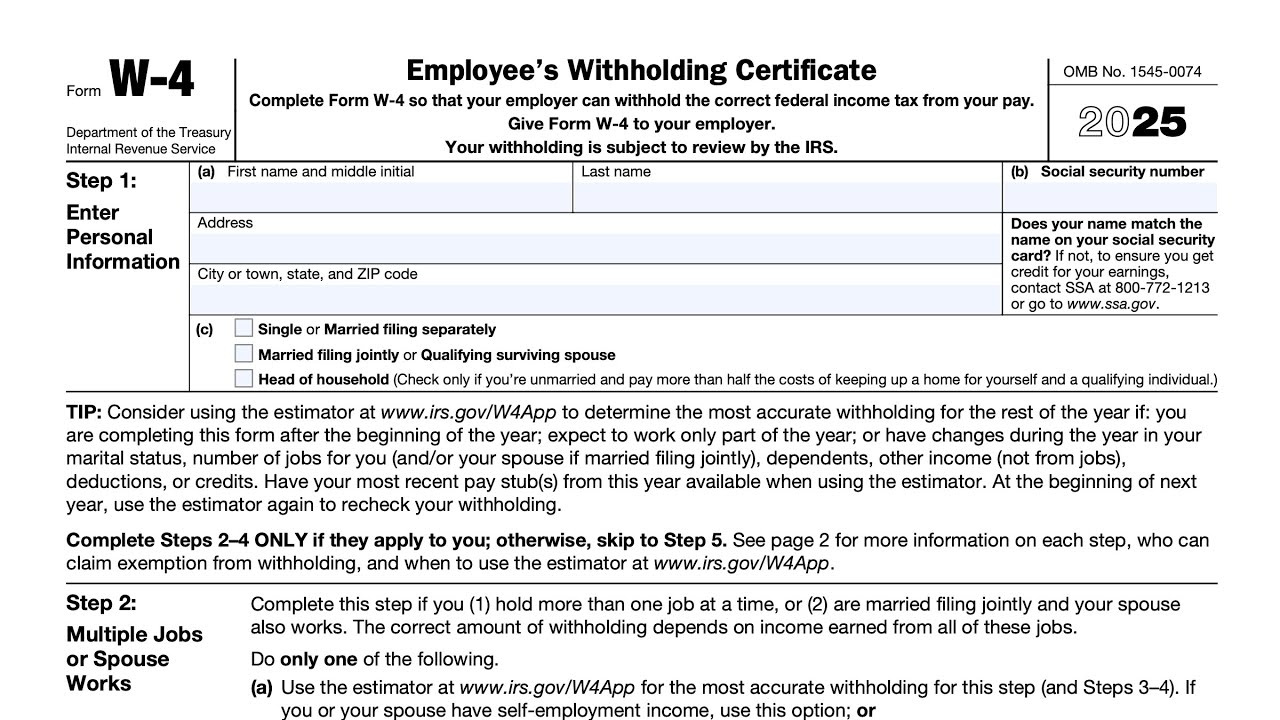

The new Federal W4 form for tax season 2025 has been updated to better reflect changes in tax laws and regulations. This updated form is designed to be more user-friendly and provide taxpayers with a clearer understanding of their tax obligations. With sections dedicated to income, deductions, and credits, the new W4 form makes it easier than ever to calculate your tax liability and ensure you are taking advantage of all available tax breaks.

To make the most of the new Federal W4 form, be sure to carefully review each section and provide accurate information. Take the time to consider any changes in your financial situation, such as a new job or additional income streams, so you can accurately report this information on the form. By taking a proactive approach to completing the new W4 form, you can ensure that your taxes are filed correctly and potentially save money on your tax bill.

Get ready for tax season 2025 with the new Federal W4 form! By staying ahead of the game and preparing in advance, you can make the tax filing process a breeze. With the right tools and information, you can ensure that your taxes are filed accurately and on time. So don’t wait until the last minute – start preparing now and get ready to conquer tax season 2025!

Accessing 2025 Federal W4 Form

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the 2025 Federal W4 Form is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the 2025 Federal W4 Form from the link below.

2025 Federal W4 Form