W4 Form 2025 | South Carolina is on the brink of a revolutionary change as the W4 Form 2025 comes into play. This updated form is set to streamline the tax filing process for residents, making it easier and more efficient than ever before. With new features and enhancements designed to simplify the process, South Carolinians can look forward to a brighter future when it comes to managing their taxes.

Embracing the Evolution of W4 Form 2025 in South Carolina

The W4 Form 2025 is a testament to the state’s commitment to progress and innovation. By embracing this evolution, South Carolina is paving the way for a more efficient and effective tax system that benefits both residents and the state as a whole. With the new form, taxpayers will have the tools they need to accurately report their income, deductions, and credits, ensuring that they receive the maximum refund possible.

This updated form is not just a paperwork exercise – it represents a shift towards a more user-friendly and transparent tax system in South Carolina. By embracing the W4 Form 2025, residents can take control of their financial future and unlock new opportunities for growth and prosperity. With a clearer understanding of their tax obligations and the resources available to them, South Carolinians can confidently navigate the tax filing process and set themselves up for success.

Unlocking Opportunities and Prosperity in the Sunshine State

The implementation of the W4 Form 2025 in South Carolina is more than just a formality – it’s a catalyst for change and progress. By simplifying the tax filing process and empowering residents to take control of their financial future, the state is unlocking new opportunities for prosperity and growth. With a more efficient and transparent tax system in place, South Carolinians can focus on building their wealth and achieving their financial goals.

As residents embrace the evolution of the W4 Form 2025, they are not just filling out a form – they are taking a step towards a brighter and more prosperous future. By accurately reporting their income and deductions, residents can maximize their refund and make the most of their financial resources. With the right tools and information at their fingertips, South Carolinians can navigate the tax system with confidence and set themselves up for success in the Sunshine State.

The W4 Form 2025 is more than just a piece of paper – it’s a symbol of progress and innovation in South Carolina. By unlocking new opportunities and empowering residents to take control of their financial future, the state is paving the way for a brighter tomorrow. As residents embrace this evolution and tap into the resources available to them, they can set themselves up for success and prosperity in the years to come.

The W4 Form 2025 represents a bright future for South Carolina, with streamlined tax processes and new opportunities for growth and prosperity. By embracing this evolution and unlocking the potential of the Sunshine State, residents can take control of their financial future and set themselves up for success. With the right tools and resources at their disposal, South Carolinians can navigate the tax system with confidence and pave the way for a brighter tomorrow.

