W4 Form 2025 | Have you ever felt overwhelmed or confused when filling out your W4 form? Fear not, as we are here to help you uncover the hidden treasures of W4 Forms 2025! By understanding the intricacies of this essential tax document, you can unlock valuable tax benefits and optimize your financial situation. So let’s dive in and explore how you can make the most of your W4 form!

Discover the Hidden Treasures of W4 Forms 2025!

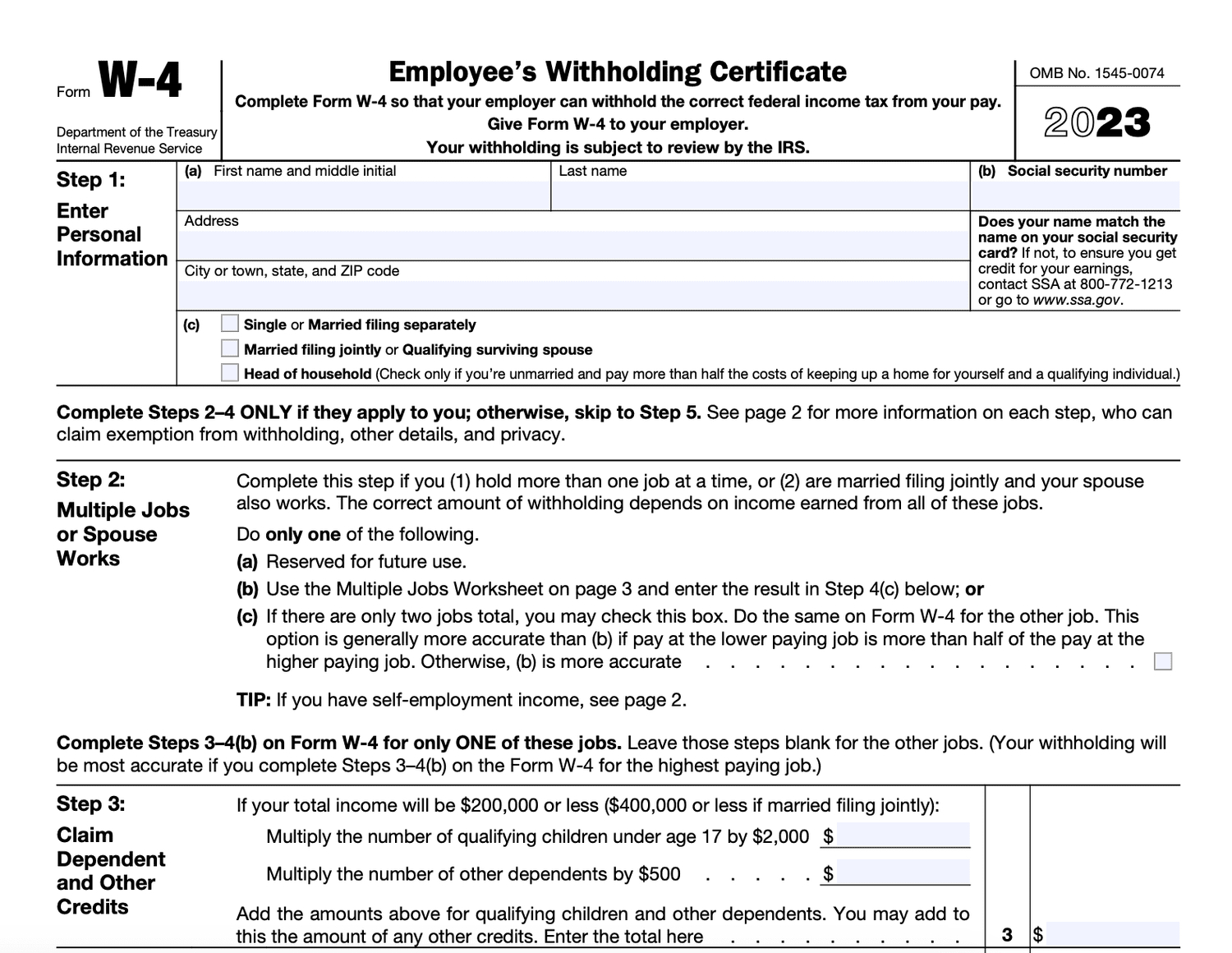

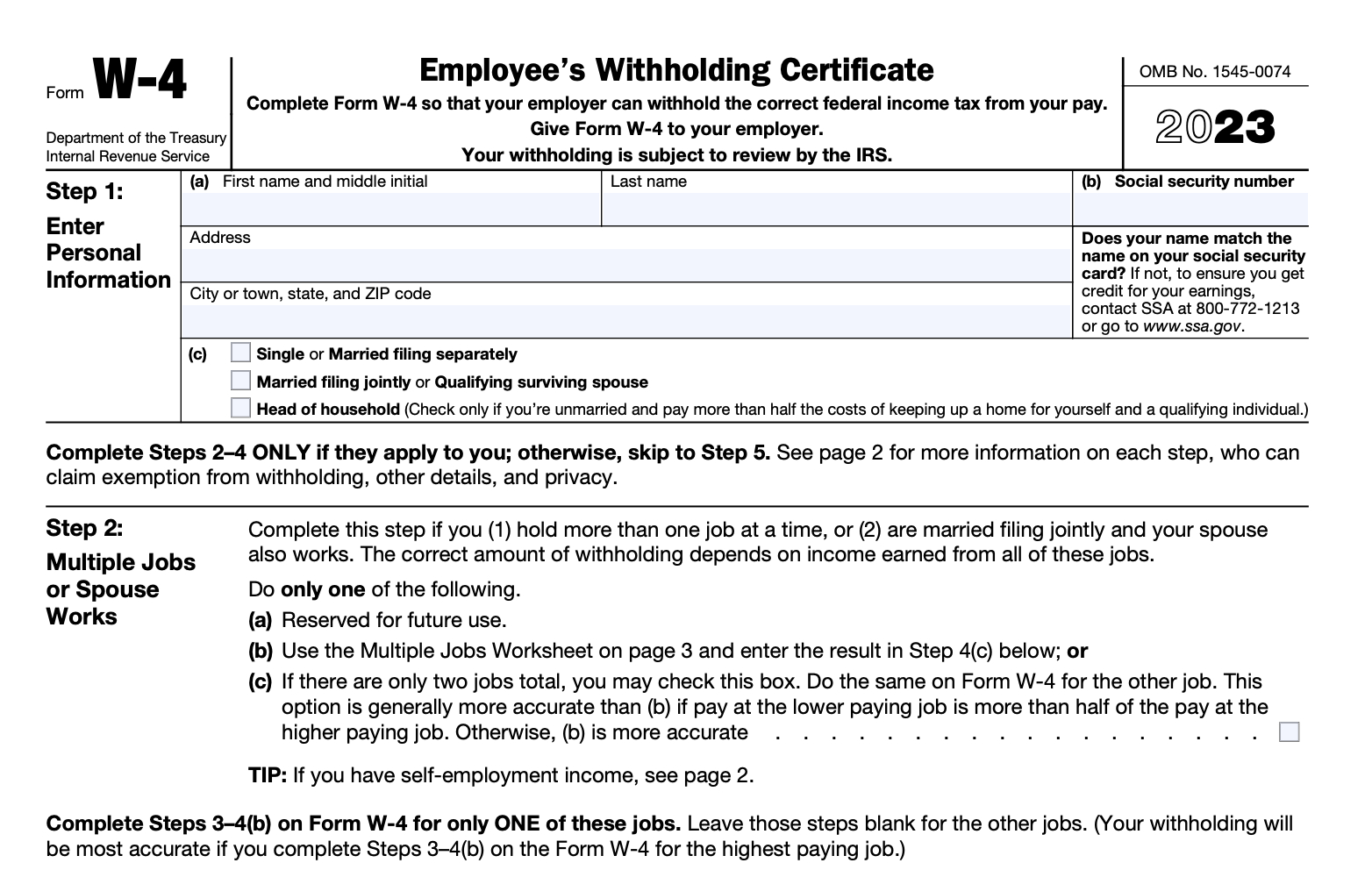

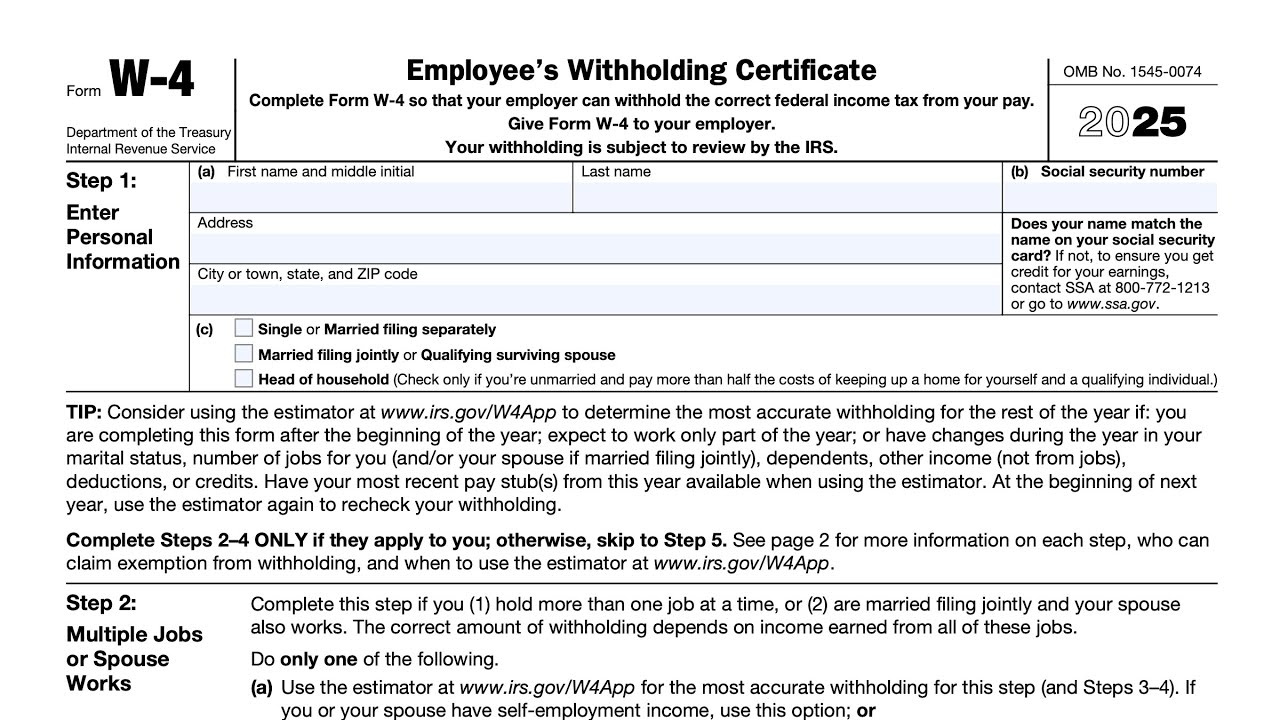

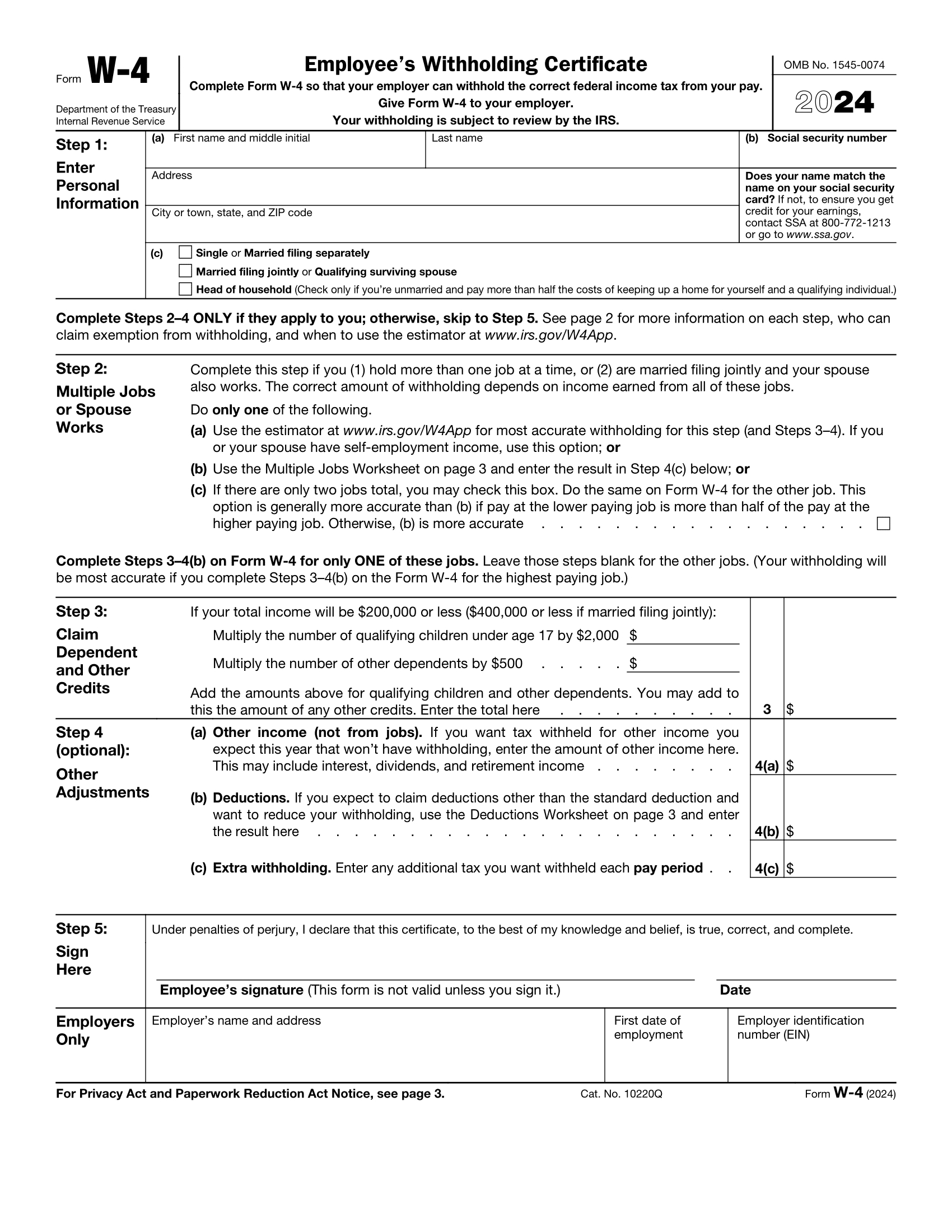

