W4 Form 2025 | Are you tired of feeling overwhelmed and confused when it comes to filing your taxes? Well, get ready to say goodbye to those days because the future of tax forms is looking brighter than ever with the upcoming IRS Form W4 2025. This innovative form is designed to help taxpayers maximize their tax potential and simplify the process of filing taxes. By understanding the changes and updates that come with IRS Form W4 2025, you can take control of your finances and make tax season a breeze.

Unlocking Your Tax Potential: A Look Ahead to IRS Form W4 2025

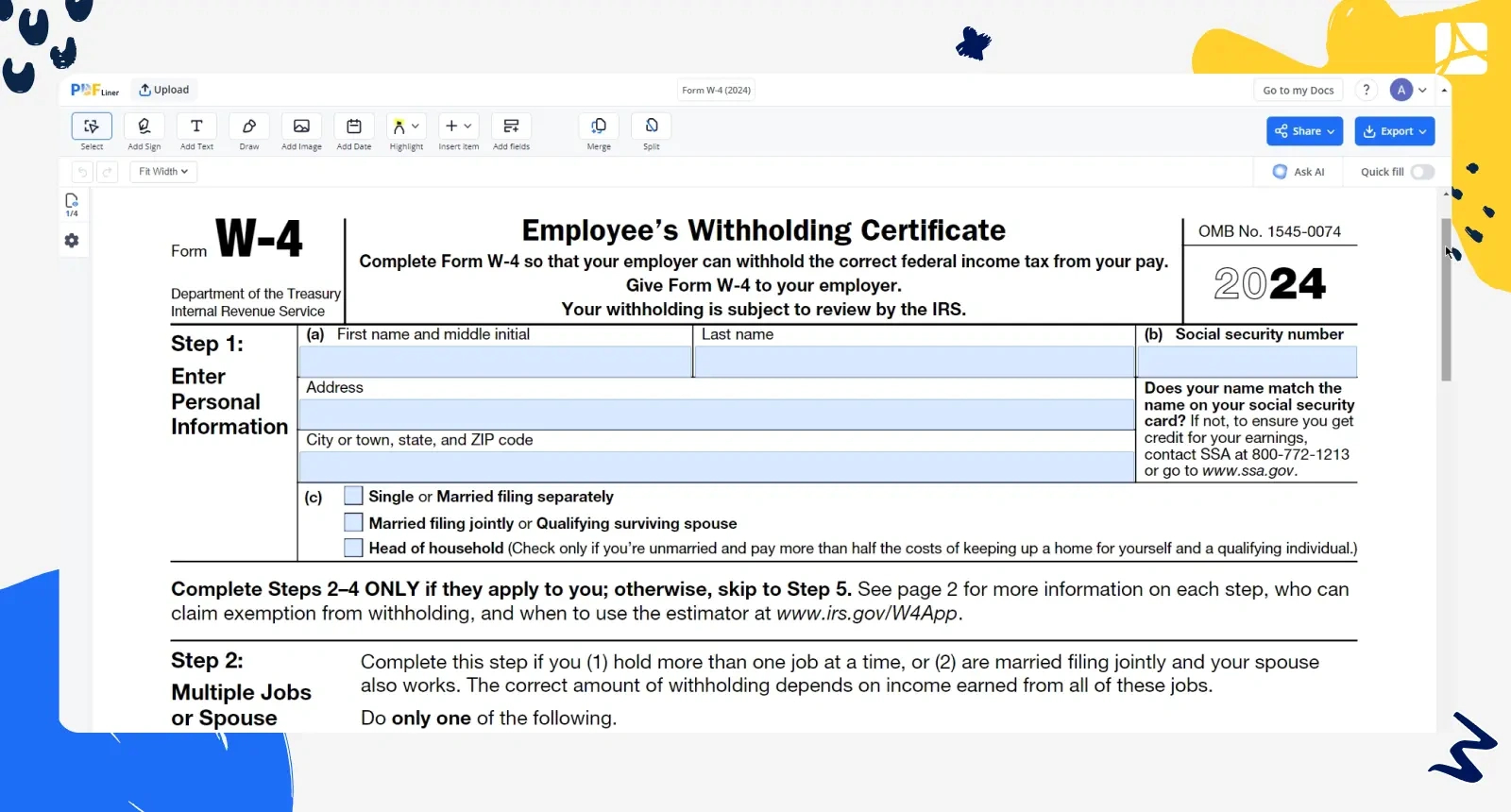

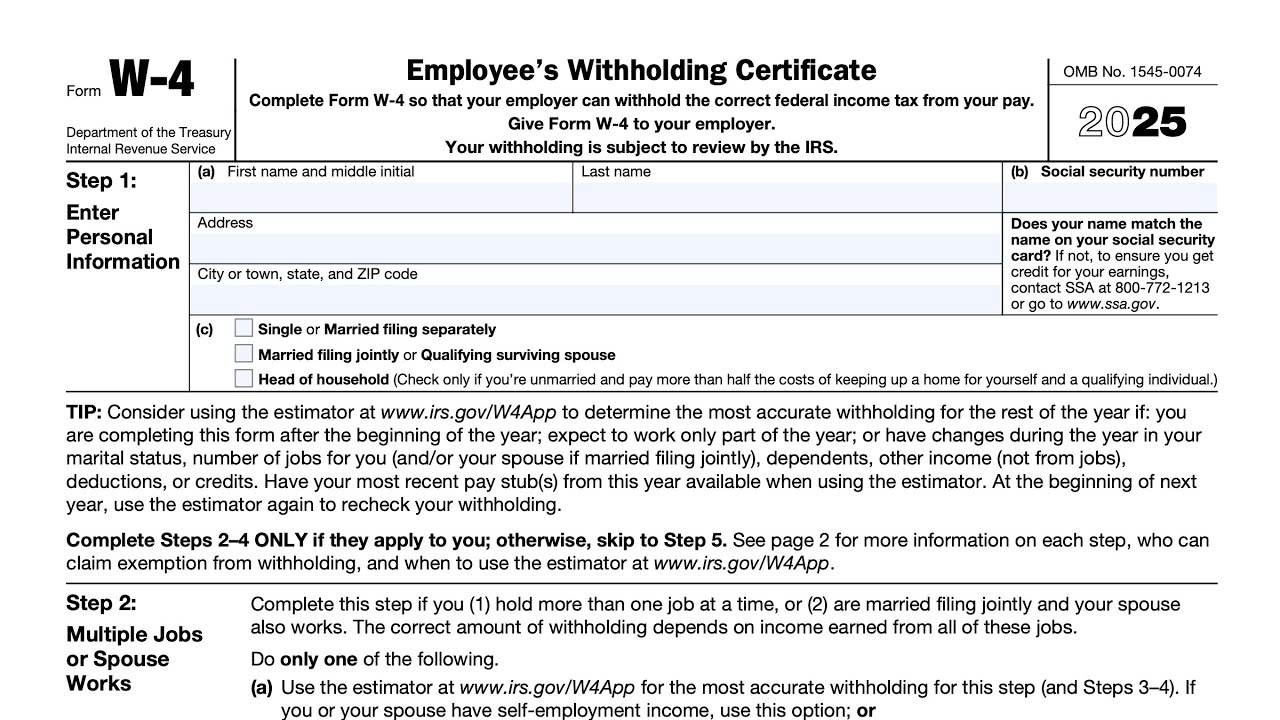

One of the key features of IRS Form W4 2025 is its user-friendly design that makes it easy for taxpayers to navigate and understand. Gone are the days of complex tax jargon and confusing instructions. With IRS Form W4 2025, you can easily input your information and make adjustments as needed without feeling overwhelmed. This streamlined approach to tax filing will not only save you time but also reduce the likelihood of making errors on your tax return.

In addition to its user-friendly design, IRS Form W4 2025 also incorporates cutting-edge technology to simplify the tax filing process. The form will be available online, allowing taxpayers to fill it out electronically and submit it with just a few clicks. This digital approach to tax filing will not only save paper but also speed up the processing time, ensuring that you receive your tax refund in a timely manner. With IRS Form W4 2025, the future of tax filing is bright, efficient, and hassle-free.

Embracing the Future: How IRS Form W4 2025 Will Simplify Your Taxes

Say goodbye to the days of dreading tax season and hello to a brighter future with IRS Form W4 2025. This innovative form is designed to simplify the tax filing process and help taxpayers take control of their finances. By embracing the future of tax filing with IRS Form W4 2025, you can say goodbye to stress and confusion and hello to a more efficient and streamlined way of managing your taxes.

One of the ways IRS Form W4 2025 simplifies the tax filing process is by providing clear and concise instructions that are easy to follow. Whether you’re a first-time filer or a seasoned taxpayer, this form will guide you through each step of the process, making it easy to input your information accurately. By providing taxpayers with the tools they need to succeed, IRS Form W4 2025 empowers individuals to take control of their tax situation and maximize their potential savings.

Another way IRS Form W4 2025 simplifies taxes is by incorporating smart features that help taxpayers make informed decisions about their withholdings. This form will provide personalized recommendations based on your individual financial situation, ensuring that you are withholding the right amount from your paycheck. By taking the guesswork out of tax withholding, IRS Form W4 2025 makes it easier than ever to stay on top of your taxes and avoid any surprises come tax season. Say goodbye to stress and confusion and hello to a brighter future with IRS Form W4 2025.