Accessing W4 Form 2025 South Carolina

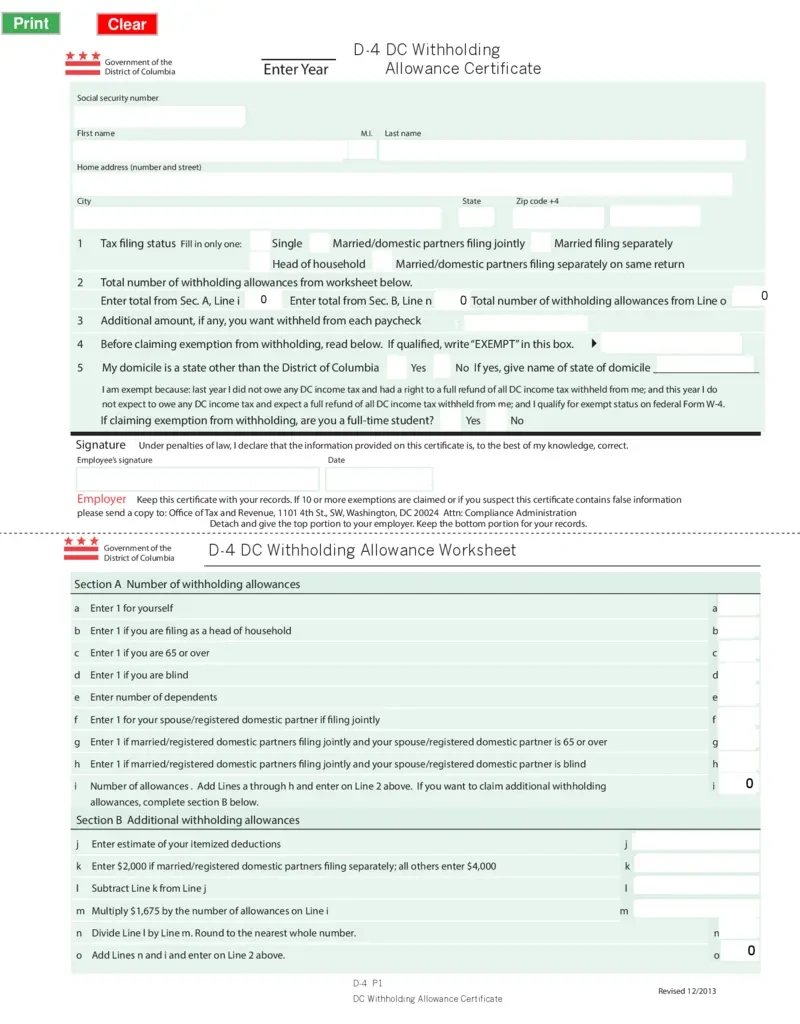

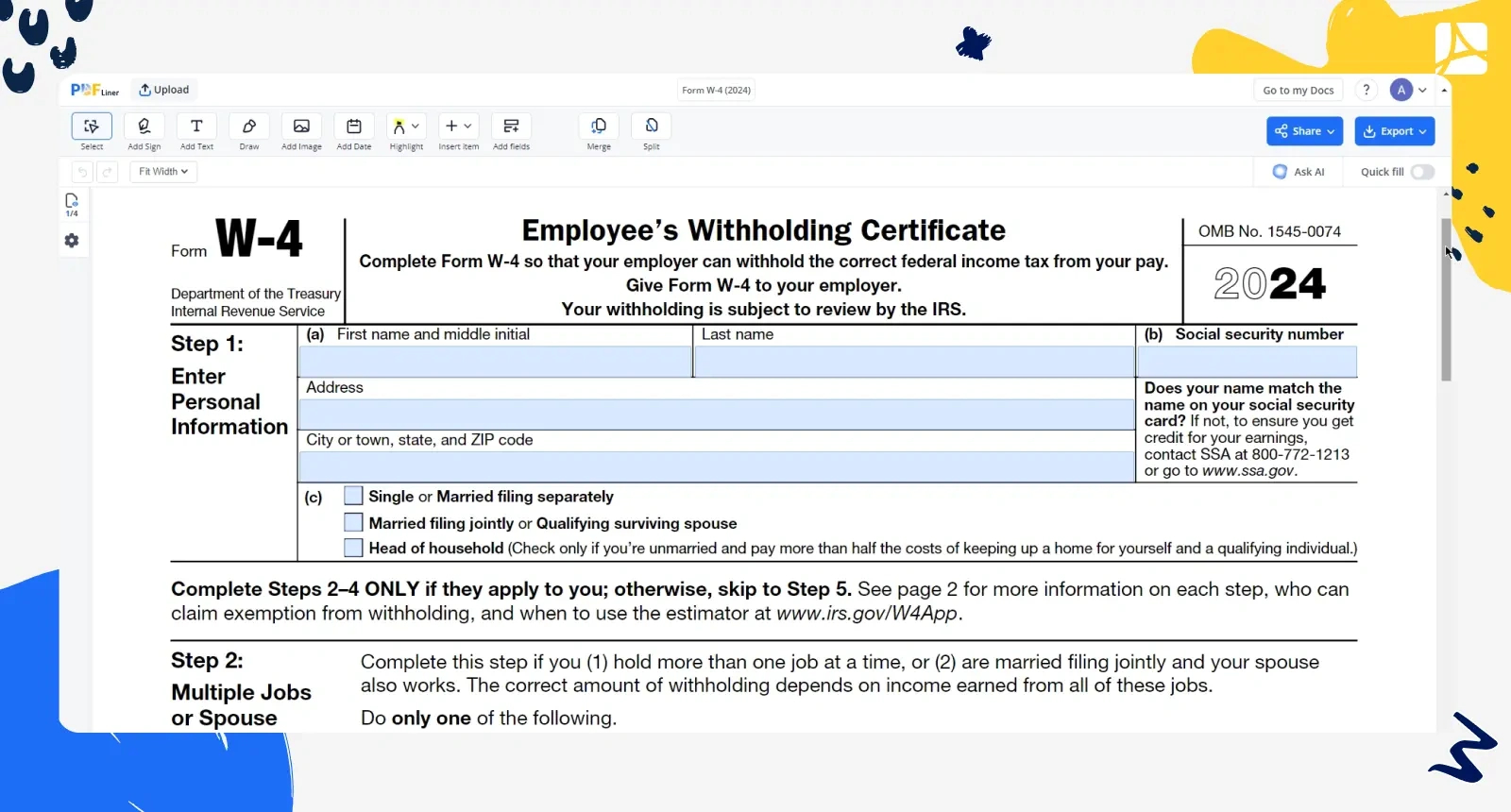

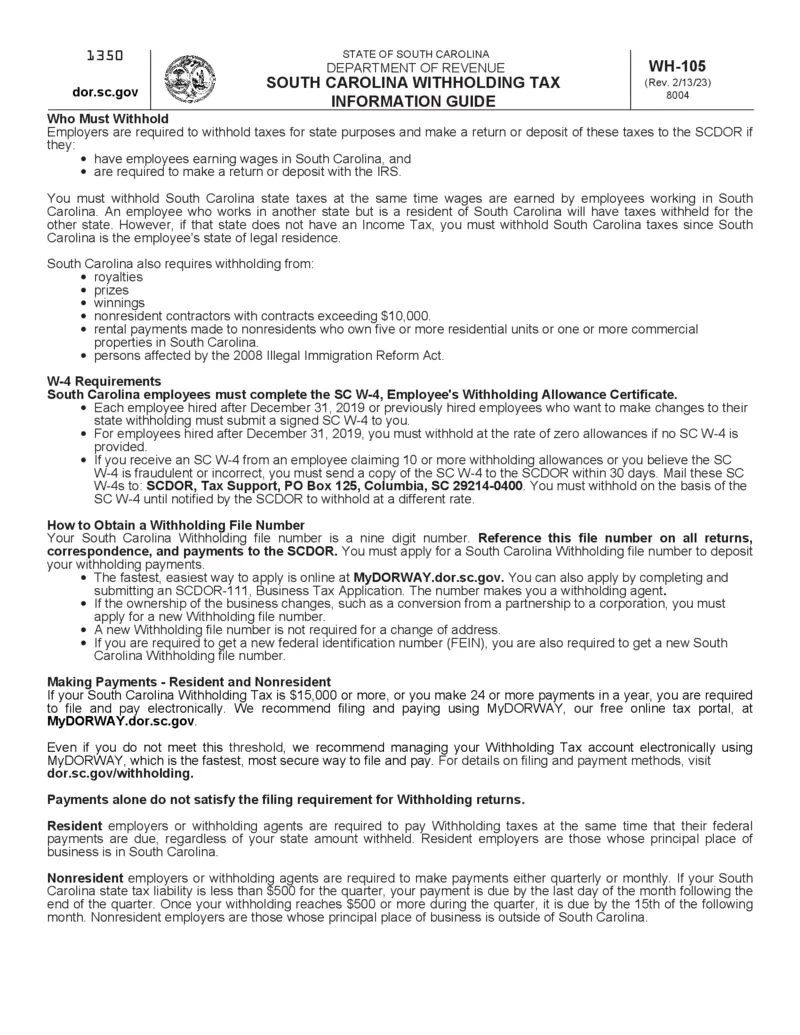