The W4 form may seem like just another piece of paperwork, but it holds the key to maximizing your tax benefits. By carefully filling out this form, you can ensure that the right amount of taxes are withheld from your paycheck throughout the year. This can prevent you from owing a large sum at tax time or receiving a hefty refund. By taking the time to understand your W4 form and making necessary adjustments, you can put more money back in your pocket and take control of your financial future.

However, navigating the complexities of the W4 form can be challenging for many individuals. That’s why it’s essential to seek expert tips and advice to help you make informed decisions. Whether you’re single, married, have children, or multiple sources of income, there are specific strategies you can implement to maximize your tax savings. By consulting with a tax professional or using online resources, you can ensure that you’re taking full advantage of all available deductions and credits. With the right guidance, you can confidently fill out your W4 form and reap the rewards come tax time.

Amplify Your Tax Savings with Expert Tips!

In addition to seeking expert advice, there are several key tips you can follow to amplify your tax savings with your W4 form. One strategy is to update your W4 form whenever there are significant life changes, such as getting married, having a child, or changing jobs. By keeping your form up to date, you can ensure that your withholding accurately reflects your current financial situation. Additionally, consider adjusting your withholding allowances to account for any deductions or credits you may be eligible for. By optimizing your W4 form, you can maximize your tax benefits and potentially increase your take-home pay.

Unlocking the secrets of W4 Forms 2025 can help you make the most of your tax situation and secure valuable savings. By understanding the hidden treasures of this essential document, seeking expert tips, and making strategic adjustments, you can optimize your financial well-being and take control of your taxes. So don’t let the W4 form intimidate you – embrace it as a tool to enhance your financial future and unlock the benefits that await you!

