W4 Form 2025 | Are you ready for a smoother and more efficient tax season in 2025? Get excited because the IRS has introduced a new and improved W4 form to make the process easier for you! With the new form, you can ensure that the right amount of taxes is withheld from your paycheck, saving you time and hassle when it comes to filing your taxes. Say goodbye to confusion and hello to a stress-free tax season!

Prepare for Tax Season 2025 with Exciting Changes!

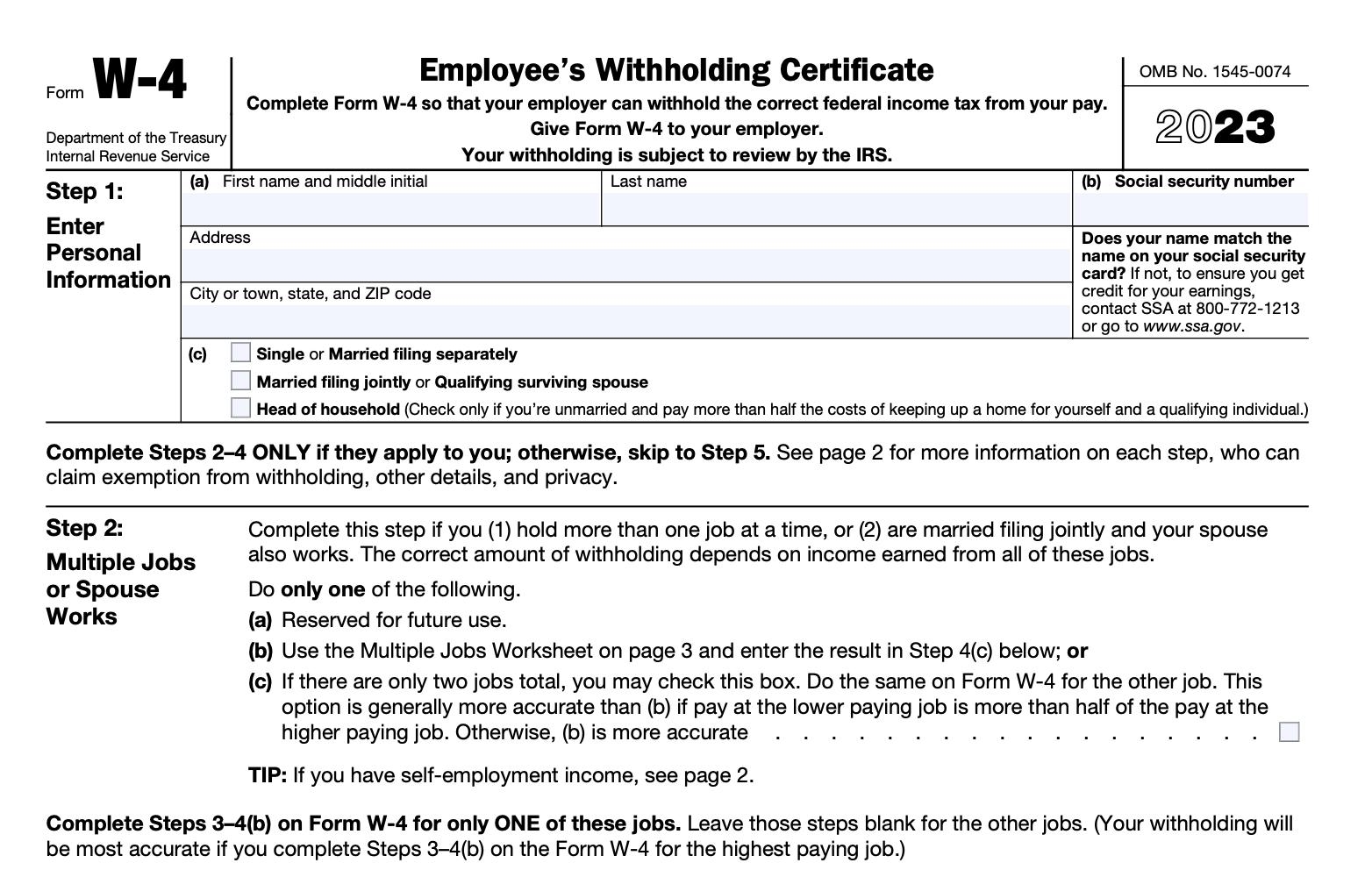

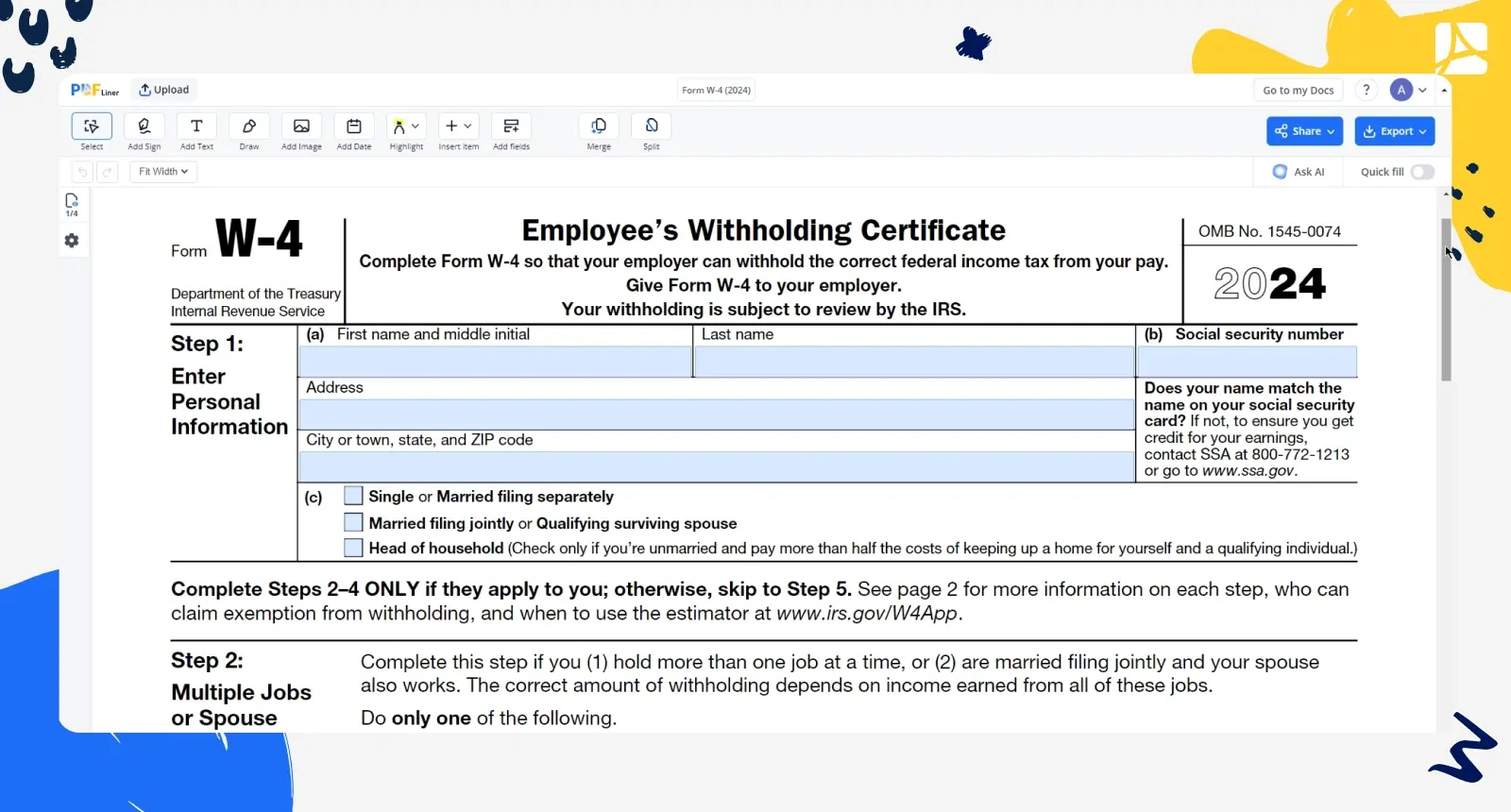

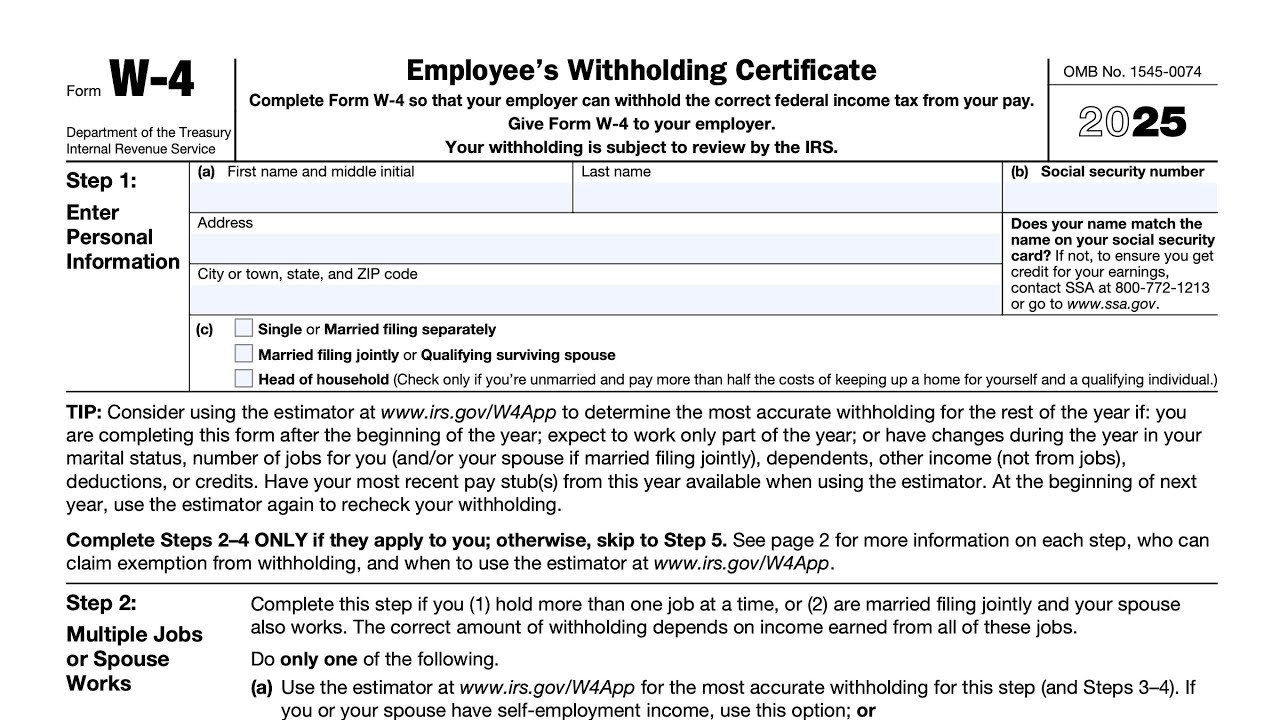

One of the most exciting changes with the new W4 form is the simplified design that makes it easier for you to fill out. Gone are the days of deciphering complicated tax jargon – the new form is straightforward and user-friendly, guiding you through the process step by step. With clear instructions and helpful tips, you can confidently navigate the form and make sure that your tax withholding is accurate.