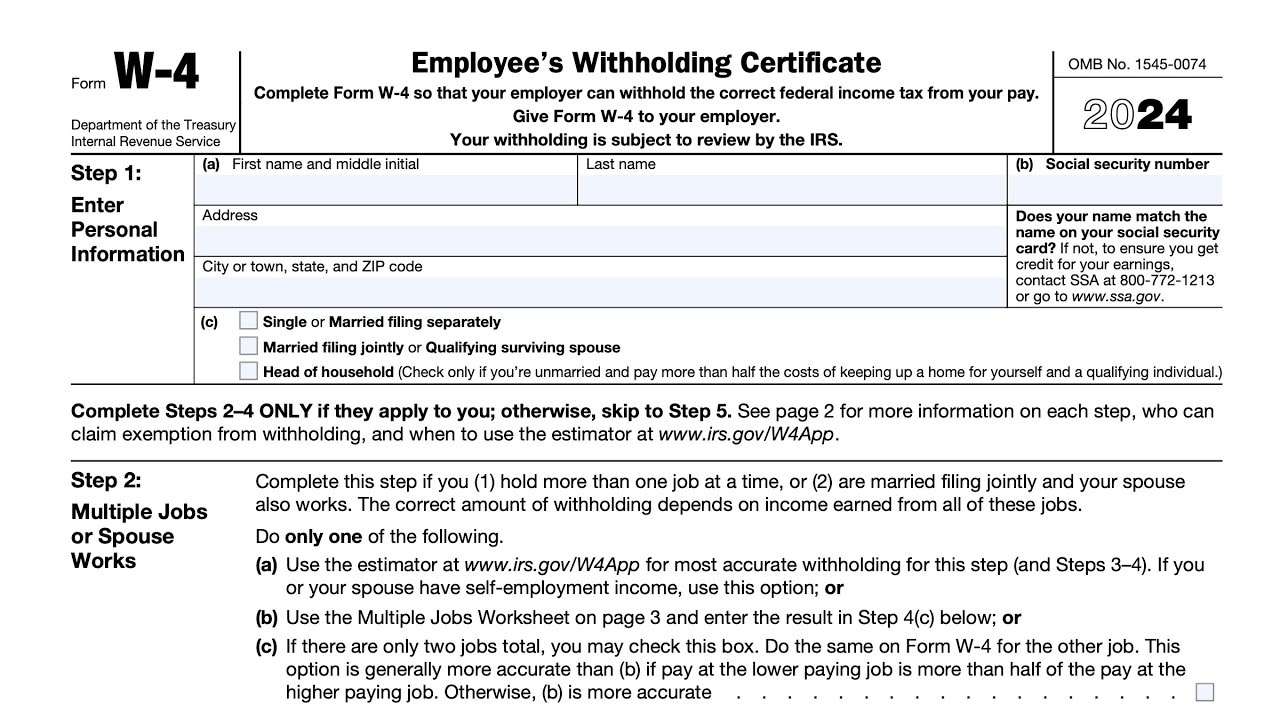

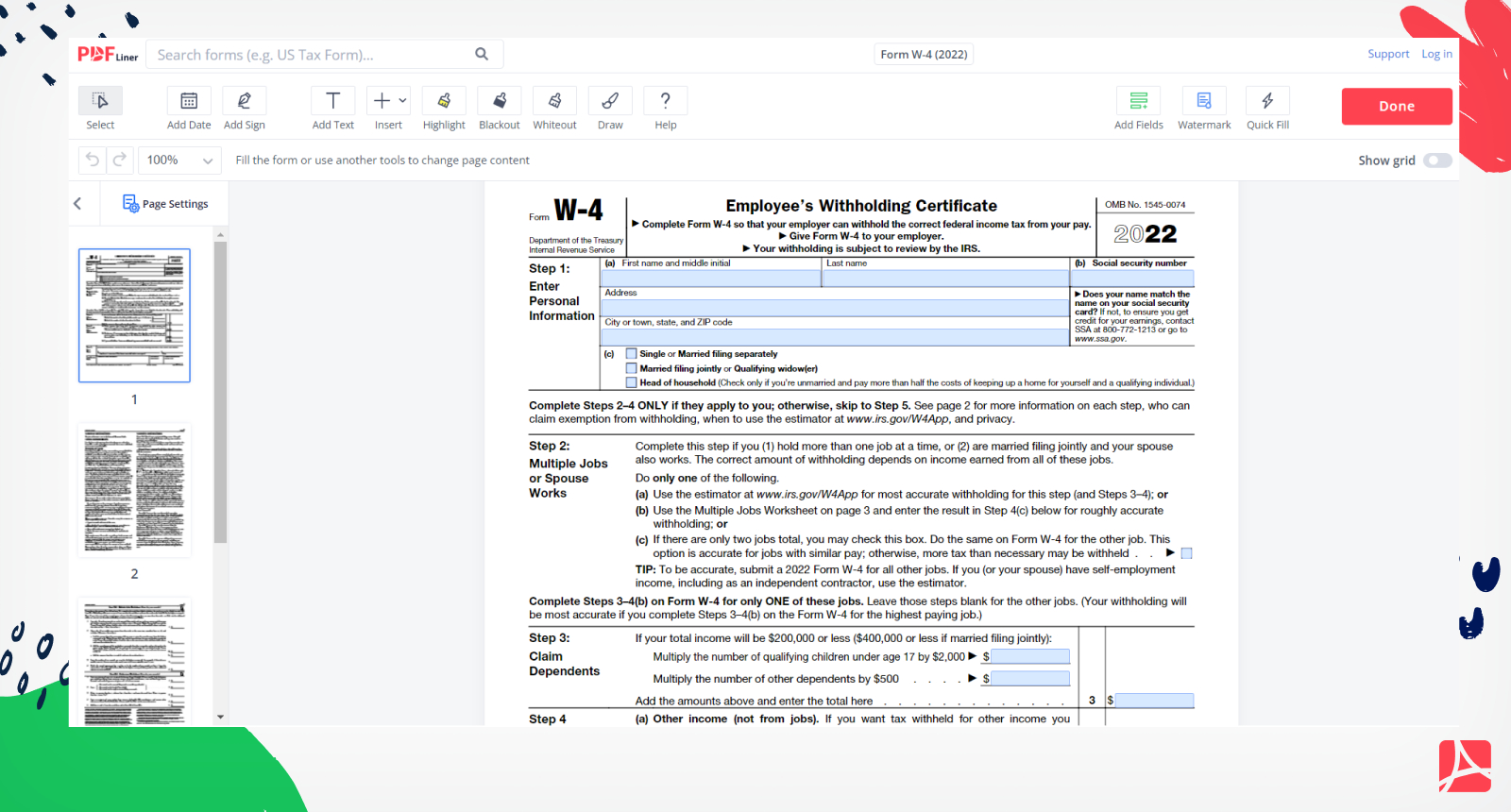

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the W4 Form 2025 South Carolina is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the W4 Form 2025 South Carolina from the link below.

W4 Form 2025 South Carolina