Accessing IRS Form W4 2025

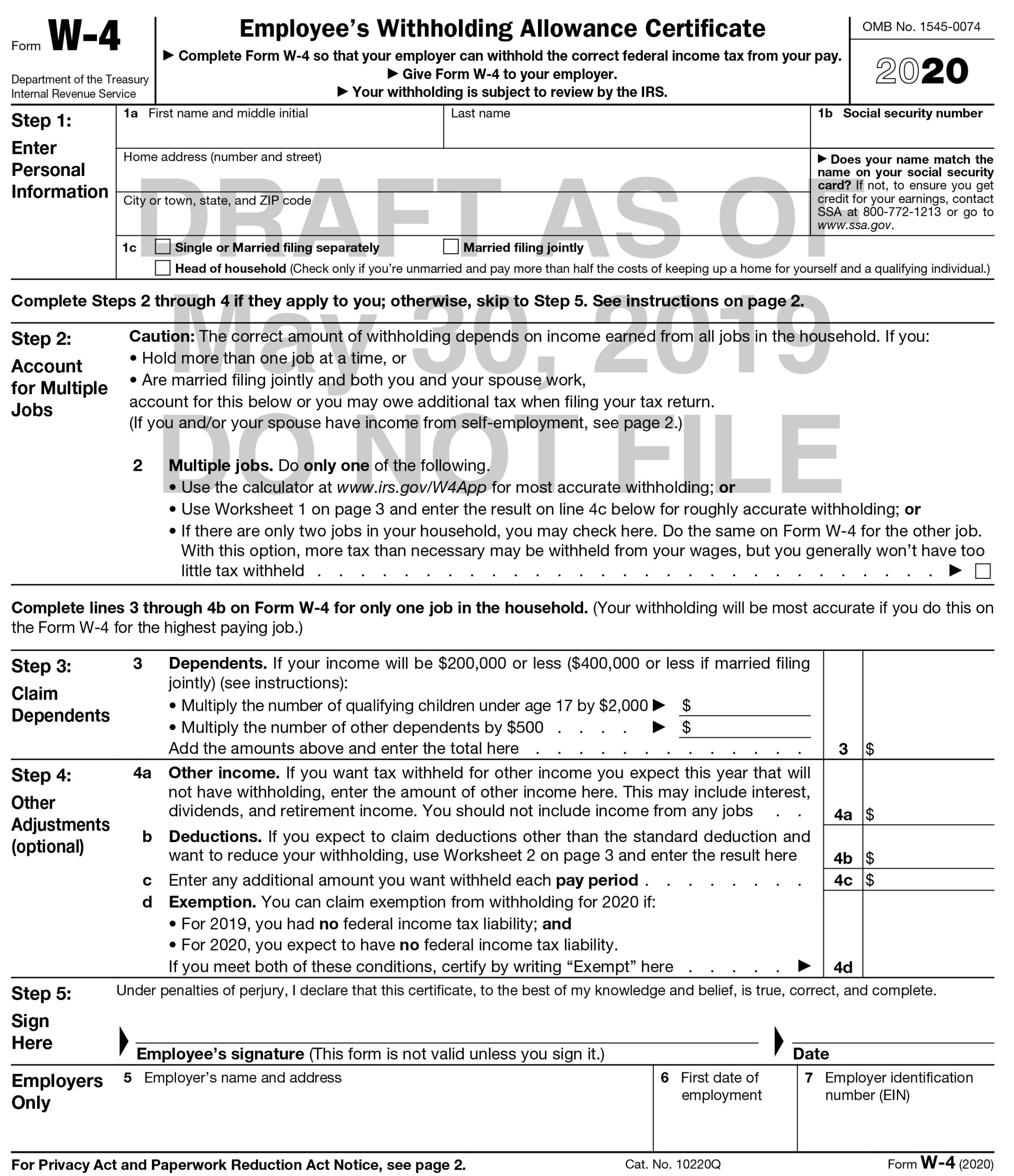

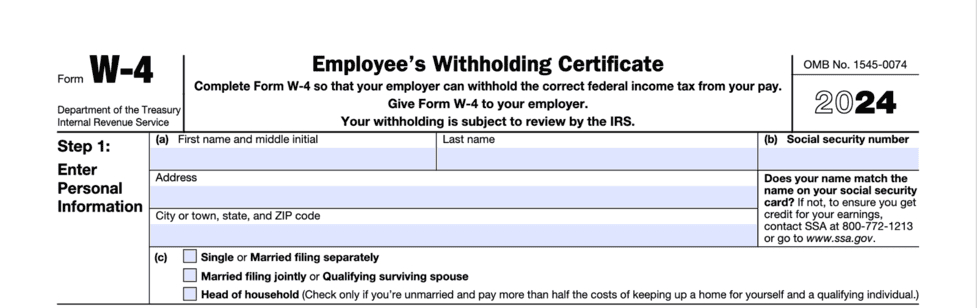

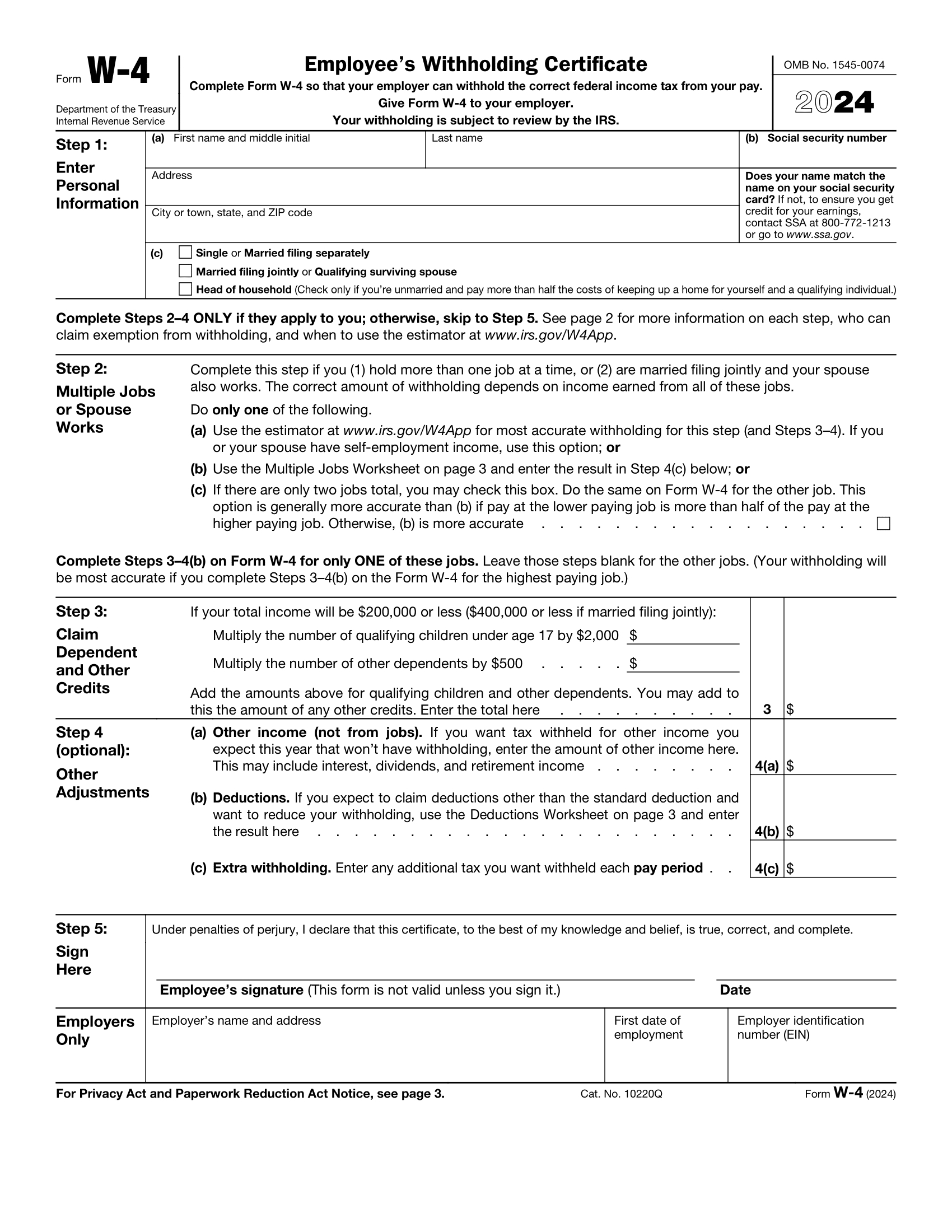

Having the right tax forms on hand is crucial for ensuring a smooth filing process, and the IRS Form W4 2025 is one of the most important documents for employees. This form helps your employer determine how much federal income tax to withhold from your paycheck. Fortunately, the IRS makes it easy to access the W-4 Form in various formats, including PDF, printable, and free printable versions whether you’re looking for convenience or specific language options. You’ll get everything you need to know about obtaining the IRS Form W4 2025 from the link below.

IRS Form W4 2025