W4 Form 2025 | Do you find yourself scratching your head every tax season when it comes to filling out your Maryland W4 Form 2025? Fear not, for we are here to help you master the art of tax filing! With a little bit of guidance and understanding, you can breeze through your taxes like a pro and maximize your return. Let’s dive into the intricacies of the Maryland W4 Form 2025 and take control of your finances!

Unleash your tax-filing expertise with Maryland W4 Form 2025!

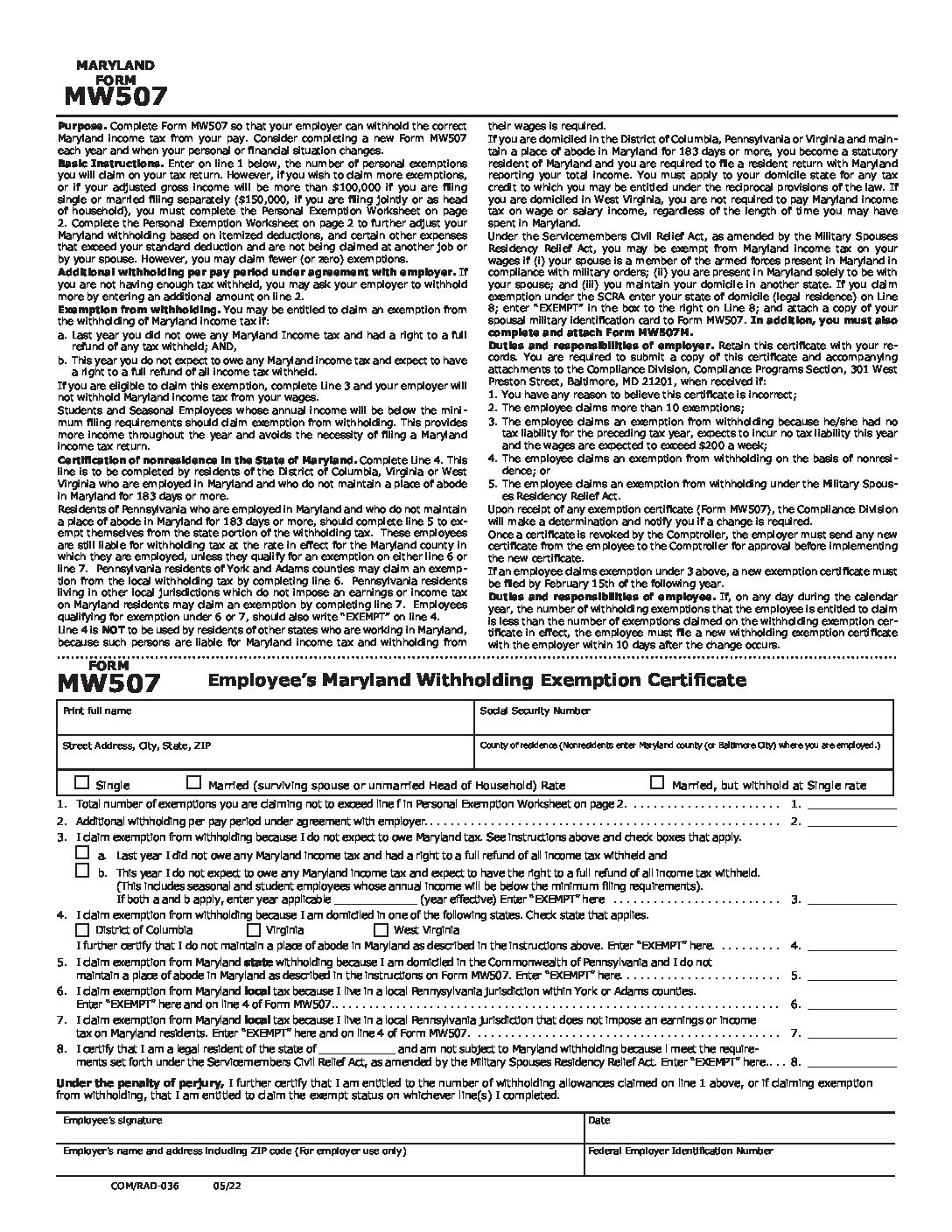

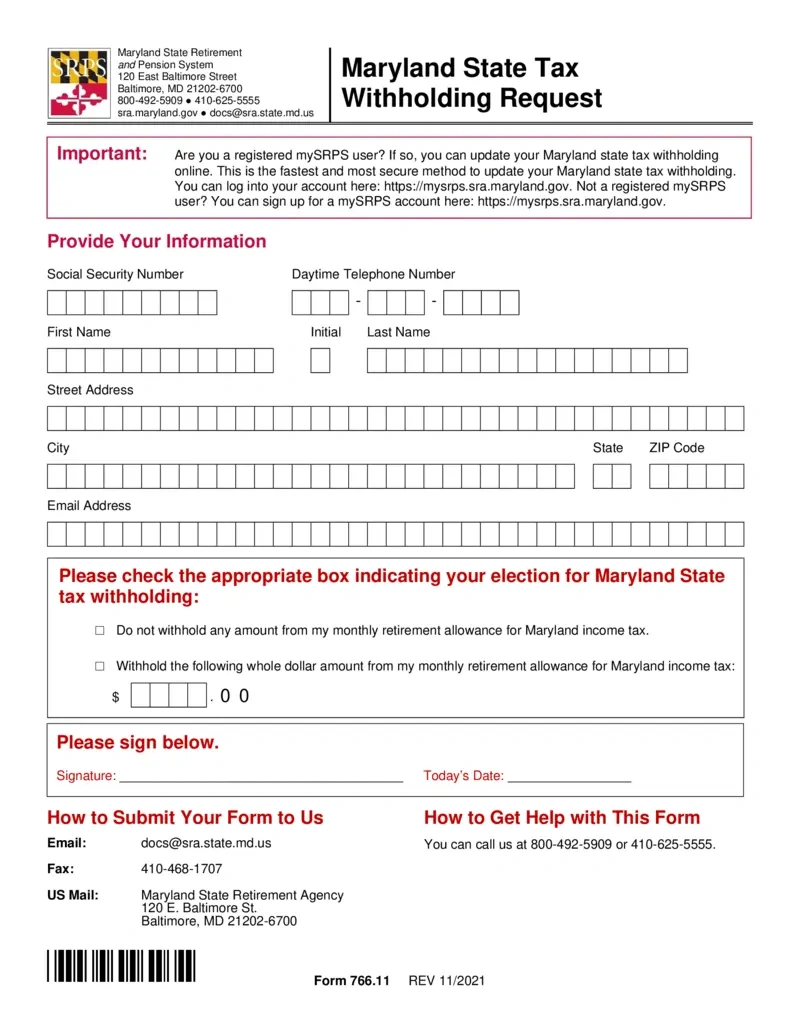

