W4 Form 2025 | Are you ready to make the most out of your tax refund this year? Look no further than IRS Form W4-R 2025! This handy form is your ticket to maximizing your refund and keeping more of your hard-earned money in your pocket. By following a few simple steps and utilizing the secrets hidden within Form W4-R 2025, you can ensure that you get the biggest refund possible. So why wait? Let’s dive in and uncover the tips and tricks to boost your tax return now!

Get ready to boost your refund with IRS Form W4-R 2025!

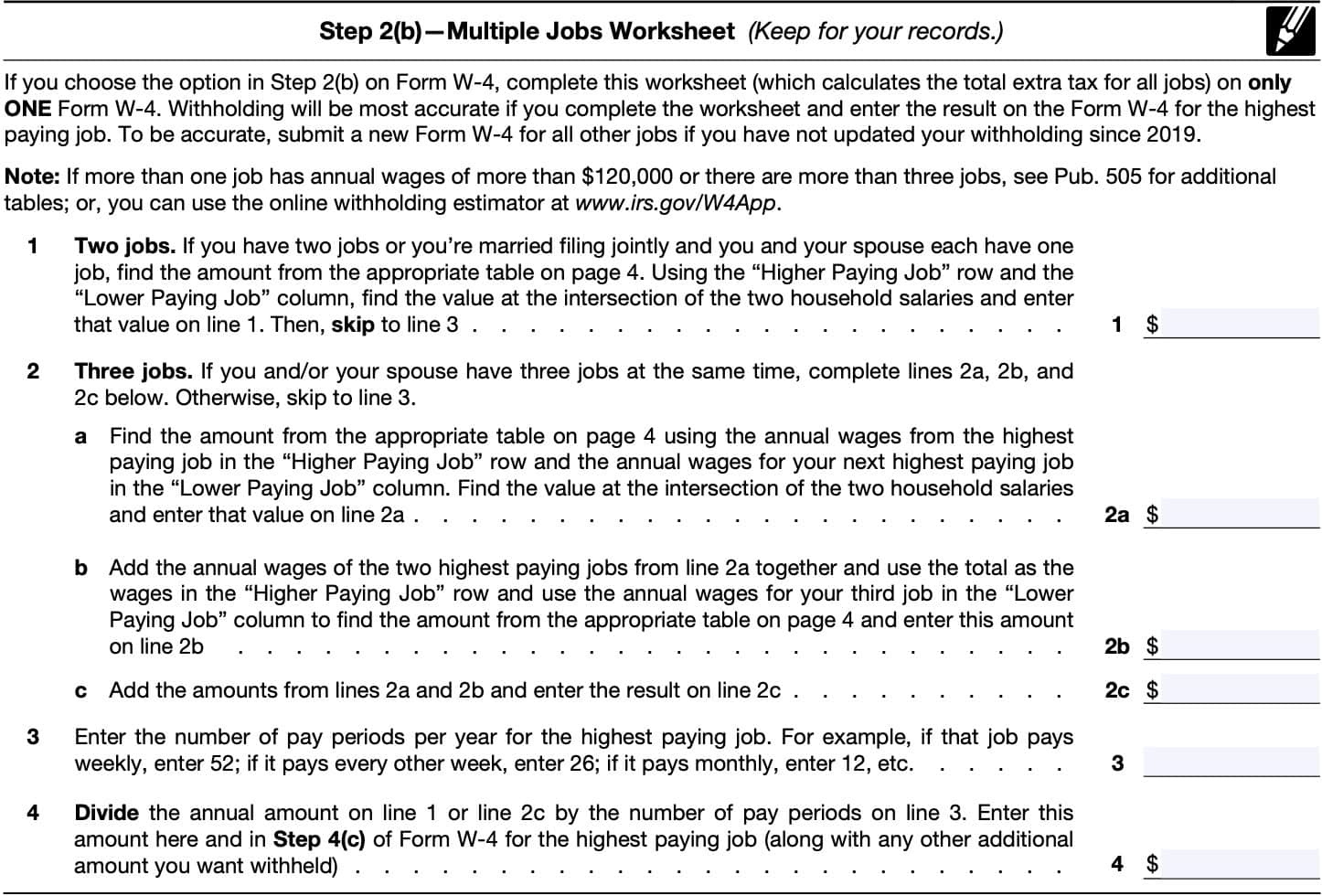

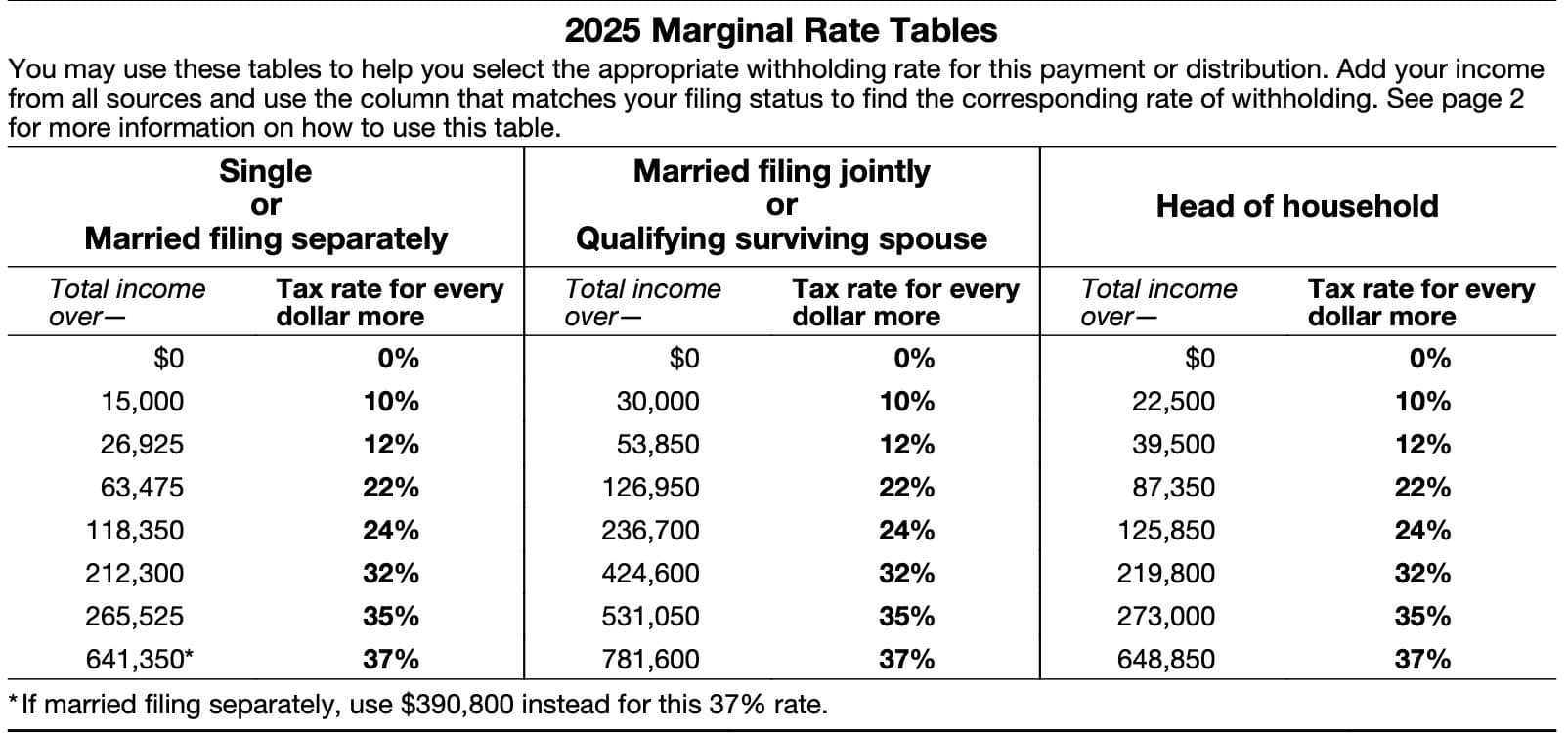

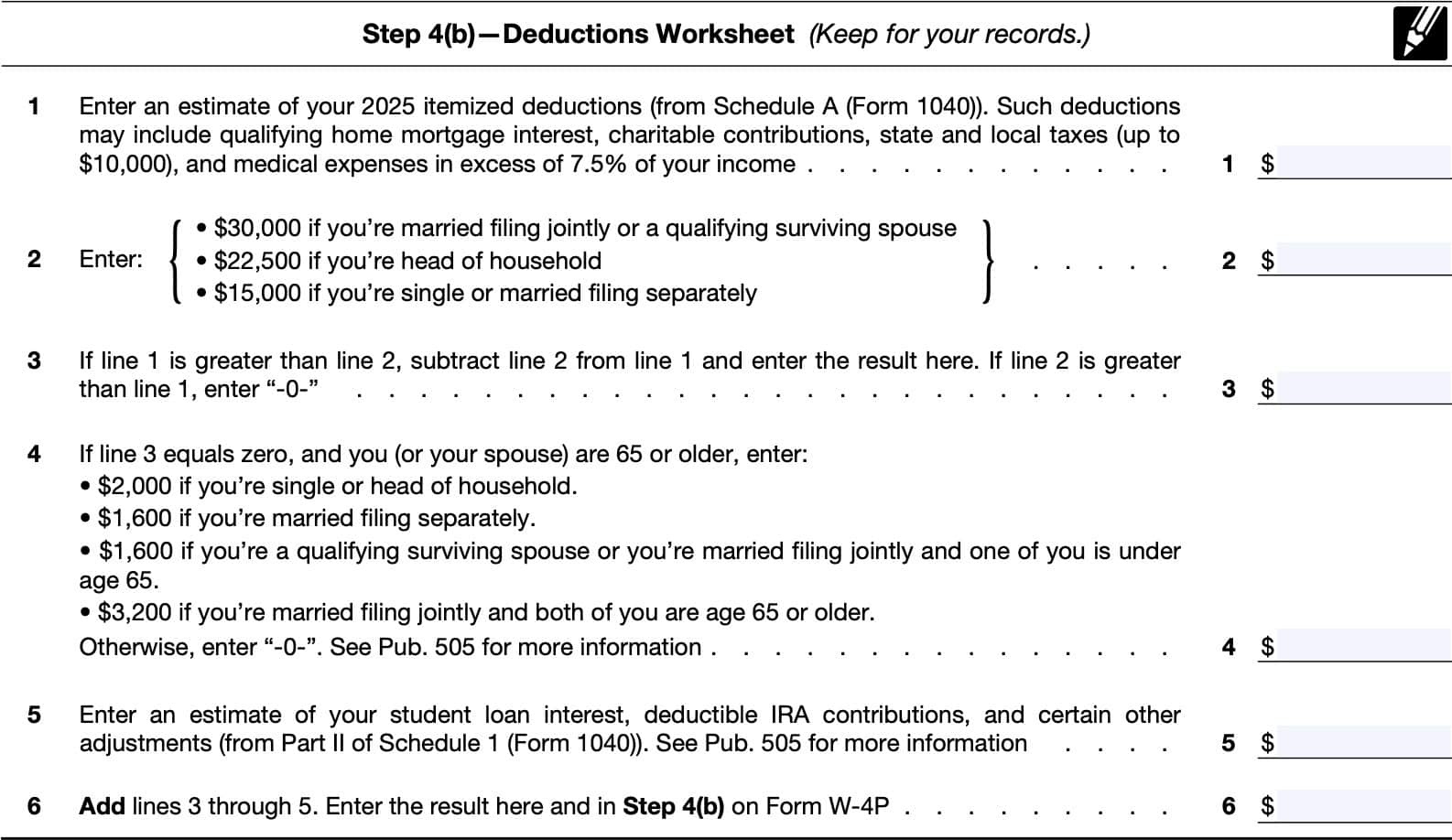