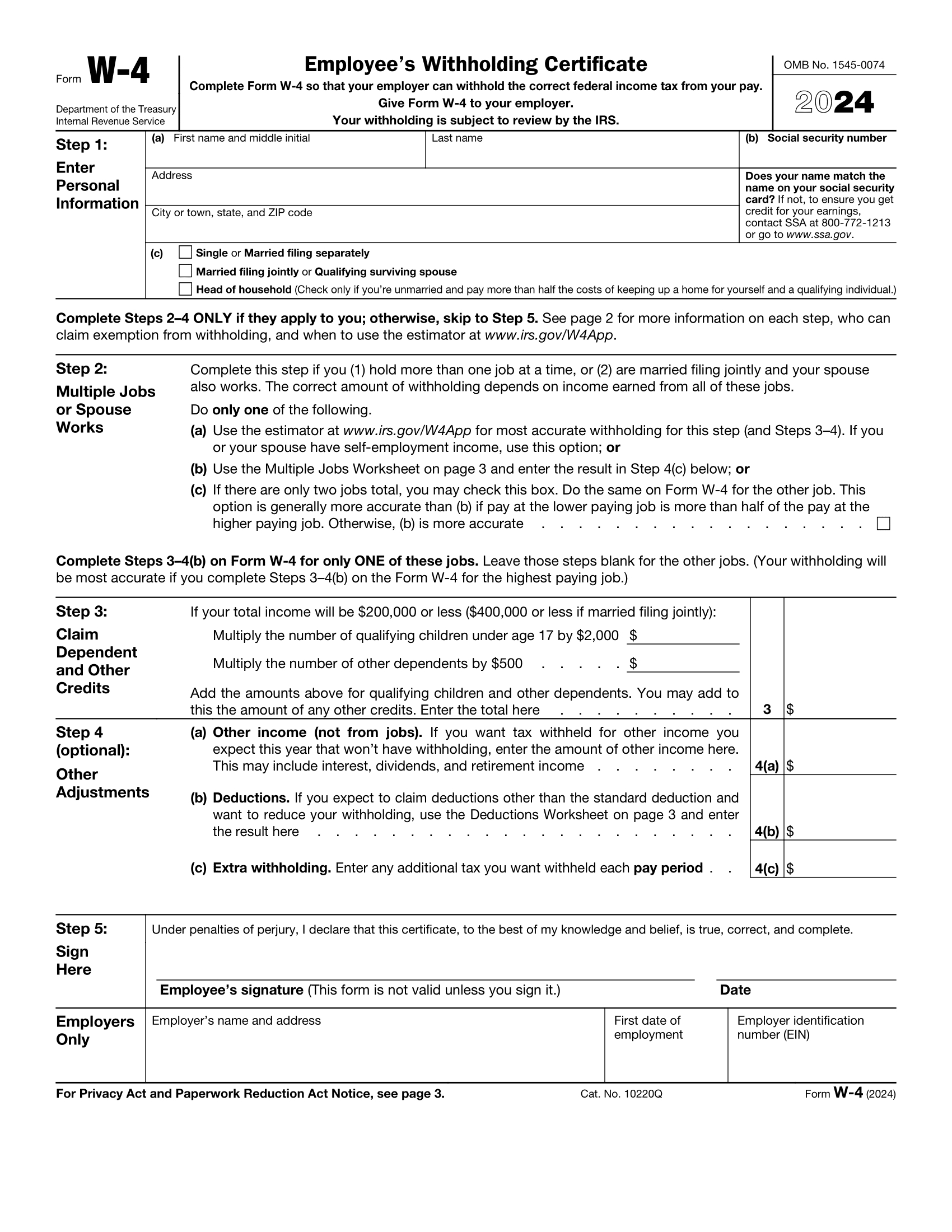

In addition to the streamlined design, the new W4 form also offers more flexibility and customization options. You can now easily adjust your withholding to account for various factors such as multiple jobs, dependents, and other income sources. This means that you can tailor your tax withholding to your specific financial situation, ensuring that you don’t end up with a surprise tax bill at the end of the year. Get ready to take control of your taxes and enjoy a smoother tax season in 2025!

Say Hello to the New W4 Form: Your Guide to Smoother Taxes!

Say goodbye to the old, confusing W4 form and hello to the new and improved version that will make your tax season a breeze! The new W4 form is designed to simplify the tax withholding process and ensure that you have the right amount of taxes withheld from your paycheck. With easy-to-follow instructions and customizable options, you can take the guesswork out of tax season and feel confident that you are setting yourself up for financial success.

When filling out the new W4 form, be sure to carefully review your personal and financial information to ensure accuracy. Take advantage of the new features that allow you to adjust your withholding based on your individual circumstances, such as changes in income or family size. By taking the time to fill out the form accurately, you can avoid any potential discrepancies and ensure that you are on the right track for a smooth tax season.

Don’t wait until the last minute to tackle your taxes – get ahead of the game with the new W4 form and set yourself up for success in 2025! By familiarizing yourself with the form and making any necessary adjustments to your withholding, you can alleviate the stress of tax season and focus on what truly matters. Say hello to a new and improved tax experience and get ready to conquer tax season with confidence!

The new W4 form is here to make your tax season in 2025 a breeze. With simplified design, flexibility, and customization options, you can take control of your taxes and ensure that you are setting yourself up for financial success. Say goodbye to confusion and hello to a stress-free tax season with the new W4 form – get ready to tackle your taxes with confidence and ease!

Accessing W4 Form For 2025

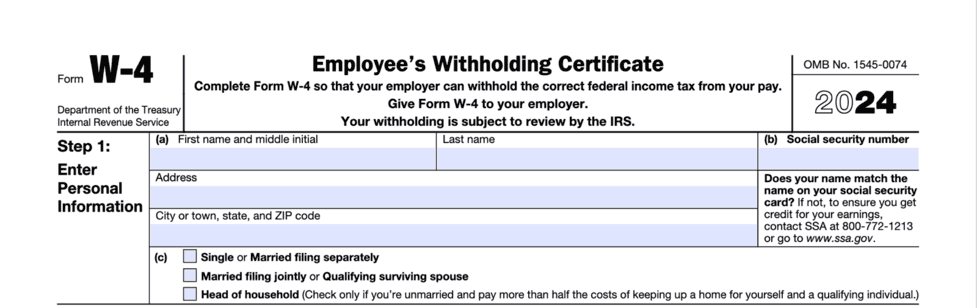

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the W4 Form For 2025 is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the W4 Form For 2025 from the link below.

W4 Form For 2025