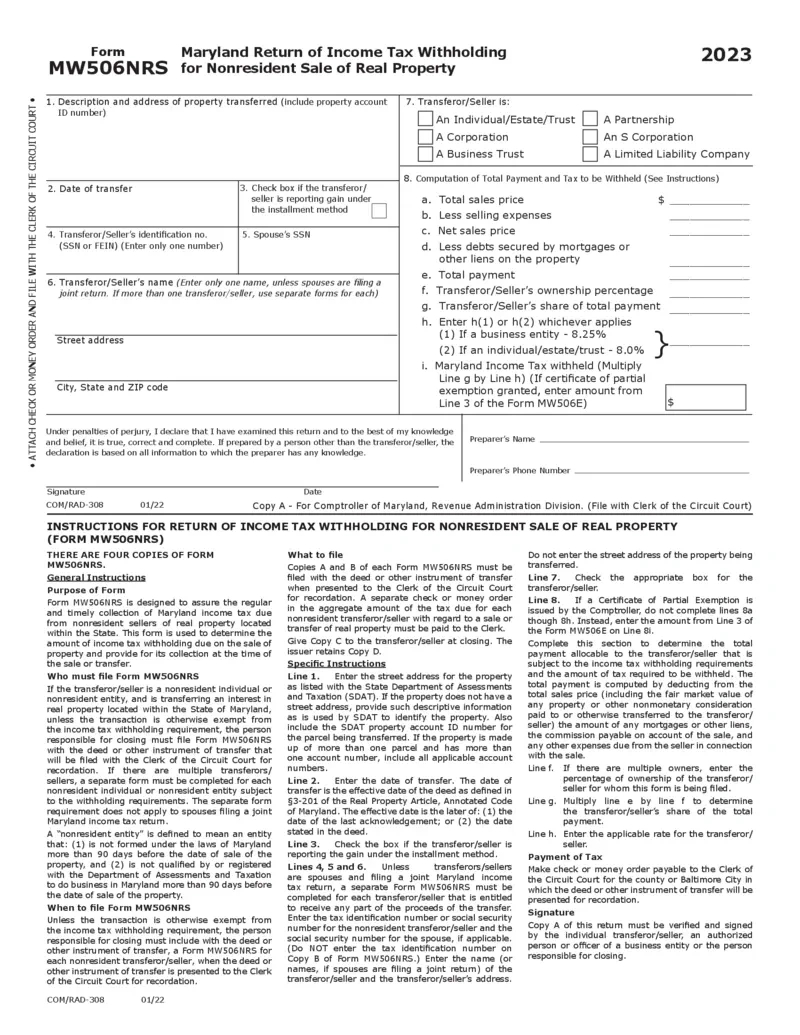

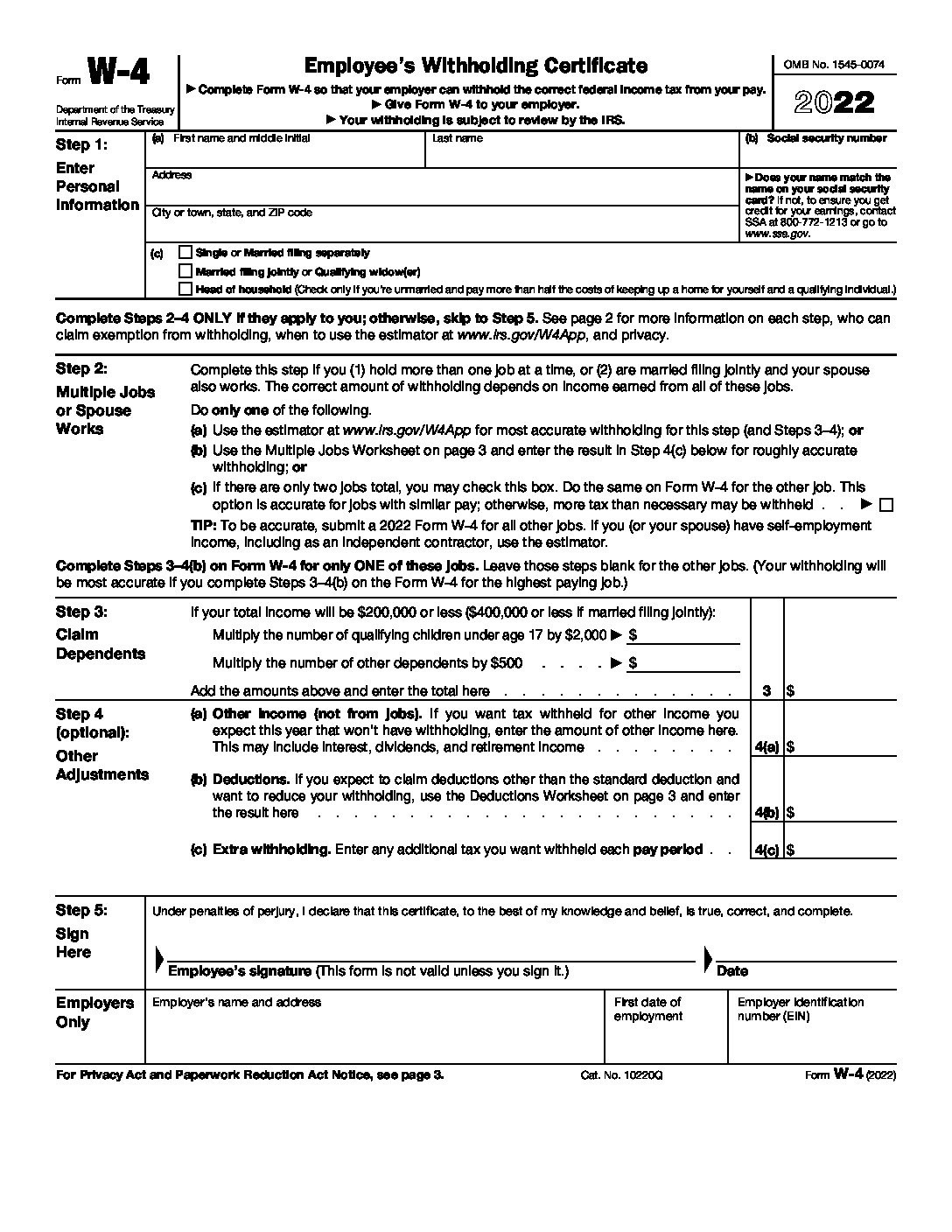

First things first, understanding the basics of the Maryland W4 Form 2025 is crucial. This form is used by employers to withhold the correct amount of state income tax from your paycheck. By accurately filling out this form, you can ensure that you are not overpaying or underpaying your taxes throughout the year. Knowing how to properly fill out your W4 can ultimately save you money and prevent any surprises come tax season.

It’s important to note that the information you provide on your Maryland W4 Form 2025 directly impacts the amount of taxes that are withheld from your paycheck. By carefully reviewing your filing status, allowances, and any additional withholding amounts, you can tailor your W4 to best suit your financial situation. Take the time to review the instructions provided with the form and seek assistance from a tax professional if needed. With a little bit of effort and attention to detail, you can take control of your taxes and ensure a smooth and stress-free filing process.