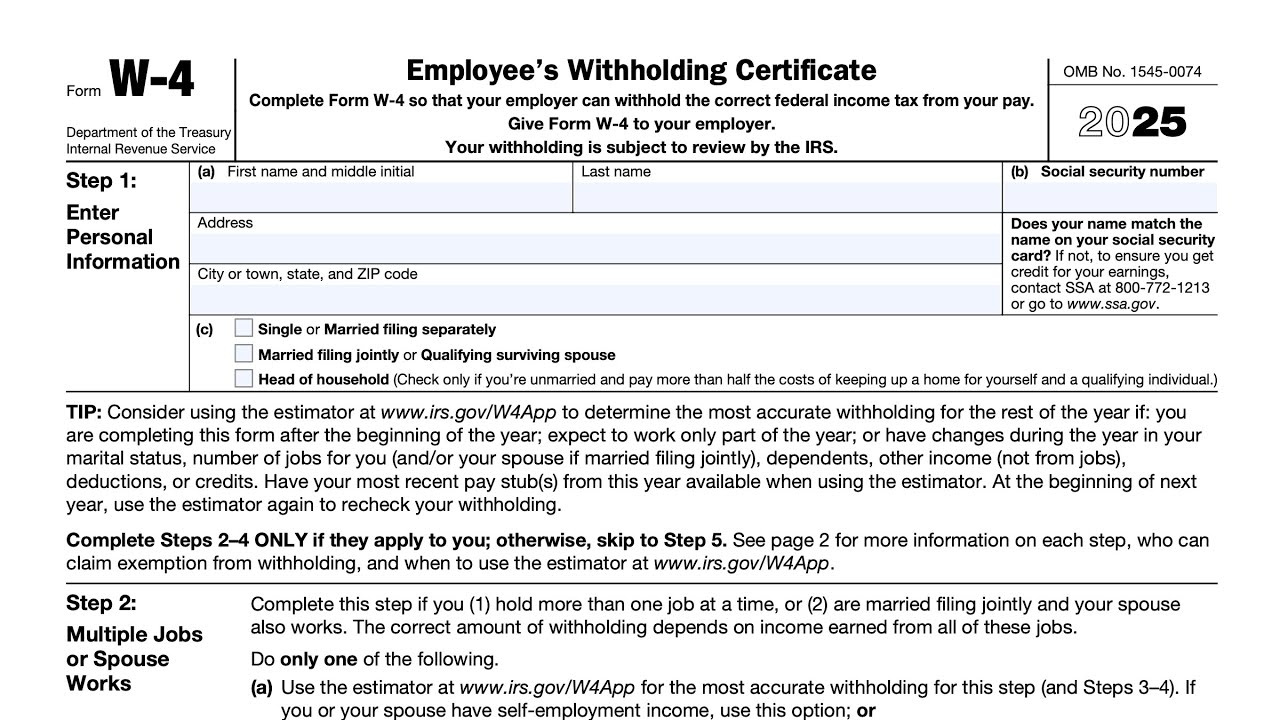

One of the key ways to maximize your refund with IRS Form W4-R 2025 is to accurately fill out the form with updated information. Make sure to provide all necessary details, such as your filing status, number of dependents, and any additional income you may have. By doing so, you can ensure that you are withholding the right amount of taxes throughout the year, ultimately leading to a larger refund when tax season rolls around.

Another important tip to keep in mind when using IRS Form W4-R 2025 is to take advantage of any available tax credits and deductions. Be sure to carefully review the form and consider any potential tax breaks that you may qualify for, such as the Earned Income Tax Credit or the Child Tax Credit. By claiming these credits and deductions, you can further increase your refund and keep more money in your pocket.

Uncover the secrets to maximizing your tax return this year!

In addition to accurately filling out Form W4-R 2025 and claiming all available credits and deductions, it’s also important to regularly review and update your tax information throughout the year. Life changes, such as getting married, having a baby, or buying a house, can all impact your tax situation. By staying on top of these changes and adjusting your withholding accordingly, you can ensure that you are maximizing your refund each year.

By following these tips and utilizing IRS Form W4-R 2025 to its fullest potential, you can take control of your tax situation and make the most out of your refund. So don’t wait until the last minute – start planning now and get ready to boost your refund this tax season!

Accessing IRS Form W4-R 2025

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the IRS Form W4-R 2025 is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the IRS Form W4-R 2025 from the link below.

IRS Form W4-R 2025