W4 Form 2025 | Are you ready to take control of your tax savings and simplify your paycheck deductions in 2025? Mastering your W4 form is the key to maximizing your tax savings and ensuring that you’re not paying more than you need to. With a few simple tips and tricks, you can navigate the world of taxes with ease and confidence. Let’s dive in and discover how you can make the most of your W4 form this year!

Maximize Your Tax Savings

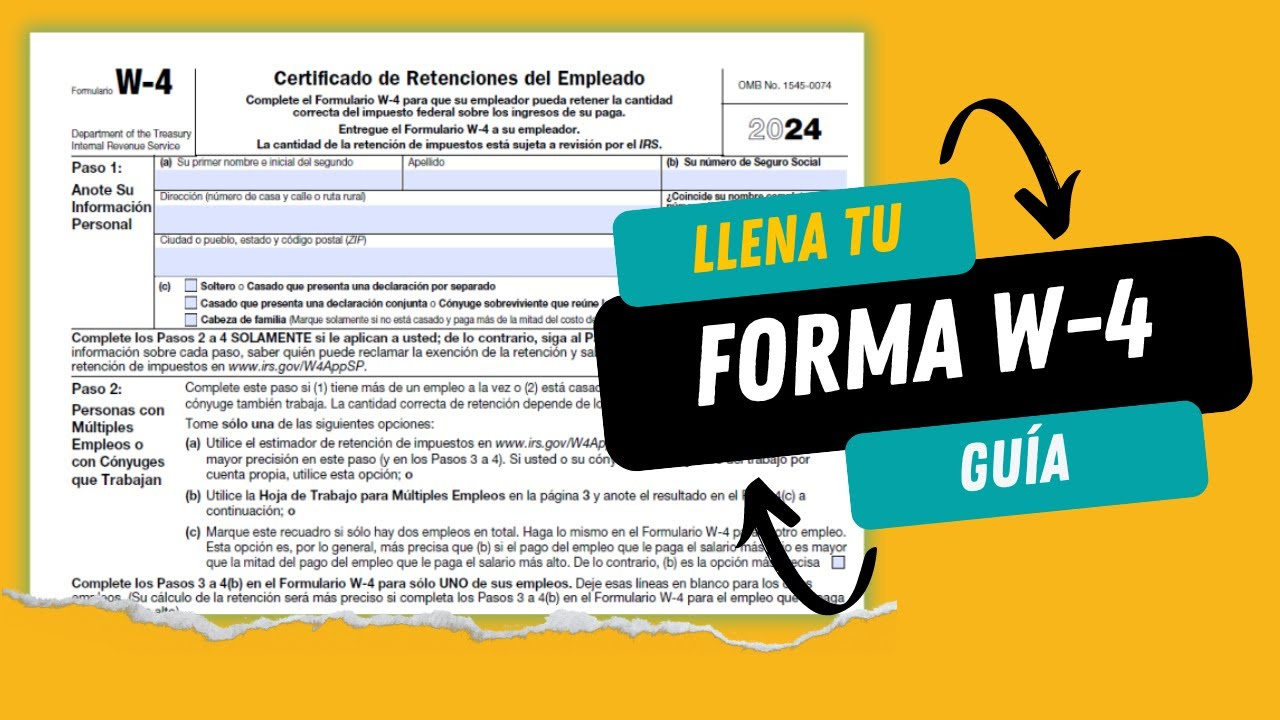

One of the most important aspects of mastering your W4 form is ensuring that you’re taking advantage of all available tax deductions and credits. Make sure to carefully review each section of your W4 form and accurately input your filing status, number of dependents, and any additional income or deductions that apply to your situation. By doing so, you can maximize your tax savings and potentially receive a larger tax refund at the end of the year.

Additionally, consider adjusting your withholding allowances to more accurately reflect your tax liability. If you’ve experienced any significant life changes, such as getting married, having a child, or buying a home, these factors can impact your tax situation and may warrant updating your W4 form. By staying proactive and regularly reviewing and updating your W4 form, you can ensure that you’re not overpaying in taxes and keep more money in your pocket.

Simplify Your Paycheck Deductions

Another key aspect of mastering your W4 form is simplifying your paycheck deductions to ensure that you’re receiving the correct amount of take-home pay each pay period. Take the time to calculate your total tax liability and adjust your withholding allowances accordingly to avoid any surprises come tax time. By accurately completing your W4 form and staying on top of any changes in your financial situation, you can streamline your paycheck deductions and avoid any unnecessary stress or confusion.

Consider utilizing online resources or speaking with a tax professional for additional guidance on simplifying your paycheck deductions and maximizing your tax savings. By staying informed and proactive, you can navigate the world of taxes with confidence and take control of your financial future. With a little effort and attention to detail, you can master your W4 form in 2025 and set yourself up for success in the years to come.

Mastering your W4 form in 2025 is a crucial step in maximizing your tax savings and simplifying your paycheck deductions. By carefully reviewing and updating your W4 form, you can ensure that you’re not overpaying in taxes and keep more money in your pocket. With a proactive approach and a little bit of effort, you can take control of your financial future and make the most of your tax situation. Here’s to a successful and stress-free tax season in 2025!

Accessing Como Llenar La Forma W4 2025

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the Como Llenar La Forma W4 2025 is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the Como Llenar La Forma W4 2025 from the link below.

Como Llenar La Forma W4 2025