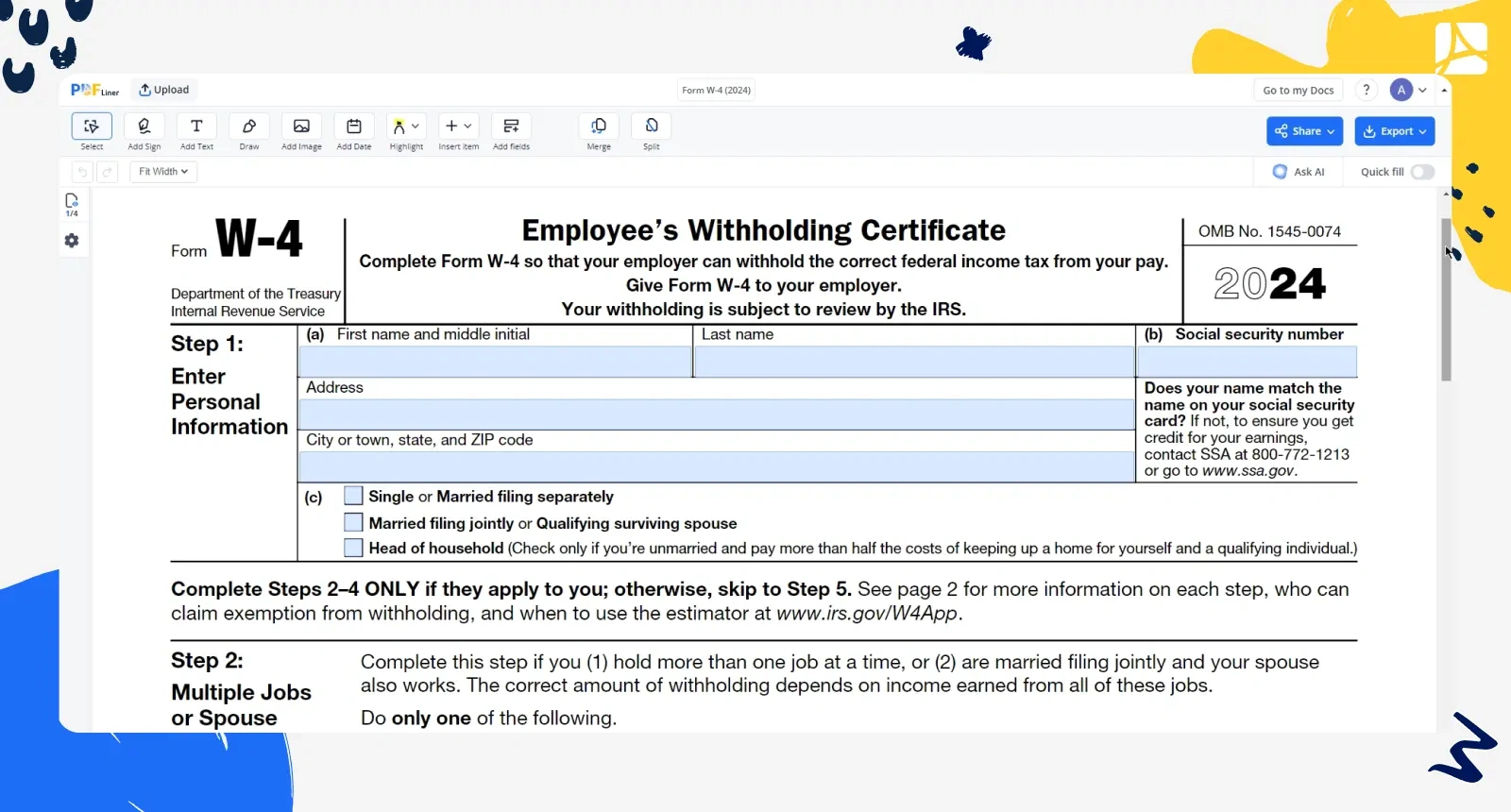

Accessing W4 Forms 2025

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the W4 Forms 2025 is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the W4 Forms 2025 from the link below.

W4 Forms 2025