Simplify your tax season with a comprehensive guide to Maryland W4 Form 2025!

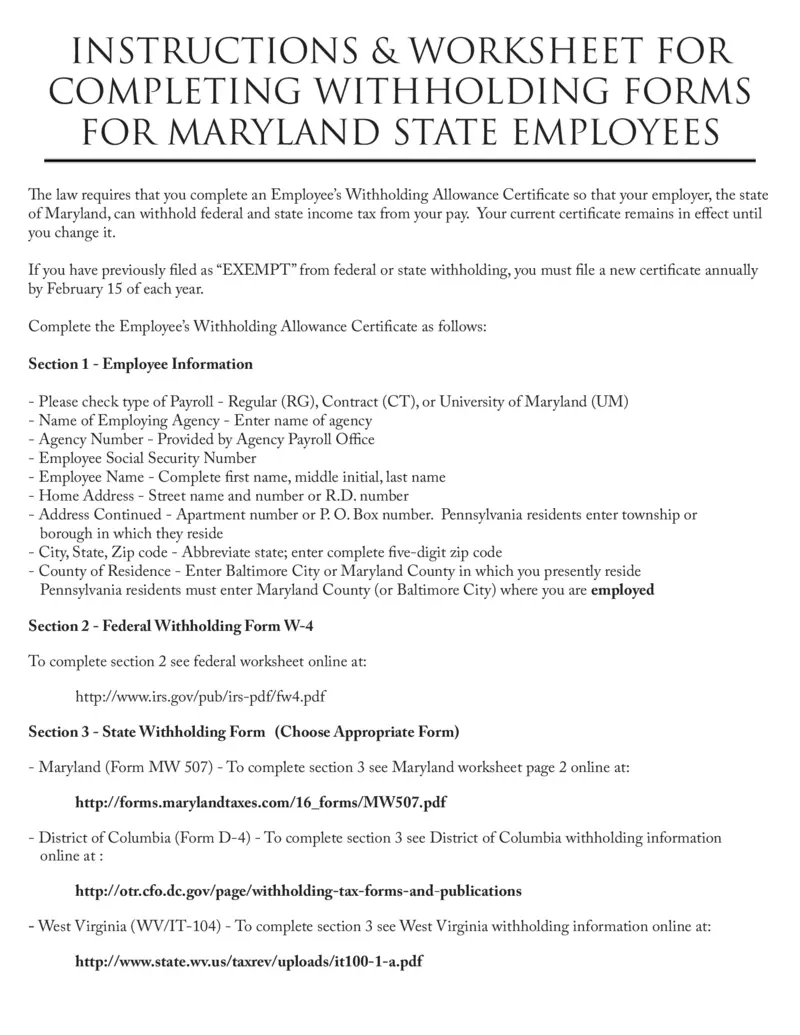

Navigating the complex world of taxes doesn’t have to be daunting, especially when armed with a comprehensive guide to the Maryland W4 Form 2025. This form may seem intimidating at first glance, but with a little bit of guidance, you can simplify the process and ensure that your tax withholding is accurate and efficient. By breaking down each section of the form and providing step-by-step instructions, we aim to empower you to take control of your finances and master your taxes like a pro.

One key aspect of the Maryland W4 Form 2025 is determining your filing status. This information helps your employer calculate the appropriate amount of taxes to withhold from your paycheck. Whether you are single, married, or head of household, it’s essential to accurately indicate your filing status on the form to avoid any discrepancies in your tax withholding. By understanding the implications of each filing status, you can make informed decisions that align with your financial goals and obligations.

In addition to filing status, the Maryland W4 Form 2025 also requires you to declare any allowances that you are entitled to claim. These allowances directly impact the amount of taxes withheld from your paycheck, so it’s crucial to assess your eligibility and make informed choices. By carefully considering your personal and financial circumstances, you can optimize your allowances and ensure that your tax withholding is tailored to your specific needs. With a clear understanding of how allowances work and how to maximize them, you can streamline your tax season and avoid any unnecessary stress or confusion.

Mastering your taxes doesn’t have to be a daunting task, especially with the right tools and knowledge at your disposal. By familiarizing yourself with the Maryland W4 Form 2025 and understanding its intricacies, you can take control of your finances and simplify your tax season. Remember to review the instructions provided with the form, seek assistance from a tax professional if needed, and make informed decisions about your filing status and allowances. With a little bit of effort and attention to detail, you can navigate the world of taxes with confidence and ensure a smooth and stress-free filing process. Happy tax-filing!

Accessing Maryland W4 Form 2025

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the Maryland W4 Form 2025 is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the Maryland W4 Form 2025 from the link below.

Maryland W4 Form 2025